Retirement is a major life milestone. Many people in Singapore underestimate the need for a reliable income stream. Rising living costs make financial security more important than ever.

Relying only on CPF may not be enough. A solid retirement plan ensures steady payouts and peace of mind. This guide helps you understand how these plans work.

We explore key benefits like guaranteed income and flexibility. You will learn how to choose the right option for your future. Providers like Manulife and Singlife offer tailored solutions.

Whether you prefer lifetime or fixed-term payouts, this guide provides expert insights. We also highlight common pitfalls to avoid. Secure your financial stability and enjoy your golden years.

Key Takeaways

- Relying solely on CPF may not provide enough income for retirement.

- Annuity plans offer a steady stream of funds after you stop working.

- Options are available for both lifetime and fixed-term payouts.

- Key features include guaranteed returns and income flexibility.

- Leading providers in Singapore offer plans tailored to different needs.

- Avoid overvaluing non-guaranteed returns to protect your savings.

- Supplementary income can help ensure a stress-free retirement.

Why Securing Your Retirement Income in Singapore is Essential

Living costs keep climbing in our city. Many people worry about money after they stop working. Your CPF savings might not cover all your needs.

A steady stream income becomes crucial for daily life. Without it, you could face financial stress during your golden years. This is where smart retirement planning makes a difference.

Relying only on basic CPF LIFE payouts may limit your lifestyle. You deserve more than just covering essentials. Private options can bridge this gap effectively.

These arrangements provide guaranteed monthly payments for life. They help maintain your independence and comfort. You gain peace of mind knowing funds will always arrive.

Consider these important advantages:

- Protection against outliving your savings

- Flexibility for travel and hobbies

- Security against rising healthcare costs

- Inflation protection over time

Starting early gives your money more time to grow. A single premium payment today can secure your future. This approach helps combat increasing expenses.

Your retirement age should mark a new beginning, not financial worries. With proper preparation, you can enjoy this chapter fully. The right strategy lets you focus on what matters most.

Many residents choose supplementary options for higher payouts. These work alongside CPF LIFE to enhance security. They offer both lifetime payout and fixed-term alternatives.

Don’t wait until it’s too late to take action. Building additional retirement income now ensures smoother transitions later. Your future self will thank you for the foresight.

Understanding Retirement Annuity Plans: How They Work

Building a secure financial future requires understanding how retirement income vehicles operate. These arrangements transform your savings into reliable payments during your golden years.

The process begins with premium contributions. You can make regular payments or opt for a single premium approach. Your money grows through interest accumulation until payout age.

When you reach your chosen retirement age, the accumulation phase ends. Your plan then starts delivering consistent income. This transition marks a crucial financial milestone.

Lifetime Payouts vs. Fixed-Term Payouts

Lifetime payout options provide income for as long as you live. They offer permanent financial security against outliving your resources. This choice brings peace of mind for your entire retirement journey.

Fixed-term arrangements deliver payments for a specific duration. They suit those with temporary income needs or other assets. Both options serve different retirement planning strategies.

Your decision depends on personal circumstances and risk tolerance. Lifetime options protect against longevity risk. Fixed-term choices offer predictability for specific timeframes.

CPF LIFE: Singapore’s National Annuity Scheme

CPF LIFE represents the national program for retirement income. It provides lifelong monthly payout security for residents. The system uses your CPF savings to fund these guaranteed payments.

This scheme offers basic financial protection during retirement. It ensures you never completely run out of income. However, it may not cover all lifestyle aspirations.

Many people combine CPF LIFE with private options. This strategy creates a more robust retirement income stream. It allows for both essential expenses and discretionary spending.

Understanding these mechanics helps you make informed choices. You can better align your retirement plan with personal goals. This knowledge empowers your financial decision-making process.

Key Benefits of a Private Retirement Annuity Plan

Additional income vehicles provide unique benefits that complement standard retirement programs. These arrangements offer features beyond basic coverage, enhancing your financial security.

Many residents find that combining different approaches creates optimal results. This strategy delivers both stability and flexibility for your future.

