Singapore’s brokerage landscape has become highly competitive, especially after the post-COVID investment surge. With more individuals turning to stocks and other assets, choosing the right brokerage is crucial for long-term success. Investors now have access to a variety of options, each offering unique features and fees.

Retail investment growth in the region is driven by inflation concerns and the need for wealth preservation. This has led to the emergence of low-cost custodial options like Longbridge and uSMART, which cater to modern investors. Understanding the difference between CDP and custodian accounts is essential for making informed decisions.

As Asia’s financial hub, Singapore provides access to 18 global exchanges. However, traditional CDP-linked accounts can incur higher costs, such as 2.5% fees on $1,000 trades. Comparing platforms based on cost structures, market access, and product diversity can help optimize returns.

Key Takeaways

- Singapore’s brokerage market is highly competitive post-COVID.

- Comparing fees and account types is essential for optimal returns.

- Retail investment growth is driven by inflation and wealth preservation.

- Understanding CDP vs custodian accounts is crucial.

- Low-cost custodial options are gaining popularity among investors.

Introduction to Trading Platforms in Singapore

The rise of digital-first solutions has transformed how investors in Singapore approach the financial markets. Since 1996, the shift from traditional brokers to fintech platforms has been remarkable. Today, 72% of Singaporeans prefer digital-first services for their investment needs.

Singapore’s markets are regulated by the Monetary Authority of Singapore (MAS), ensuring a secure environment for investors. This includes safeguards like SDIC coverage, protecting deposits up to S$75k. Such measures make the region a trusted hub for stock trading.

For local investments, investors often need two types of account: a brokerage account and a CDP account. This dual requirement ensures seamless access to SGX-listed securities. Mobile apps have further simplified this process, with adoption rates reaching 89% among investors under 35.

Platforms like Tiger Trade and moomoo offer 24/7 access to global markets, catering to the growing demand for flexibility. Integration with banking services, such as DBS Vickers and Standard Chartered, adds convenience for users.

Educational resources, like those from ProsperUs Academy, empower new investors. This is especially important as 41% of new investors are millennials. With a daily trading volume of $2.8B, Singapore’s online brokerage scene is thriving.

Why Singapore is a Hub for Online Trading

Singapore has emerged as a global leader in online trading due to its strategic location and advanced infrastructure. Positioned between Asian and Western market hours, it offers seamless access to global markets. This unique advantage makes it a hotspot for traders worldwide.

The Monetary Authority of Singapore (MAS) plays a key role in fostering innovation. Through its fintech sandbox, it encourages the development of cutting-edge trading tools. This regulatory support ensures a secure and efficient environment for investors.

Singapore’s tax policies further enhance its appeal. With 0% capital gains tax on international investments, it attracts traders looking to maximize returns. Additionally, 78% of platforms offer multi-currency accounts, supporting SGD, HKD, and USD transactions.

Connectivity is another major strength. Traders can access over 30 global exchanges, including NASDAQ and Hong Kong’s HKEX. This broad reach ensures diverse opportunities for portfolio growth.

Here are some key features that make Singapore a top choice for traders:

- Competitive forex spreads, averaging 0.08 pips for USD-SGD pairs.

- High-speed trading infrastructure with execution speeds under 10ms.

- Multi-lingual support for Mandarin, Malay, and English speakers.

- Partnerships with global custodians like HSBC and Citi.

- Alignment with EU MiFID II and US SEC regulatory standards.

With its strategic advantages, robust regulations, and advanced technology, Singapore continues to lead as a global trading hub. Whether you’re trading forex, stocks, or derivatives, the city-state offers unparalleled access and opportunities.

Types of Trading Accounts: CDP vs Custodian

Investors in Singapore often face the decision between CDP and custodian accounts. Each account type offers unique benefits and considerations. Understanding these differences can help you make informed choices that align with your investment goals.

CDP-Linked Accounts

CDP-linked accounts are a popular choice for many investors. They provide direct ownership of shares, ensuring transparency and control. Here are some key features:

- Direct shareholder voting rights in AGMs.

- Required for SRS/CPF investment schemes.

- Higher transparency through SGX portal access.

- Mandatory for SGX bond purchases.

