Investing in the right companies can make a big difference for your financial future. This year offers some exciting opportunities in the Singapore market. We’ve picked stocks that show strong performance and solid growth potential.

Blue-chip companies with proven track records provide stability. They also offer consistent income through dividends. This is especially valuable during uncertain economic times.

Building a diversified portfolio helps balance risk and reward. Our selections focus on financial health and market position. These factors point to promising future prospects.

Singapore remains an attractive market for investors seeking reliable opportunities. These recommendations can be part of a broader investment strategy tailored to your goals.

Key Takeaways

- Focus on blue-chip companies with strong performance records

- Select stocks offering both stability and growth potential

- Dividend-paying stocks provide consistent income

- Diversified portfolios balance risk and reward

- Consider financial performance and market position

- Singapore offers attractive investment opportunities

- Tailor recommendations to your investment goals

Introduction: Navigating the Singapore Stock Market in 2023

Navigating today’s financial markets requires understanding key economic drivers and market trends. The current landscape offers both challenges and opportunities for those looking at equity investments.

Global economic conditions continue to influence local market performance. Interest rate changes, inflation concerns, and geopolitical factors all play significant roles. These elements create a complex environment for investment decisions.

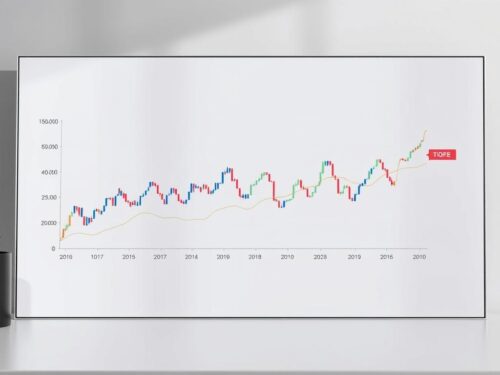

The Straits Times Index serves as a valuable benchmark for top-performing companies. This index tracks the thirty largest entities on the local exchange. It provides investors with a clear view of market leadership and stability.

Blue-chip companies represent some of the most reliable opportunities available. These established businesses typically demonstrate strong financial health and consistent performance. Their resilience makes them particularly valuable during uncertain economic periods.

The TTM dividend yields for top-weighted STI components ranged from 4.04% to 4.64% recently

This dividend advantage becomes particularly attractive when compared to traditional savings options. Fixed deposits typically offer around 3% annually, making equity income more compelling. This difference matters greatly for those seeking regular returns.

Market volatility remains a consideration for all investment strategies. Economic fluctuations can affect short-term performance across various sectors. However, quality companies often demonstrate recovery strength over longer periods.

Diversification through established enterprises helps balance portfolio risk. Adding these proven performers can mitigate overall volatility. This approach benefits both conservative and growth-oriented investors.

Our following sections will guide you through specific opportunities and selection criteria. We’ll examine individual companies showing strong potential. You’ll also learn how to identify undervalued opportunities in various sectors.

Finally, we’ll discuss building a balanced portfolio tailored to your financial objectives. This comprehensive approach helps position you for success in today’s market environment.

What Are Blue-Chip Stocks?

When building a solid investment foundation, established companies with proven track records offer exceptional stability. These enterprises represent some of the most reliable opportunities available to investors seeking consistent returns.

Blue-chip investments typically come from large, well-capitalized corporations with strong financial health. They demonstrate remarkable consistency across various market conditions. This reliability makes them attractive for both conservative and growth-oriented portfolios.

Large Market Capitalization and Stability

These companies often boast market values exceeding $10 billion. Their substantial size provides significant advantages during market fluctuations. This scale helps maintain investor confidence through various economic environments.

Large capitalization enables these enterprises to access capital more easily. They can fund expansion projects and weather temporary setbacks. This financial strength contributes to their overall stability and long-term success.

Strong Reputation and Brand Value

Years of reliable operations build tremendous consumer trust and recognition. This established reputation creates consistent demand for products and services. Brand strength becomes a valuable asset that drives ongoing success.

Companies with strong reputations often maintain premium pricing power. They can negotiate favorable terms with suppliers and partners. This market position supports sustained revenue growth over extended periods.

Consistent and Growing Dividend Payouts

Regular income distributions represent a hallmark feature of these investments. Many provide increasing payments per share over time. This reliable income stream becomes particularly valuable during retirement planning.

The dividend yield often compares favorably with traditional savings options. Recent analysis shows competitive returns that outpace many fixed-income alternatives. This income advantage supports total return objectives for investors.

“Blue-chip companies typically maintain dividend policies that prioritize shareholder returns, often increasing distributions as earnings grow.”

