Fixed deposit rates in Singapore have been trending downward recently. Many banks have lowered their offers over the past few months.

This makes comparing different financial institutions more important than ever. Finding the right account can help you maximize returns on your spare cash.

Our guide provides current information on various tenures and minimum deposit requirements. We’ll regularly update these details to ensure you have the latest data.

Fixed deposit accounts offer guaranteed returns but require locking your funds for specific periods. Consider your financial goals and liquidity needs before choosing.

Key Takeaways

- Fixed deposit interest rates have generally decreased across most banks

- Comparing different institutions can help you find higher interest rates

- Minimum deposit requirements vary significantly between providers

- These accounts offer guaranteed returns but limit access to your funds

- Promotional rates change frequently – always check current offers

- Consider alternative low-risk investments for comparison

- Your financial goals should guide your deposit strategy

Introduction to Time Deposits in Singapore

Many savers seek stable options for their money in today’s financial landscape. These accounts provide predictable growth without market volatility concerns.

Understanding how these instruments function helps you make informed decisions. They remain popular despite changing economic conditions.

What Are Fixed Deposits and How Do They Work?

A fixed deposit represents a secure arrangement with financial institutions. You commit a specific sum for a predetermined period.

The bank guarantees a set interest rate throughout your chosen tenure. This creates certainty about your returns from day one.

Minimum investment requirements vary significantly across providers. Some institutions accept amounts as low as S$500 while others require S$20,000 or more.

Your funds receive protection under Singapore’s Deposit Insurance Scheme. Coverage extends up to S$100,000 per depositor per scheme member.

Early access to your money typically involves penalty fees. These charges discourage premature withdrawals and maintain account stability.

Current Market Trends for Singapore Fixed Deposits

The landscape for fixed deposit rates has shifted noticeably recently. Many institutions adjusted their offers downward throughout 2024.

This follows a period of relatively attractive promotional rates during late 2023. Economic factors including monetary policy changes influenced this trend.

Despite lower returns, these accounts maintain strong appeal. Their guaranteed outcomes and capital protection continue attracting conservative investors.

Financial institutions frequently update their deposit rates and special offers. This makes regular comparison essential for maximizing returns.

You’ll find different interest rates for identical tenures across banks. Some providers offer marginally higher interest to attract new customers.

When considering your deposit amount, review all available options. The right choice depends on your financial goals and liquidity needs.

Why Consider Time Deposits for Your Savings

Predictable growth without market volatility makes certain savings vehicles particularly appealing. These instruments offer financial certainty when other options might fluctuate unexpectedly.

Benefits of Locking in Your Interest Rates

Fixed deposit accounts provide guaranteed returns that remain unchanged by market movements. This stability helps with financial planning and budgeting.

You know exactly what your money will earn from day one. This predictability creates peace of mind for conservative investors.

These accounts offer principal protection alongside guaranteed growth. Your initial investment remains safe while earning consistent deposit interest.

Compared to regular savings accounts, these instruments typically provide higher interest rates. The trade-off involves locking your funds for specific periods.

Minimal management makes these options attractive for busy individuals. Once established, they require little ongoing attention.

During economic uncertainty, these vehicles become especially valuable. Their guaranteed outcomes provide financial security when markets fluctuate.

Understanding Deposit Insurance in Singapore

The Singapore deposit insurance scheme offers significant protection for savers. Coverage extends up to S$100,000 per depositor per institution.

In 2024, the Monetary Authority increased protection from S$75,000 to S$100,000. This enhancement provides greater security for your savings.

The Singapore Deposit Insurance Corporation (SDIC) administers this protection. It covers various deposit types including savings and fixed accounts.

This insurance protects consumers if a member institution fails. Your funds receive protection regardless of market conditions.

Compared to other investment options, this insurance provides unique security. Many alternatives lack similar protection mechanisms.

When considering your minimum deposit requirements, remember this coverage limit. It’s wise to spread larger amounts across multiple institutions.

These accounts fit well within diversified investment portfolios. They provide stable foundation elements alongside growth-oriented options.

For comprehensive deposit rates comparison across different banks, visit our detailed fixed deposit comparison guide.

DBS/POSB Fixed Deposit Rates and Features

DBS and POSB present an interesting approach to their savings products that differs from many competitors. Their tiered structure creates unique opportunities for different types of savers.

Short-term vs Long-term Tenure Options

These institutions offer varied fixed deposit rates based on your chosen timeframe. For amounts between S$1,000 and S$19,999, you’ll find attractive returns.