Guaranteed Financial Security for Your Golden Years

Private arrangements provide predictable monthly payments throughout retirement. This stability differs from market-dependent investments that can fluctuate.

Your funds remain protected against economic downturns and volatility. This security helps maintain your lifestyle without unexpected changes.

Guaranteed returns ensure consistent income regardless of market conditions. You can rely on these payments for essential expenses and discretionary spending.

Flexibility and Customization Options

These solutions offer remarkable adaptability to your changing needs. You can adjust premium structures and payout timing as circumstances evolve.

Options include single premium payments or regular contributions over time. This flexibility accommodates different financial situations and preferences.

Some programs even allow mid-term adjustments before payments begin. As one financial expert notes,

“The ability to customize your approach is what sets these solutions apart.”

Creating a Supplementary Income Stream

Supplemental arrangements work alongside CPF LIFE to enhance overall income. This combination provides higher monthly amounts than either option alone.

The extra funds support lifestyle choices like travel, hobbies, and healthcare needs. This approach helps combat rising costs during your retirement years.

Additional layers of protection often include disability coverage and other safeguards. These features provide comprehensive security beyond basic income guarantees.

Top Factors to Consider When Choosing Your Plan

Selecting the right financial vehicle requires careful thought. You want something that fits your unique situation perfectly. This means looking at several important aspects before deciding.

Your choice will impact your lifestyle during retirement. It determines how much money you receive each month. Getting this right brings peace of mind for your future.

The Importance of Guaranteed Income

A steady stream income forms the backbone of financial security. It ensures you always have money for daily needs. Market changes won’t affect these reliable payments.

Focus on the assured amounts rather than projections. For example, $100,000 at 2.5% gives $2,500 yearly. This certainty helps with budgeting throughout your golden years.

Guaranteed returns protect against economic uncertainty. They provide stability when other investments might fluctuate. This reliability becomes more valuable as you age.

Evaluating Premium Payment Structures

Payment options affect how you fund your arrangement. A single premium requires one large payment upfront. This approach works well if you have available capital.

Regular premium payment options spread costs over time. They make contributions more manageable for many people. Each method suits different financial situations.

Consider your current savings and future earning potential. A lump sum might deplete emergency funds. Spreading payments preserves liquidity during working years.

Choosing Your Retirement and Payout Age

Your selected retirement age determines when payments begin. Private options often start as early as age 55. This flexibility helps those wanting earlier retirement.

CPF LIFE typically begins at age 65. The difference allows for customized timing. Earlier payout age requires more savings accumulation.

Think about your health and career plans. Some people want to work longer while others seek early freedom. Your choice should match personal goals and circumstances.

Always assess your financial capacity before committing. Calculate needed investments carefully. For instance, $480,000 might generate $1,000 monthly at 2.5% return.

Consider using SRS funds for potential tax benefits. Verify plan eligibility first since not all accept these payments. This strategy can optimize your contributions.

By weighing these factors thoughtfully, you create security. Your retirement income will support the lifestyle you envision. The right choice brings confidence and comfort.

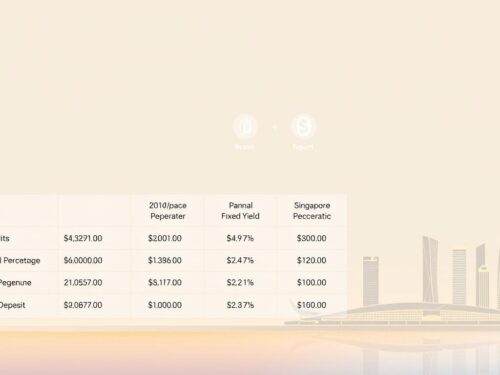

Spotlight on the Best Annuity Plan Singapore Options

Exploring different financial solutions helps you find the perfect fit. Each option brings unique advantages to your retirement planning. Let’s examine three popular choices available today.

Manulife RetireReady Plus III: For Retrenchment Protection

This option provides exceptional job loss security. If you face unemployment for 30 days, it pays 50% of your annual premium. This feature offers crucial support during career transitions.