- Preferred by institutional investors, with an 83% adoption rate.

These accounts are ideal for those who value direct ownership and long-term investment strategies.

Custodian Accounts

Custodian accounts offer a more cost-effective solution for active traders. They eliminate the need for a CDP account, reducing fees and simplifying the process. Key advantages include:

- No clearing fees, compared to 0.0325% for CDP accounts.

- Lower minimum commission fees, starting at $1.99 instead of $25.

- Access to global markets without additional paperwork.

This account type is perfect for those who prioritize cost efficiency and flexibility in their trading activities.

Comparing Fees: What to Expect

Understanding the fee structure is essential for maximizing your investment returns. Whether you’re a seasoned investor or just starting, knowing what to expect can help you make smarter decisions. Let’s break down the key components of fees and how they impact your trades.

Commission Fees

Commission fees vary widely depending on the type of account and the broker you choose. For CDP-linked accounts, the commission typically starts at 0.28%, while custodial accounts offer rates as low as 0.03%. This difference can significantly affect your overall costs, especially for frequent traders.

Here’s a quick comparison of minimum commission fees:

- Longbridge: $0.99 per trade

- DBS Vickers: $25 per trade

- Active trader discounts: Up to 50% off after 30 monthly trades

Additionally, FX conversion spreads range from 0.2% to 0.8% for USD transactions. These spreads can add up, so it’s important to factor them into your calculations.

Other Trading Fees

Beyond commission, there are other costs to consider. For example, SGX charges a trading fee of 0.0075% plus a $0.35 settlement fee per contract. GST also adds 9% to all brokerage charges, increasing the total amount you pay.

Here are some other fees to keep in mind:

- Clearing fees: 0.0325% for CDP accounts

- Minimum commission fees: $1.99 for custodial accounts

- FX conversion spreads: 0.2-0.8% for USD transactions

By understanding these fees, you can better plan your trades and minimize unnecessary costs. Always review the fee structure of your chosen broker to ensure it aligns with your investment strategy.

Top Trading Platforms in Singapore

Singapore offers a variety of reliable options for investors looking to diversify their portfolios. Whether you’re focused on stocks, ETFs, or other assets, these platforms provide unique features to meet your needs. Let’s explore some of the top choices available today.

POEMS by Phillip Securities

POEMS stands out with its 47-year heritage and physical branches across Singapore. This platform is regulated by the Monetary Authority of Singapore (MAS), ensuring the safety of over $50 billion in client assets. It’s a trusted choice for both beginners and experienced investors.

Key features include:

- Low SGX fees at 0.08% and flat US trades for $3.88.

- Integrated unit trust platform with 0% sales charges.

- Access to a wide range of markets and asset classes.

Tiger Brokers

Tiger Brokers is known for its cost-effective solutions, making it ideal for active traders. With fees as low as $1.99 per trade for US options contracts, it’s a popular choice for those looking to minimize costs.

Here’s what makes it stand out:

- User-friendly interface for seamless trading.

- Access to global markets, including US and Asian exchanges.

- Competitive pricing for stocks and ETFs.

Moomoo SG

Moomoo SG combines affordability with advanced tools, catering to both new and seasoned investors. Its intuitive design and robust features make it a top contender in the Singaporean market.

Highlights include:

- Low-cost trading with transparent fee structures.

- Comprehensive educational resources for beginners.

- Access to a diverse range of markets and asset types.

These brokers offer distinct advantages, making it easier for investors to find the right fit for their goals. Whether you prioritize cost, accessibility, or advanced tools, Singapore’s top platforms have you covered.

Best Trading Platform for Beginners

Starting your investment journey can feel overwhelming, but the right tools and resources make it easier. An investment platform designed for beginners offers features like guided portfolio builders and educational resources. These tools help you understand your risk tolerance and make informed decisions.

For example, Moomoo’s beginner course has a 94% completion rate, showing its effectiveness. Many new users prefer custodial accounts, with 73% choosing this option for its simplicity and low fees. This makes it an excellent choice for those just starting out.

Here are some features that make a beginner-friendly investment platform stand out:

- Guided portfolio builders with risk assessment quizzes.

- Pre-built thematic baskets like ESG and Tech Titans.