The six-month option provides 1.40% annual returns. Seven-month placements earn 1.55%, while eight to twelve-month commitments yield 1.60%.

This structure makes their medium-term options particularly compelling. The 12-month fixed deposit stands out among local offerings.

Special Senior Citizen Rates

Customers aged 55 and above receive additional benefits through the Premier Income Account. This program adds 0.10% to standard rates for tenures of six months or longer.

The enhanced fixed deposit interest creates a 1.70% return for one-year placements. This represents a meaningful boost for qualified individuals.

Eligibility requires maintaining a minimum deposit 10,000 threshold. The program demonstrates DBS/POSB’s commitment to serving older customers.

Minimum Deposit Requirements

These fixed deposit accounts feature an unusual inverse relationship between amount and returns. Larger deposits actually receive lower rates.

Amounts exceeding S$20,000 drop to just 0.05% across all tenures. This encourages multiple smaller placements rather than single large investments.

The approach benefits savers with modest amounts to invest. It creates accessibility that many other institutions don’t offer.

“Our tiered rate structure ensures competitive returns for various customer segments while maintaining financial accessibility.”

You can access these offerings through digital banking platforms or branch visits. The deposit rates Singapore market continues to evolve, making regular checking essential.

These deposit interest rates represent current promotions that may change. Always verify the latest terms before committing your funds.

For those seeking higher interest rates on medium-term placements, DBS/POSB frequently ranks among the top choices. Their unique structure rewards careful planning.

RHB Bank Time Deposit Offerings

Savvy investors often explore regional banks for potentially better returns. RHB presents compelling options worth considering for your savings strategy.

The bank offers distinct fixed deposit rates based on your banking relationship. This tiered approach rewards loyal customers with enhanced benefits.

Personal Banking vs Premier Banking Rates

RHB’s structure clearly differentiates between regular and premium clients. Personal Banking customers receive solid returns across various tenures.

Three-month placements earn 1.40% annually under this tier. Six-month commitments yield 1.30%, while twelve-month options provide 1.10%.

Premier Banking clients enjoy noticeably higher interest across all durations. Their three-month rate offered reaches 1.50%, beating the personal tier.

Six-month Premier accounts deliver 1.40%, and twelve-month options pay 1.15%. This represents meaningful advantages for qualified customers.

Promotional Rates and Terms

RHB’s current promotional rates make their short-term options particularly attractive. The three-month tenure stands out among local offerings.

All placements require a minimum deposit 20,000 Singapore dollars. This threshold applies equally across both banking tiers.

These special interest rates remain subject to change without notice. RHB frequently updates their deposit rates based on market conditions.

Application occurs exclusively through the RHB Mobile SG application. This digital-first approach streamlines the placement process significantly.

The bank’s competitive fixed deposit rate for short durations appeals to many savers. It offers flexibility without locking funds for extended periods.

Compared to other institutions, RHB’s three-month deposit rate ranks among the more attractive options. Always verify current promotions before committing funds.

Bank of China Fixed Deposit Options

International banks provide unique opportunities for savers seeking competitive returns. Bank of China stands out with its accessible approach to savings products.

The institution offers attractive terms through digital channels. Their mobile platform makes opening accounts straightforward and convenient.

Mobile Banking Placement Benefits

Bank of China’s digital platform simplifies the entire process. You can establish your account from anywhere using your smartphone.

The mobile application offers real-time rate information. This helps you make informed decisions quickly.

Digital placements often receive preferential treatment. Some institutions provide slightly better terms through online channels.

The minimum requirement through mobile banking is just S$500. This low threshold makes savings accessible to many people.

Tiered Rates Based on Deposit Amount

Bank of China employs a two-tier system for their offerings. Smaller amounts through mobile banking receive solid returns.

Larger investments qualify for enhanced terms. Deposits exceeding S$40,000 unlock different rate structures.

This approach benefits both small and substantial savers. Each group receives appropriate consideration.

| Tenure | Mobile Banking (Min S$500) | Premium Tier (Min S$40,000) |

|---|---|---|

| 3 Months | 1.30% | Not Available |

| 6 Months | 1.25% | 1.30% |

| 9 Months | 1.15% | 1.18% |

| 12 Months | 1.15% | 1.20% |

The bank regularly updates their promotional rates. New placements always receive current terms.