Resilience Through Economic Cycles

These enterprises demonstrate remarkable ability to maintain performance during downturns. Their diversified operations across multiple segments help balance overall results. This operational diversity provides natural protection against sector-specific challenges.

During the first half of challenging economic periods, blue-chip companies often show stronger relative performance. Their financial resources allow strategic investments when competitors struggle. This positions them for accelerated recovery when conditions improve.

| Characteristic | Description | Investor Benefit |

|---|---|---|

| Market Capitalization | Typically exceeds $10 billion | Enhanced stability and reduced volatility |

| Financial Performance | Consistent revenue and earnings growth | Predictable investment returns |

| Dividend Policy | Regular and often increasing payments | Reliable income stream |

| Economic Resilience | Strong performance across cycles | Capital preservation during downturns |

| Asset Quality | High-quality holdings and investments | Reduced risk profile |

Understanding these characteristics helps investors identify quality opportunities. The combination of size, reputation, income, and resilience creates compelling investment propositions. For those seeking reliable dividends and stability, these companies often form portfolio cornerstones.

Many investors find that incorporating these established performers enhances overall portfolio quality. Their consistent track records provide confidence during uncertain market periods. This approach supports long-term wealth accumulation objectives.

When evaluating specific opportunities, consider both current price levels and historical performance patterns. The right balance of value and quality can lead to excellent investment outcomes. For more insights on income-focused strategies, explore our analysis of reliable dividend-paying companies in various market segments.

Why Invest in Blue-Chip Stocks?

Choosing established companies offers multiple advantages for investors seeking both security and growth. These enterprises combine financial strength with operational excellence across market cycles.

Their proven business models deliver consistent results through various economic environments. This reliability makes them attractive for different investment strategies.

Proven Stability for Capital Preservation

Large corporations demonstrate remarkable resilience during market downturns. Their substantial financial resources help maintain operations when smaller competitors struggle.

This stability comes from diversified revenue streams and strong balance sheets. Companies like DBS Bank maintain excellent capital ratio levels.

Their size provides natural protection against temporary market fluctuations. This helps preserve your investment capital during challenging periods.

Reliable Stream of Dividend Income

Regular income distributions represent a key advantage of these investments. Many companies increase payments per share as their earnings grow.

The current dividend yield often exceeds returns from traditional savings accounts. This income advantage becomes particularly valuable for long-term wealth building.

During the first half of 2023, many established companies maintained their distribution policies. This consistency provides investors with predictable cash flow.

High-Quality Portfolio Diversification

These companies operate across multiple business segments and geographic regions. This natural diversification helps reduce overall portfolio risk.

Investors gain exposure to various sectors including banking, telecommunications, and real estate property. Each sector responds differently to economic conditions.

This variety creates a balanced approach to market participation. It helps smooth returns across different market environments.

Exposure to Trusted Brands and International Markets

Well-known companies like Singapore Airlines benefit from strong brand recognition. This consumer trust translates into consistent demand for their services.

Many enterprises maintain significant international operations across Asia. This global presence provides exposure to growing markets beyond local boundaries.

Their international revenue streams add another layer of diversification. This enhances growth potential while maintaining stability.

| Investment Benefit | Key Mechanism | Real-World Example |

|---|---|---|

| Capital Preservation | Strong balance sheets and cash reserves | DBS Bank’s capital adequacy ratios |

| Dividend Income | Consistent payout policies | 4.5% average yield among top companies |

| Diversification | Cross-sector operations | Banking, telecom, and real estate exposure |

| Global Growth | International market presence | Asian regional operations |

| Brand Value | Consumer trust and recognition | Singapore Airlines’ premium reputation |

These established companies typically show strong net profit margins across economic cycles. Their financial health supports continued investment in growth initiatives.

The right stock selection can provide both income and appreciation potential. Current price levels often reflect this balanced opportunity.

Investors benefit from the compound effect of reinvested dividends over time. This approach builds substantial long-term value.

These companies manage their asset base efficiently to generate optimal returns. This operational excellence supports shareholder value creation.

While market interest rates fluctuate, these companies maintain their competitive positions. Their established market presence provides lasting advantages.

Our Top Picks: The Best Singapore Stocks to Buy

The foundation of successful investing lies in choosing enterprises with sustainable competitive advantages. Our selection focuses on market leaders demonstrating exceptional performance.

We’ve curated our recommendations from the Straits Times Index constituents. These established names represent the most reliable opportunities available.

Our choices span multiple sectors including banking, telecommunications, and real estate. This diversity provides broad exposure to different market segments.

Each selection meets rigorous standards for financial health and market position. We prioritize companies with strong capitalization and consistent dividend distributions.