- 1-click ETF replication of the Straits Times Index.

- Demo accounts with real-time market data.

- Auto-conversion of SGD to 9 foreign currencies.

These features help beginners explore different products and build confidence. Alert systems for price movements and news keep you informed, while educational webinars with CMT-certified mentors provide valuable insights.

Round-up investing via linked bank cards is another innovative feature. It allows you to invest small amounts effortlessly. Social sentiment indicators for popular stocks help you gauge market trends. Plus, 24/7 chatbot support ensures quick answers to your questions.

| Feature | Benefit |

|---|---|

| Guided Portfolio Builders | Helps assess risk and build a tailored portfolio. |

| Pre-built Thematic Baskets | Simplifies investing in specific sectors or themes. |

| Demo Accounts | Provides practice with real-time data. |

| Auto-conversion | Easily invest in foreign funds. |

| Chatbot Support | Offers quick assistance anytime. |

For more details on Moomoo’s beginner-friendly features, check out this comprehensive guide. With the right investment platform, you can start your journey with confidence and ease.

Best Trading Platform for Advanced Traders

Advanced traders require sophisticated tools to navigate complex financial markets. Whether you’re focusing on options, forex, or futures, the right platform can make all the difference. Platforms like Saxo Markets and Interactive Brokers offer features tailored for professionals.

Saxo Markets provides access to over 71,000 instruments, making it a top choice for diversification. Interactive Brokers’ PRO platform includes 120+ technical indicators, ideal for in-depth analysis. These brokers cater to the needs of experienced traders with precision and flexibility.

Here are some advanced features to look for:

- Algorithmic trading APIs with Python integration for custom strategies.

- Dark pool access through Liquidnet and Instinet for discreet trading.

- Options strategies builder with P/L simulations for risk management.

- Futures trading across 30+ commodities for portfolio diversification.

- FX swap points calculator with carry trade analytics for forex optimization.

These tools help advanced traders execute strategies efficiently and maximize returns.

For those leveraging higher rates, portfolio margin accounts offer up to 6:1 leverage. Institutional-grade research from Morningstar and Reuters ensures informed decision-making. Co-location services are available for high-frequency trading firms, reducing latency.

| Feature | Benefit |

|---|---|

| Algorithmic Trading APIs | Enables custom strategy development. |

| Dark Pool Access | Facilitates discreet, large-volume trades. |

| Options Strategies Builder | Simulates P/L for better risk management. |

| Portfolio Margin Accounts | Offers higher leverage for advanced strategies. |

| Co-location Services | Reduces latency for high-frequency trading. |

Customizable market depth heatmaps and block trade negotiation platforms further enhance the trading experience. These features ensure that advanced traders have the tools they need to succeed in competitive markets.

Whether you’re trading options, forex, or futures, these platforms provide the precision and flexibility required for professional-level trading. Explore these advanced tools to elevate your trading strategy.