Foreign banks often structure their products differently than local institutions. This creates interesting alternatives for comparison.

Smaller investors benefit greatly from the low entry requirement. Many other banks demand substantially larger initial amounts.

Always verify current terms before making decisions. Financial institutions adjust their offers frequently.

CIMB Fixed Deposit Accounts Comparison

Exploring options from Malaysian banks can reveal attractive opportunities for Singaporean savers. CIMB presents a compelling choice with its dual-tier structure that rewards different customer segments.

The bank offers distinct fixed deposit rates based on your account status. This approach creates meaningful differences in potential returns.

Preferred Banking Advantages

CIMB’s Preferred Banking program delivers enhanced benefits for qualified clients. These customers receive noticeably higher interest across all tenures compared to personal banking clients.

The three-month fixed deposit rate reaches 1.35% for preferred members. This beats the 1.30% rate offered to regular customers.

Six-month placements show similar advantages at 1.30% versus 1.25%. The pattern continues through longer durations with consistent benefits.

“Our Preferred Banking program recognizes loyal customers with enhanced returns on their savings commitments.”

Qualification typically requires maintaining specific relationship balances. The program demonstrates CIMB’s commitment to rewarding dedicated clients.

Online Placement Requirements

CIMB exclusively offers promotional deposit rates through digital channels. You must apply online to access these special terms.

The process involves completing forms through CIMB’s web platform. This digital approach ensures quick processing and immediate confirmation.

All account types require a minimum deposit 10,000 Singapore dollars. This threshold applies uniformly across both banking tiers.

The bank’s interest rates remain particularly competitive for shorter durations. Their three and six-month options frequently rank among market leaders.

| Tenure | Personal Banking Rate | Preferred Banking Rate |

|---|---|---|

| 3 Months | 1.30% | 1.35% |

| 6 Months | 1.25% | 1.30% |

| 9 Months | 1.10% | 1.15% |

| 12 Months | 1.10% | 1.15% |

CIMB regularly updates their promotional offers. Always verify current deposit rates before making placement decisions.

The online application process provides convenience and sometimes better terms. Digital placements often receive preferential treatment compared to branch applications.

Compared to other Malaysian banks in Singapore, CIMB’s structure offers clear advantages. Their tiered approach benefits both regular and premium clients.

Preferred banking customers enjoy the most significant benefits. The enhanced interest rate structure makes their program particularly valuable.

When considering your options, remember that these are promotional rates. They may change based on market conditions and bank policies.

ICBC Time Deposit Products

Global financial institutions continue expanding their presence in the local market with competitive savings options. Industrial and Commercial Bank of China provides attractive opportunities through their digital platform.

Their approach combines accessibility with tiered benefits based on investment size. This creates opportunities for both small and substantial savers.

E-banking vs Traditional Placement

ICBC strongly encourages digital applications through their e-banking platform. Online placements receive special promotional terms unavailable through branch visits.

The minimum deposit requirement differs significantly between channels. E-banking accepts amounts as low as S$500 while counter placements require S$20,000.

This digital-first strategy makes savings accessible to more people. It also streamlines the application process for faster account establishment.

“Our e-banking platform provides convenient access to competitive rates while maintaining strong security standards for all customers.”

Rate Differences by Deposit Size

ICBC employs a two-tier system that rewards larger investments with enhanced returns. This structure creates clear advantages for substantial savers.

Deposits between S$500 and S$200,000 receive solid fixed deposit rates. The three-month option offers 1.20% while six-month placements yield 1.15%.

Amounts exceeding S$200,000 qualify for noticeably higher interest returns. These larger investments receive a 1.25% rate offered for three-month commitments.

The pattern continues across longer tenures with consistent benefits. This tiered approach demonstrates how deposit amount influences potential returns.

| Tenure | Deposits S$500-S$200,000 | Deposits ≥S$200,000 |

|---|---|---|

| 3 Months | 1.20% | 1.25% |

| 6 Months | 1.15% | 1.20% |

| 9 Months | 1.10% | 1.15% |

| 12 Months | 1.10% | 1.15% |

Compared to other Chinese banks operating locally, ICBC’s structure offers competitive advantages. Their flexible requirements and tiered benefits appeal to diverse savers.

The bank regularly updates their promotional deposit rates based on market conditions. Always verify current terms before making placement decisions.

Digital applications through ICBC’s platform remain straightforward and user-friendly. The process typically completes quickly with immediate confirmation.