The arrangement accepts both single premium and multi-year payment structures. You can choose between 5 to 20 years of contributions. This flexibility accommodates various financial situations.

Comprehensive protection includes premium waiver benefits for disability. If you experience activities of daily living loss, payments continue. This security extends to terminal illness coverage as well.

Fixed retirement ages between 55 and 70 are available. Your monthly income begins at your chosen time. This predictability helps with long-term financial planning.

Singlife Flexi Retirement II: For Maximum Flexibility

This solution stands out for its remarkable adaptability. You can adjust payout terms from 5 years up to age 120. Changes are possible as your needs evolve over time.

The program allows premium freezes for up to one year. This helps during temporary financial challenges. You maintain coverage while managing cash flow concerns.

It includes retrenchment benefits at 40% of annual premium. SRS funds are accepted for potential tax advantages. These features make it attractive for many savers.

Early payout options are available from age 50. This creates retirement income sooner than standard programs. The flexibility supports various lifestyle choices.

China Taiping i-Retire (II): For High Guaranteed Yields

This choice focuses on strong guaranteed returns for your future. It delivers competitive interest rates on your contributions. Your money grows reliably over time.

The loss of independence benefit provides 24 months’ income. This activates if you lose 2 out of 6 daily living activities. This protection adds valuable security.

Customizable payout terms span 10, 20, or 30 years. You select the duration that matches your needs. Flexible premium options accommodate different budgets.

This approach maximizes your retirement savings potential. It creates a robust stream income for your later years. The combination of growth and protection is compelling.

Each option serves different priorities in retirement planning. Some emphasize job security while others focus on growth or flexibility. Understanding these differences helps you make informed decisions.

Consider your personal circumstances and risk tolerance. Your choice should align with your vision for those golden years. The right selection brings confidence and peace of mind.

What to Look for in a Superior Annuity Plan

Finding the right financial solution requires knowing what makes a quality option. You want something that delivers security and flexibility. This means focusing on key features that matter most.

A strong arrangement provides guaranteed monthly payments you can count on. These funds form your foundation for golden years comfort. Market changes won’t affect this reliable stream income.

Customization options let you tailor the approach to your life. Adjustable premium payment structures accommodate changing circumstances. You can modify timing and amounts as needed.

Look for programs that work alongside your existing CPF LIFE benefits. This creates a powerful retirement income combination. Together they provide both essentials and lifestyle choices.

Always prioritize the guaranteed portions over projections. Non-guaranteed elements involve speculation and risk. Your security comes from what’s promised, not what’s possible.

Additional protections add valuable security layers. Features like disability coverage or job loss benefits provide extra peace of mind. These safeguards extend beyond basic income guarantees.

Check whether arrangements accept SRS funds for potential tax advantages. This strategy can optimize your contributions and savings. Not all options offer this flexibility.

Avoid options that emphasize insurance riders over core income features. Your primary goal remains reliable monthly payout security. Ancillary coverage shouldn’t distract from this focus.

Compare effective interest rates between different providers. Read the fine print carefully for any hidden costs or limitations. Understanding these details prevents surprises later.

Choose from reputable companies with strong financial stability. Their long-term reliability ensures your payments continue as promised. This security matters for decades of retirement.

| Feature | Why It Matters | What to Look For |

|---|---|---|

| Guaranteed Income | Provides stable payments regardless of market conditions | Clear promised amounts, not projections |

| Payment Flexibility | Allows adjustments to premium structures and timing | Option to change contribution methods |

| Supplementary Role | Enhances overall retirement strategy alongside CPF | Compatibility with existing arrangements |

| Additional Protections | Offers security beyond basic income guarantees | Disability or retrenchment benefits |

| SRS Eligibility | Provides potential tax advantages on contributions | Clear statement accepting SRS payments |

| Provider Stability | Ensures long-term reliability of all payments | Strong financial ratings and history |

By focusing on these criteria, you create lasting financial peace. Your selection should support your vision for those special years ahead. The right choice brings confidence and comfort throughout retirement.