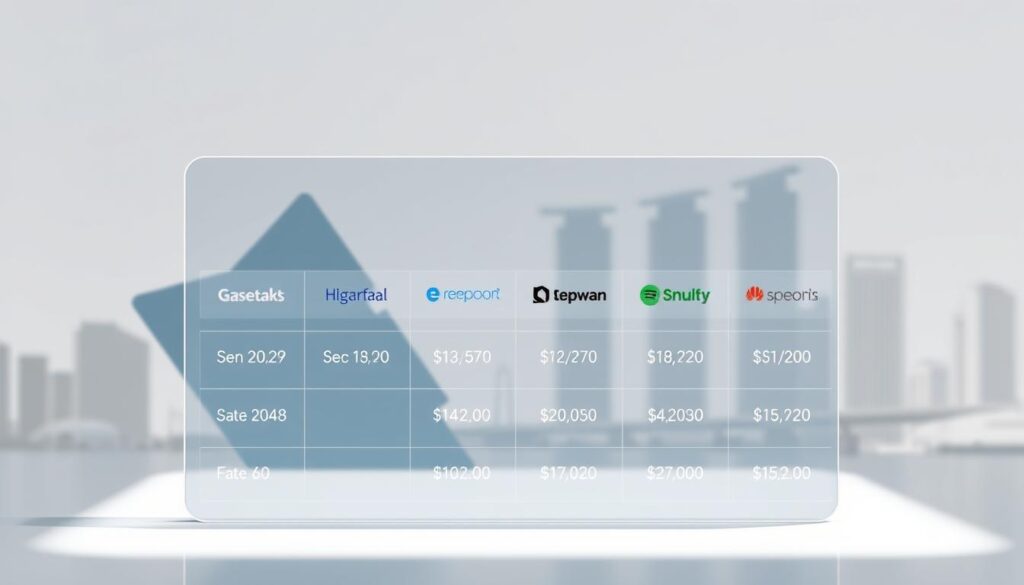

Lowest Cost Platforms for SG and US Stocks

Finding the most cost-effective way to invest in SG and US stocks is a priority for many. Whether you’re focusing on stocks etfs or individual shares, minimizing fees can significantly enhance your portfolio’s value.

Longbridge stands out with its $0.99 SG trades, waived for the first 90 days. Webull offers competitive US stock commissions at 0.025%, making it a strong choice for international investors. These platforms provide excellent value for frequent traders.

When comparing custodial accounts, CMC Invest charges $2 per trade, while uSMART offers zero fees. This difference can add up, especially for those making multiple transactions monthly.

For CDP-linked accounts, lump-sum investing often incurs higher costs compared to SIP (Systematic Investment Plan) strategies. SIPs allow you to spread your amount over time, reducing the impact of fees.

Odd-lot trading platforms like FSMOne and POEMS cater to investors looking to buy smaller amounts of shares. These platforms provide flexibility for those who don’t want to commit to full-lot purchases.

| Platform | Fee Structure |

|---|---|

| Longbridge | $0.99 SG trades (waived first 90 days) |

| Webull | 0.025% US stock commissions |

| CMC Invest | $2 per trade |

| uSMART | Zero fees |

By understanding these fee structures, you can make informed decisions that align with your investment goals. Whether you’re trading stocks etfs or individual shares, choosing the right platform can maximize your returns.

Investing with CPF/SRS Funds

Using CPF and SRS funds for investments can unlock significant financial opportunities. These funds provide a secure way to grow your wealth while enjoying tax benefits. With 9 MAS-approved CPFIS providers, you have access to a variety of investment options tailored to your needs.

Approved instruments include STI ETFs and blue-chip REITs, which are known for their stability and growth potential. These products are ideal for those looking to balance risk and returns. Comparing fees is essential, as providers like POEMS charge 0.3% pa RSP fees, while FSMOne offers a flat rate of $3.80.

- Choose a MAS-approved provider.

- Submit your application with required documents.

- Select your preferred investment instruments.

- Monitor your portfolio regularly.

SRS accounts offer additional tax relief strategies, such as dividend reinvestment. However, liquidity constraints like 3-day withdrawal periods should be considered. Estate planning is also crucial, especially when setting up nominee accounts for your funds.

Performance benchmarking against the CPF OA 2.5% rate helps you evaluate your returns. Robo-advisors like Endowus and AutoWealth provide automated solutions for CPF investments, making it easier to manage your portfolio.

| Provider | Fee Structure |

|---|---|

| POEMS | 0.3% pa RSP fee |

| FSMOne | $3.80 flat rate |

| Endowus | 0.4% management fee |

| AutoWealth | 0.5% management fee |

By understanding these options, you can make informed decisions that align with your financial goals. Whether you’re a beginner or an experienced investor, leveraging CPF and SRS funds can help you achieve long-term success.

Conclusion: Choosing the Best Trading Platform for You

Selecting the right broker depends on your unique investment goals and preferences. Start by evaluating your trade frequency and portfolio size. Active traders may prioritize low fees, while long-term investors might focus on security features like 2FA and fund segregation.

Emerging trends, such as AI trade copiers and NFT stock tokens, are reshaping the landscape. Stay informed about regulatory updates from MAS to ensure compliance and security. Transitioning between brokers can be seamless with proper planning and research.

Personalized matching tools can help you find a solution tailored to your needs. Whether you’re a beginner or an experienced trader, understanding your options is key to making informed decisions. Explore community-driven ratings and cost comparisons to find the right fit for your financial journey.