These interest rates represent current promotions that may change. Financial institutions adjust their offers frequently throughout the year.

When considering your options, remember that promotional rates apply exclusively to online applications. Branch placements receive different standard terms.

The fixed deposit rate structure demonstrates ICBC’s commitment to serving various customer segments. Both small and large investors find suitable options.

UOB Fixed Deposit Promotions

United Overseas Bank frequently introduces special fixed deposit promotions with attractive terms. Their current offer runs through October 30, 2025, providing two distinct tenure options for savers.

These limited-time opportunities give you predictable returns while keeping your funds secure. The bank structures these promotions to appeal to different financial planning needs.

Fresh Funds Requirements

UOB requires new money transfers for promotional eligibility. Fresh funds mean money not currently held in any UOB account.

This includes transfers from other banks or new cash deposits. The requirement ensures these offers attract new capital to the bank.

You must maintain a minimum deposit 10,000 Singapore dollars. Both the six and ten-month options share this threshold.

Short-term vs Medium-term Options

The six-month placement offers a 1.20% annual return. This shorter commitment provides quicker access to your funds.

For those preferring slightly longer terms, the ten-month option pays 1.00%. This represents a trade-off between duration and return.

Your choice depends on when you might need access to your money. Consider your upcoming financial needs before deciding.

“Our promotional fixed deposit rates provide customers with guaranteed returns while maintaining flexibility through multiple tenure options.”

These promotional rates compare interestingly with UOB’s savings products. The UOB One account currently offers higher interest under certain conditions.

However, these fixed options provide certainty that savings accounts cannot match. You know exactly what returns you’ll receive from day one.

| Feature | 6-Month Option | 10-Month Option |

|---|---|---|

| Annual Interest Rate | 1.20% | 1.00% |

| Minimum Amount | S$10,000 | S$10,000 |

| Fresh Funds Required | Yes | Yes |

| Promotional Period | Until 30 Oct 2025 | Until 30 Oct 2025 |

Applications must occur during the promotional period to qualify. The bank processes these quickly through their digital platforms.

UOB regularly updates their fixed deposit rates with new promotions. Current offers might change based on market conditions.

Compared to other local banks, UOB’s rate offered remains competitive for short-term placements. Always check current deposit rates before deciding.

These interest rates provide stability amid economic uncertainty. Your principal remains protected while earning predictable returns.

Hong Leong Finance Deposit Plans

Finance companies offer unique savings opportunities that differ from traditional banking institutions. Hong Leong Finance provides competitive options worth considering for your financial strategy.

Online Special Rates

Hong Leong Finance offers special fixed deposit rates for online applications. These digital placements often provide better terms than branch visits.

The online application process is straightforward and user-friendly. You can complete everything from home using their secure platform.

These special deposit rates change monthly as part of regular promotions. Always check current offers before making decisions.

Deposit Amount Tiers

Hong Leong Finance uses a tiered system based on your investment size. This structure rewards larger placements with enhanced returns.

Amounts between S$5,000 and S$19,999 receive solid interest rates. The 9 and 12-month options both pay 1.15% annually.

Investments of S$20,000 or more qualify for noticeably higher interest. These larger amounts earn 1.20% for the same durations.

The 15-month tenure offers different returns based on your placement size. Smaller amounts receive 0.90% while larger investments get 0.95%.

“Our tiered rate structure ensures competitive returns for various customer segments while maintaining financial accessibility.”

This approach benefits both modest and substantial savers. Each group receives appropriate consideration for their investment.

The finance fixed deposit options include longer tenures than many banks offer. The 15-month duration provides additional flexibility for planning.

Compared to traditional banks, finance companies sometimes provide different terms. They often feature more personalized service and unique product structures.

Applications can be completed online or through branch visits. Both methods offer secure processing and quick confirmation.

Hong Leong Finance regularly updates their promotional fixed deposit rate offers. These changes typically occur monthly based on market conditions.

When comparing options, remember that finance companies operate under different regulations than banks. They still provide secure savings vehicles with guaranteed returns.

The leong finance fixed deposit plans represent current promotions that may change. Always verify the latest terms before committing your funds.