Common Pitfalls and What to Avoid

Navigating retirement choices requires careful attention to detail. Some options might seem attractive initially but hide potential drawbacks. Understanding these common mistakes helps protect your financial future.

Many people focus on flashy features rather than core benefits. This approach can lead to disappointing results later. Always prioritize security and reliability above all else.

Overvaluing Non-Guaranteed Returns

Projected returns often look impressive in brochures. These numbers represent potential performance, not promises. Market conditions can change these outcomes significantly.

One investor chose an option based on high projected bonuses. The actual returns fell short by 30%. This created income gaps during their golden years.

Always base decisions on guaranteed returns instead of projections. These promised amounts form your reliable stream income. They won’t change with economic fluctuations.

Compare the assured yields between different providers. This comparison reveals true value beyond marketing claims. Your retirement savings deserve this protection.

Prioritizing Insurance Riders Over Core Income

Additional benefits like terminal illness coverage seem valuable. However, they shouldn’t overshadow the main purpose. Your primary need remains consistent monthly income.

Some arrangements emphasize premium waiver features excessively. While useful, these remain secondary to income generation. The core function should always come first.

As one financial expert advises:

“Treat riders as complementary features, not decision-makers. Your retirement security depends on income reliability above all else.”

Evaluate any extra costs associated with these additions. Expensive riders might reduce your overall retirement income. Ensure the value justifies any premium increases.

Other Important Considerations

Capital protection exists in all Singapore arrangements. Don’t let this standard feature influence your choice. Focus instead on payout flexibility and amounts.

Medical underwriting typically isn’t required for these programs. Disregard this as a unique selling point. Concentrate on more relevant factors like payment duration.

High management fees can erode your savings over time. Compare total costs between different options. Ensure you receive value for every dollar spent.

| Potential Mistake | Why It Matters | Smart Alternative |

|---|---|---|

| Chasing projected bonuses | Non-guaranteed amounts may not materialize | Focus on promised returns only |

| Overvaluing insurance riders | Increases costs without enhancing core income | Evaluate riders separately from main features |

| Ignoring fee structures | High costs reduce overall retirement funds | Compare total expense ratios carefully |

| Focusing on standard features | All options offer basic capital protection | Prioritize unique benefits and flexibility |

| Neglecting provider stability | Affects long-term payment reliability | Choose companies with strong financial ratings |

Consulting a financial advisor provides valuable perspective. They help identify hidden costs and compare true values. This guidance prevents costly mistakes.

Remember that your goal is financial security during golden years. Keep your evaluation centered on guarantees and practicality. This approach ensures peace of mind for decades.

How Premium Payments Work: Single vs. Regular Premiums

Choosing how to fund your future is a big decision. The way you pay affects your financial flexibility today and tomorrow. Understanding payment options helps you make a smart choice.

You have two main ways to build your retirement savings. A single premium means one large payment now. Regular premiums spread smaller payments over several years.

A single premium payment uses a lump sum of money. This approach works well if you have savings available. It gets your money working for you right away.

Regular premium payments happen over time. You might pay monthly, yearly, or another schedule. This method fits people with steady income streams.

Both methods help create reliable income for your golden years. Your choice depends on your current financial situation. Consider what works best for your budget and goals.

Single Premium Payments: The Lump Sum Approach

A single premium involves one immediate payment. You commit a larger amount upfront. This option suits those with significant savings.

Your money begins accumulating interest immediately. This can lead to faster growth of your retirement fund. You lock in current rates for future returns.

Some arrangements accept SRS funds for single premiums. This can provide tax advantages on your contribution. Always check if your chosen option allows this.

This method simplifies your financial planning. You make one decision and one payment. After that, your future income is secured.

Regular Premium Payments: The Spreading Method

Regular premiums let you pay over several years. Common periods include 5, 10, or 15 years. This approach helps manage cash flow.

You can align payments with your income schedule. Monthly deductions might come from your salary. This makes budgeting easier for many people.

This flexibility accommodates changing circumstances. If your income increases, you might pay more. During tighter times, you maintain smaller payments.

Your retirement savings grow gradually over time. Each payment adds to your future security. This method builds discipline into your financial habits.