These enterprises offer both appreciation potential and regular income streams. This combination supports total return objectives for long-term wealth building.

Upcoming sections will provide detailed analysis of individual companies. You’ll see key metrics and future prospects for each recommendation.

Consider these picks as core holdings for a robust investment strategy. They form a solid foundation for balanced returns with managed risk.

“The STI’s composition reflects quality companies with proven resilience across market cycles.”

Current market conditions favor established performers with strong fundamentals. These selections align well with today’s investment environment.

#1: DBS Group Holdings Ltd (SGX:D05)

Leading our selection stands DBS Group Holdings, Asia’s premier banking institution. This financial powerhouse demonstrates exceptional performance across all key metrics. Its consistent growth and innovation make it a cornerstone investment choice.

Robust Financial Performance and Growth Momentum

DBS achieved remarkable results throughout 2024. The bank reported record-breaking numbers that impressed investors worldwide.

Full-year net profit reached S$11.4 billion. This represented an impressive 11% increase from the previous year. The return on equity remained strong at 18.0%.

Fourth quarter performance showed continued momentum. Earnings grew 10% year-over-year to S$2.62 billion. This consistent growth demonstrates operational excellence.

Leadership in Digital Banking and Wealth Management

DBS leads the industry in digital transformation initiatives. Their technological advancements enhance customer experience significantly.

The wealth management segment shows particularly strong results. Fees in this division surged 45% to S$2.18 billion. Assets under management reached S$396 billion.

Singapore’s favorable environment supports continued growth. The bank targets S$500 billion in assets by 2026. This ambitious goal reflects confidence in future expansion.

“Our digital banking capabilities and wealth management expansion drive sustainable competitive advantages in evolving markets.”

Strong Commitment to Shareholder Returns

DBS maintains an outstanding record of rewarding investors. The bank increased its total dividend to S$2.22 per share for 2024.

This represents a substantial 27% increase from the previous year. Additionally, shareholders will receive special capital return dividends throughout 2025.

The attractive dividend yield compares favorably with other income options. This consistent return policy supports long-term wealth building.

| Performance Metric | 2024 Result | Year-over-Year Change |

|---|---|---|

| Net Profit | S$11.4 billion | +11% |

| Return on Equity | 18.0% | Maintained |

| Wealth Management AUM | S$396 billion | +24% |

| Total Dividend Per Share | S$2.22 | +27% |

| Net Interest Income | S$15.0 billion | +5% |

DBS demonstrates strength across all business segments. Net interest income grew 5% to S$15.0 billion. Fee income increased 23% to S$4.17 billion.

The bank’s capital ratio remains among the industry’s strongest. This financial health supports continued growth initiatives.

Current price levels offer attractive entry points for investors. The company‘s resilience during market fluctuations provides stability.

DBS represents a premier stock selection for diversified portfolios. Its quality asset base and strong revenue streams create compelling value.

#2: Oversea-Chinese Banking Corporation Ltd (SGX:O39)

Following our first recommendation, we present another financial powerhouse with impressive performance metrics. This institution combines traditional banking strength with modern wealth management capabilities.

Its diversified operations span multiple business areas across Southeast Asia. This regional presence provides natural growth opportunities beyond local markets.

The company maintains excellent financial discipline across all operations. This approach supports consistent results through various market conditions.

Record Earnings and Diversified Revenue Streams

OCBC achieved outstanding financial results during the latest reporting period. The bank reported record-breaking numbers that demonstrate operational excellence.

Full-year net profit reached S$7.59 billion. This represented an impressive 8% increase from the previous year. The growth came from broad-based performance across all core segments.

Total revenue rose 7% to S$14.5 billion. Net interest income grew 1% to S$9.76 billion. Non-interest income surged 22% to S$4.72 billion.

Wealth management showed particularly strong performance. Income in this division increased 13% to S$4.89 billion. This segment now contributes 34% of total income.

“Our diversified revenue streams and disciplined cost control drive sustainable growth across market cycles.”

Attractive and Sustainable Dividend Payouts

OCBC maintains an outstanding commitment to shareholder returns. The board declared a total dividend of S$1.01 per share for the year.

This distribution reflects a 60% payout ratio. It demonstrates the group’s strong capital position and consistent policy.

Additionally, management announced a S$2.5 billion capital return plan. This program will run over two years through special dividends and share buybacks.

The attractive dividend yield provides reliable income for investors. This consistent return supports long-term wealth accumulation objectives.

Solid Capital and Risk Management

OCBC maintains exceptional asset quality across its lending portfolio. The non-performing loan ratio improved to 0.9% from 1.0% previously.