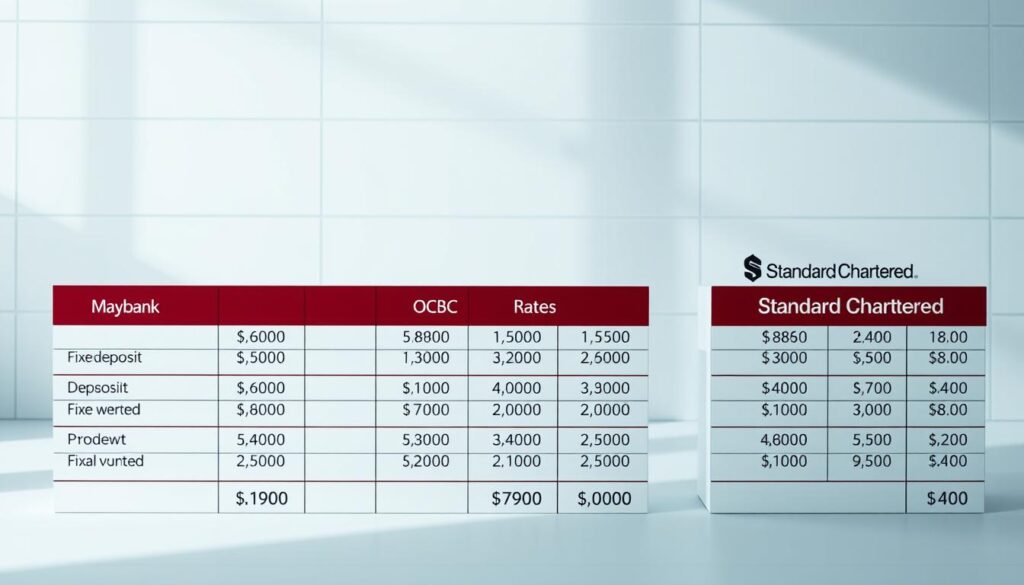

Other Bank Offerings: Maybank, OCBC, and Standard Chartered

Several additional financial institutions provide competitive savings options for Singaporean investors. These banks offer distinct features that may suit different financial needs and preferences.

Each institution structures their products with unique requirements and benefits. Understanding these differences helps you make informed decisions about your money.

Maybank iSAVvy Time Deposit

Maybank’s digital-exclusive iSAVvy Time Deposit offers attractive returns for online applications. This promotion requires establishing your account through their internet banking platform.

The six-month option provides a solid 1.20% annual return. Nine and twelve-month placements both yield 1.10% under current terms.

All options require a minimum deposit 20,000 Singapore dollars. This threshold applies uniformly across available tenures.

Online placement offers convenience and sometimes better terms than branch visits. Digital applications typically process quickly with immediate confirmation.

OCBC Online vs Branch Rates

OCBC presents different fixed deposit rates based on your application method. Online banking provides slightly enhanced returns compared to branch placements.

Digital applications for nine and twelve-month tenures earn 1.15% annually. The same durations through branch visits yield 1.10%.

This difference demonstrates the advantage of online placement. Both options require the same minimum deposit amount of S$20,000.

The bank’s digital platform offers streamlined application processing. You can complete everything from home using their secure website.

Standard Chartered Fresh Fund Promotions

Standard Chartered operates unique promotional requirements for their savings products. They mandate fresh funds transfers from external accounts.

Personal banking clients receive 1.10% for six-month commitments. Priority banking customers enjoy enhanced returns at 1.15% for the same duration.

The chartered fixed deposit requires S$25,000, slightly higher than other institutions. This amount must represent new money not currently held with the bank.

Their priority banking program offers meaningful advantages for qualified clients. Eligible customers receive better terms through this premium service.

| Bank | Product | Tenure | Interest Rate | Minimum Amount | Special Requirements |

|---|---|---|---|---|---|

| Maybank | iSAVvy Time Deposit | 6 Months | 1.20% | S$20,000 | Online only |

| Maybank | iSAVvy Time Deposit | 9/12 Months | 1.10% | S$20,000 | Online only |

| OCBC | Fixed Deposit | 9/12 Months | 1.15% | S$20,000 | Online banking |

| OCBC | Fixed Deposit | 9/12 Months | 1.10% | S$20,000 | Branch placement |

| Standard Chartered | Fixed Deposit | 6 Months | 1.10% | S$25,000 | Fresh funds, personal banking |

| Standard Chartered | Fixed Deposit | 6 Months | 1.15% | S$25,000 | Fresh funds, priority banking |

These institutions offer competitive alternatives to previously discussed banks. Their deposit rates remain attractive despite recent market trends.

Digital applications generally provide better terms than traditional methods. Online platforms offer convenience and sometimes enhanced returns.