Comparing Both Approaches

Each payment method offers distinct advantages. Your personal situation determines the better choice. Consider these factors when deciding.

Single premiums work well with windfalls or bonuses. They’re ideal if you’ve accumulated significant savings. This approach provides immediate peace of mind.

Regular premiums suit steady income earners. They help those who prefer spreading costs over time. This method preserves liquidity for other needs.

Some programs offer both payment options. Singlife Flexi Retirement II allows either approach. This flexibility lets you choose what works best.

| Payment Type | Best For | Key Considerations |

|---|---|---|

| Single Premium | Those with lump sum savings | Immediate accumulation, potential tax benefits with SRS |

| Regular Premium | Steady income earners | Budget-friendly, maintains liquidity |

| Both Options | Those wanting flexibility | Allows adjustment based on changing circumstances |

Your payment choice affects your retirement timeline. Single premiums might enable earlier payouts. Regular premiums require longer commitment but offer adaptability.

Consider consulting a financial advisor for guidance. They can help calculate required investment amounts. This ensures your choice aligns with your income goals.

Remember that both methods lead to the same destination: reliable monthly income during your retirement years. The path you choose should match your current financial landscape.

Using SRS Funds for Your Annuity: What You Need to Know

Many Singapore residents overlook a powerful tool for building retirement security. The Supplementary Retirement Scheme offers unique tax advantages when funding your future income. This approach can significantly enhance your financial preparation.

SRS represents a voluntary savings program with special benefits. You can use these funds for single premium payments on eligible arrangements. This strategy provides immediate tax relief while building long-term security.

Not all financial vehicles accept SRS contributions. Popular options like Singlife Flexi Retirement II welcome these payments. Manulife RetireReady Plus III also supports this funding method.

Using SRS reduces your current taxable income. Contributions qualify for tax deductions up to specific limits. This immediate benefit helps higher earners optimize their tax situation.

Withdrawals during your golden years face favorable tax treatment. Only 50% of withdrawn amounts count as taxable income. This structure creates significant long-term savings.

Key Benefits of SRS Funding

SRS offers multiple advantages for retirement planning. The tax deferment feature helps your money work more efficiently. You keep more of your earnings while building future security.

This approach maximizes your retirement savings through compound growth. Funds invested earlier have more time to accumulate value. The combination of tax benefits and growth creates powerful results.

As one financial advisor explains:

“SRS represents one of Singapore’s most effective tools for retirement planning. The tax advantages alone make it worth considering for any serious saver.”

Higher income earners particularly benefit from this strategy. The tax savings can be substantial for those in upper brackets. These funds then grow tax-deferred until withdrawal.

Important Considerations and Rules

SRS withdrawals have specific regulations you must follow. Funds remain accessible only after reaching retirement age. Early access triggers penalties and full taxation.

The standard retirement age for SRS is 62 years. Withdrawals before this date incur a 5% penalty. All withdrawn amounts become fully taxable as well.

Some arrangements may have additional restrictions. Always verify SRS eligibility with your chosen provider. Understand any extra fees or limitations before committing.

Planning your withdrawal strategy requires careful thought. Staggered withdrawals can minimize tax impact during retirement. This approach helps maintain lower tax brackets.

SRS vs. Cash Payments: A Comparison

Both funding methods serve different financial situations. Cash payments work well for those seeking simplicity. SRS offers tax advantages for those wanting optimization.

Consider this comparison of key differences:

| Funding Method | Tax Treatment | Best For | Considerations |

|---|---|---|---|

| SRS Contributions | Tax-deductible now, partial taxation later | Higher income earners, tax optimization | Withdrawal restrictions, early penalty |

| Cash Payments | No tax benefits, but complete flexibility | Those wanting immediate access, simpler approach | No tax advantages, but no restrictions |

Your choice depends on income level and financial goals. SRS works best for those seeking tax efficiency. Cash payments offer simplicity without complications.

Many residents use a combination of both approaches. They fund part of their premium through SRS. The remainder comes from regular savings or other sources.