Minimum investment requirements vary between S$20,000 and S$25,000. Always verify current terms before making placement decisions.

Financial institutions frequently update their promotional offers. Check directly with each bank for the latest interest rates and requirements.

How Fixed Deposits Compare to Other Low-Risk Investments

Exploring alternatives to traditional savings vehicles helps you make informed financial decisions. Various options offer different benefits depending on your goals and preferences.

Each choice presents unique advantages and trade-offs. Understanding these differences helps you select the right instrument for your situation.

Singapore Savings Bonds (SSBs)

Singapore Savings Bonds provide government-backed security with flexible access. These instruments offer step-up interest that increases over time.

You can redeem your investment anytime without penalty fees. This creates valuable liquidity compared to locked-in alternatives.

The minimum investment starts at just S$500, making it accessible to many savers. Recent one-year average returns reached 1.93%, outperforming most fixed options.

SSBs feature transparent pricing and regular monthly issuances. The Singapore government fully backs these instruments, ensuring capital security.

Singapore Treasury Bills (T-bills)

Treasury Bills represent short-term government securities with competitive yields. These instruments offer potentially higher returns than some traditional savings methods.

Recent six-month T-bills yielded 1.44%, slightly above comparable fixed alternatives. The minimum investment requires S$1,000, remaining accessible to various investors.

Secondary market trading provides some liquidity, though less than SSBs. Regular auctions occur throughout the year, offering frequent investment opportunities.

Like SSBs, T-bills carry the Singapore government’s full backing. This guarantees principal protection alongside competitive returns.

High-Yield Savings Accounts

Some financial institutions offer special savings accounts with attractive promotional rates. These can provide substantially higher potential returns than fixed alternatives.

Current top offers reach up to 8.05% annually under specific conditions. These typically require meeting monthly transaction targets or balance thresholds.

The main advantage involves immediate access to your funds without lock-in periods. Rates can change frequently based on bank policies and market conditions.

Unlike guaranteed fixed returns, these accounts offer variable interest rates. Your actual earnings depend on maintaining qualification criteria.

| Investment Type | Average Return | Minimum Amount | Liquidity | Government Backed |

|---|---|---|---|---|

| Fixed Deposit | 1.60% (12-month) | Varies by bank | Limited (penalties apply) | No (but SDIC insured) |

| Singapore Savings Bonds | 1.93% (1-year) | S$500 | High (redeemable anytime) | Yes |

| Treasury Bills | 1.44% (6-month) | S$1,000 | Medium (secondary market) | Yes |

| High-Yield Savings Account | Up to 8.05% | Usually none | Immediate access | No (but SDIC insured) |

The choice between guaranteed returns and potentially higher earnings involves careful consideration. Fixed options provide certainty while alternatives offer flexibility.

Your decision should align with your financial goals and risk tolerance. Each option serves different purposes within a diversified savings strategy.

Remember that promotional rates for savings accounts may change frequently. Always verify current terms and conditions before making investment decisions.

Cash Management Accounts as Alternatives

Modern investors now have more choices beyond traditional savings methods. These alternatives offer different benefits that might suit your financial goals better.

They provide unique combinations of flexibility and potential returns. Understanding these options helps you make smarter decisions with your money.

StashAway Simple™ and Other Options

StashAway Simple™ presents an interesting alternative with its projected 2.35% annual yield. This option requires no minimum investment and imposes no lock-in periods.

The platform also offers StashAway Simple™ Guaranteed with set returns. You receive 1.5% for one or three-month commitments and 1.4% for six or twelve-month terms.

Unlike traditional methods, these accounts invest in money market or bond funds. This approach aims for higher interest rates while maintaining relative stability.

Another popular choice is the Fullerton SGD Cash Fund. It currently offers a 1.536% yield through similar investment strategies.

These cash management accounts function differently from standard bank products. They pool investor funds into professionally managed portfolios.

Flexibility vs Guaranteed Returns

The main advantage of these alternatives involves their flexibility. You can access your money within days instead of waiting months.

This liquidity comes with different risk considerations. These accounts lack capital guarantees and don’t carry SDIC insurance protection.

Traditional methods offer certainty about your returns from day one. The trade-off involves locking your funds for specific periods.

Management accounts provide potential for better earnings but with some uncertainty. Your actual returns might vary slightly from projected yields.

“Cash management solutions offer modern investors flexibility and competitive yields, though they operate under different risk parameters than traditional guaranteed products.”

The choice between these options depends on your priorities. Guaranteed returns provide peace of mind while flexible accounts offer accessibility.

Consider how quickly you might need access to your funds. Also think about your comfort level with non-guaranteed outcomes.

| Feature | Cash Management Accounts | Traditional Methods |

|---|---|---|

| Projected Yield | Up to 2.35% | Up to 1.60% |

| Minimum Investment | None | Varies (S$500-S$25,000) |

| Lock-in Period | None | 3-12 months |

| Capital Guarantee | No | Yes (SDIC insured) |

| Liquidity | Days | Months (with penalties) |

These alternatives represent evolving options in the savings landscape. They appeal particularly to investors seeking flexibility and potentially higher interest rates.

Always review current promotional rates and terms before making decisions. Financial products change frequently based on market conditions.

Your choice should align with your financial goals and risk tolerance. Both traditional and modern options have their place in a diversified strategy.

Factors to Consider When Choosing Your Time Deposit

Selecting the right savings instrument requires careful evaluation of multiple factors. Your decision should balance potential returns with practical considerations about your financial situation.

Different institutions offer varying terms that might suit different needs. Understanding these differences helps you make the most appropriate choice.

Interest Rates vs Tenure Length

Longer commitment periods typically provide better returns on your investment. Most institutions offer higher interest rates for extended tenures.

The relationship between duration and return isn’t always linear. Some banks provide special promotional rates for specific timeframes that might outperform longer options.

Your choice should consider both the interest rate and how long you can comfortably lock your funds. Short-term placements offer flexibility while longer commitments provide better earnings.

Minimum Deposit Requirements

Financial institutions set different thresholds for account establishment. These minimum deposit requirements range from S$500 to S$25,000 across various providers.

Your available deposit amount directly influences which options you can consider. Some banks offer tiered rates where larger investments receive better terms.

Always verify whether you meet the required threshold before comparing fixed deposit rates. The right choice depends on matching your available funds with suitable options.

Early Withdrawal Penalties

Most institutions impose significant fees for accessing funds before maturity. These penalties typically involve losing some or all accrued interest.

Understanding these terms is crucial before committing your money. Unexpected needs might require early access, making penalty awareness important.

“Always review the early withdrawal terms before placing funds. These provisions protect the bank’s interests but can significantly impact your returns if invoked.”

Some banks charge flat fees while others reduce your interest earnings. The specific approach varies between institutions and account types.

Additional Important Considerations

Many banks offer special deposit rates for online applications. Digital placements often provide better terms than branch visits.

Promotional offers frequently require transferring new money from external accounts. These fresh funds requirements ensure the bank attracts new capital.

Your liquidity needs should guide your tenure selection. Consider upcoming expenses before locking funds for specific periods.

Calculating effective returns involves considering all factors beyond the headline fixed deposit rate. Include potential penalties and special requirements in your evaluation.

| Consideration | Typical Range | Impact on Decision |

|---|---|---|

| Tenure Length | 1-12 months | Longer usually means higher returns but less flexibility |

| Minimum Investment | S$500-S$25,000 | Determines which options are available to you |

| Early Withdrawal Penalty | Loss of interest or flat fee | Important for emergency planning |

| Promotional Rates | Limited time offers | Can provide better returns but may have special requirements |

| Placement Method | Online vs branch | Digital applications often offer better terms |

Comparing total returns rather than just headline rates gives you a complete picture. Consider all factors including special requirements and potential limitations.

For comprehensive information about current interest rates across different institutions, visit our detailed fixed deposit comparison guide.

Your financial goals and personal circumstances should ultimately guide your selection. The right choice balances potential returns with practical considerations about your situation.

Conclusion: Finding the Best Time Deposit Singapore Option for You

Recent months show many banks adjusting their offers downward. This makes regular comparison essential for maximizing returns.

DBS/POSB works well for medium-term placements. RHB provides attractive short-term options. Bank of China offers low minimum requirements.

Match your choice to personal financial needs. Consider your available amount and preferred tenure. Also think about liquidity requirements.

Alternative options like SSBs or T-bills might suit different goals. Cash management accounts offer more flexibility.

Always verify current promotions directly with banks. Check their websites for the latest terms before deciding.

For comprehensive rate comparisons, visit our detailed fixed deposit comparison guide.

These accounts remain a solid choice for guaranteed growth. Your funds stay protected under Singapore’s deposit insurance scheme.