Real Examples of SRS Benefits

Consider someone earning $100,000 annually. Their SRS contribution of $15,300 reduces taxable income. This creates immediate tax savings of approximately $2,500.

These funds then grow within their chosen arrangement. The tax-deferred growth compounds over years or decades. Withdrawal at retirement faces only partial taxation.

The total savings can reach significant amounts over time. This strategy effectively boosts your retirement income. You enjoy higher monthly payments with less tax impact.

Always consult a financial advisor for personalized guidance. They can calculate your optimal contribution amount. This ensures you maximize benefits while following regulations.

Using SRS wisely enhances your overall retirement strategy. It creates tax efficiency while building reliable income. This approach helps secure your financial future.

Comparing the Top Annuity Plans in Singapore

Understanding different financial options helps you find the right fit for your future. Each choice brings unique strengths to your retirement planning. Let’s examine popular arrangements available today.

Singlife Flexi Retirement II stands out for adaptability. You can adjust payout terms from 5 years up to age 120. Premium freezes help during temporary financial challenges.

This option includes retrenchment benefits at 40% of annual premium. SRS funds are accepted for potential tax advantages. These features make it attractive for many savers.

Manulife RetireReady Plus III provides job loss security. If unemployed for 30 days, it pays 50% of your annual premium. This feature offers crucial support during career transitions.

The arrangement accepts both single premium and multi-year payment structures. Comprehensive protection includes premium waiver benefits for disability. This security extends to terminal illness coverage.

China Taiping i-Retire (II) focuses on strong guaranteed returns. It delivers competitive interest rates on your contributions. Your money grows reliably over time.

The loss of independence benefit provides 24 months’ income. Customizable payout terms span 10, 20, or 30 years. Flexible premium options accommodate different budgets.

NTUC Income Gro Retire Flex Pro offers high returns and disability coverage. AIA Platinum Gift For Life focuses on legacy planning. Both serve different priorities in financial preparation.

As one financial expert observes:

“The diversity of options ensures everyone can find something matching their specific needs and risk tolerance.”

Features vary significantly between providers. Some emphasize flexibility while others focus on protection or growth. Understanding these differences helps you make informed decisions.

| Feature | Singlife Flexi Retirement II | Manulife RetireReady Plus III | China Taiping i-Retire (II) |

|---|---|---|---|

| Payout Flexibility | 5 years to age 120 | Fixed terms available | 10, 20, or 30 years |

| Unique Protection | Premium freeze option | Retrenchment benefit | Loss of independence coverage |

| Premium Options | Single or regular | Single or multi-year | Flexible structures |

| SRS Eligibility | Yes | Yes | Check provider |

| Retirement Age Start | From age 50 | 55-70 | 55-70 |

| Guaranteed Returns | Competitive rates | Stable yields | High yields |

Each arrangement serves different financial priorities. Some emphasize job security while others focus on growth or flexibility. Your choice should align with your vision for those golden years.

Consider using Supplementary Retirement Scheme funds for potential tax advantages. This strategy can optimize your contributions and enhance your overall financial preparation.

Always compare the guaranteed portions rather than projections. Your security comes from promised amounts, not potential performance. This approach ensures reliable income during retirement.

Consult a financial advisor for personalized guidance. They can help calculate required investment amounts. This ensures your choice aligns with your income goals and personal circumstances.

Conclusion: Making an Informed Decision for Your Retirement

Securing your financial future requires thoughtful preparation. Start by focusing on guaranteed income and avoiding common mistakes. Choose a solution that matches your personal goals and risk comfort.

These arrangements work alongside CPF LIFE to create complete coverage. They provide both essential funds and extra money for lifestyle choices. This combination ensures comfort during your golden years.

Consider your desired retirement age and income needs carefully. Talk with a financial advisor for personalized guidance. They help select the right option for your situation.

Begin early to lock in favorable terms and maximize growth. Use SRS funds smartly for potential tax advantages. Always review all details before making any commitment.

This guide offers comprehensive knowledge to support your choice. With proper preparation, you can achieve financial peace. Enjoy your retirement years with confidence and security.