Total allowances fell by 6% to S$690 million. Credit costs remained low at 19 basis points. This prudent approach enhances overall stability.

The bank strengthened its capital buffers significantly. The CET1 ratio reached 17.1% under transitional rules. This strong capitalization supports future growth initiatives.

Net interest margin declined slightly to 2.20%. This 8 basis point decrease reflected elevated funding costs. The margin remains healthy compared to industry peers.

| Performance Metric | 2024 Result | Year-over-Year Change |

|---|---|---|

| Net Profit | S$7.59 billion | +8% |

| Total Income | S$14.5 billion | +7% |

| Wealth Management AUM | S$299 billion | +14% |

| Total Dividend Per Share | S$1.01 | Special dividend included |

| Non-Performing Loan Ratio | 0.9% | Improved from 1.0% |

Wealth management assets under management reached S$299 billion. This 14% increase reflected net new inflows and favorable market conditions.

Net fee income rose 9% to S$1.97 billion. Wealth management fees increased 22% significantly. Trading income surged 53% to a new high of S$1.54 billion.

Insurance income grew 14% to S$917 million. This improvement reflected better performance at Great Eastern Holdings.

Current price levels offer attractive entry points for this quality stock. The bank’s regional presence enhances growth potential across Southeast Asia.

OCBC represents a compelling choice for balanced portfolios. Its combination of growth, income, and stability creates lasting value.

#3: United Overseas Bank Ltd (SGX:U11)

Our third selection represents another financial institution with outstanding regional reach and performance. This banking group demonstrates remarkable strength across Southeast Asian markets.

The company combines traditional banking excellence with modern wealth services. Its diversified operations create multiple growth opportunities for investors.

Strong Regional Presence and Growth

UOB maintains an extensive network across Southeast Asia. This regional footprint provides natural exposure to growing economies.

The bank successfully integrated Citigroup portfolios in Thailand and Vietnam. This expansion enhances its competitive position across key markets.

Loan growth reached 5% despite challenging conditions. This demonstrates the bank’s ability to maintain momentum across different segments.

Regional operations contribute significantly to overall revenue streams. This diversification supports stability during local market fluctuations.

Impressive Growth in Wealth Management Fees

Wealth management represents a standout performer for UOB. This division shows exceptional momentum and growth potential.

Wealth income surged 30% year-over-year. This impressive growth reflects strong investor sentiment and service quality.

Assets under management reached S$190 billion. This 8% increase demonstrates the division’s expanding scale and capabilities.

The wealth segment now contributes meaningfully to overall earnings. This diversification enhances the bank’s long-term prospects.

“Our regional expansion and wealth management growth demonstrate disciplined execution across evolving market conditions.”

Anniversary Capital Return Package for Shareholders

UOB celebrates its 90th anniversary with exceptional shareholder rewards. The bank demonstrates strong commitment to investor returns.

Total dividends reached S$1.80 per share for the year. This represents a 50% payout ratio from consistent earnings.

A special S$3 billion capital return package includes multiple components. Shareholders receive special dividends and benefit from share buybacks.

The attractive dividend yield provides reliable income streams. This return policy supports long-term wealth accumulation objectives.

| Performance Metric | 2024 Result | Year-over-Year Change |

|---|---|---|

| Net Profit | S$6.0 billion | +6% |

| Core Net Profit | S$6.2 billion | Excluding one-time items |

| Wealth Management AUM | S$190 billion | +8% |

| Total Dividend Per Share | S$1.80 | 50% payout ratio |

| Net Interest Income | S$9.7 billion | Stable performance |

Net interest income remained stable at S$9.7 billion. This consistency reflects balanced loan growth and margin management.

Net fee income grew 7% to S$2.4 billion. Other non-interest income increased 10% to S$2.2 billion.

Total income rose 3% to S$14.3 billion. This growth came from diversified revenue sources across business lines.

The bank maintains excellent asset quality and risk management practices. This disciplined approach supports sustainable performance.

Current price levels offer attractive entry points for this quality stock. Its regional strength and income potential create compelling value.

UOB represents an excellent choice for diversified portfolios. Investors benefit from both growth opportunities and reliable income streams.

#4: Singapore Telecommunications Ltd (SGX:Z74)

Our next recommendation showcases a telecommunications leader with impressive digital transformation. This company demonstrates remarkable growth across multiple technology segments.

Singapore Telecommunications delivers essential connectivity services alongside emerging digital solutions. Their strategic investments position them for sustained future success.

Strategic Growth Through Digital Infrastructure and 5G

Singtel achieved outstanding financial results during their latest reporting period. The company reported exceptional net profit growth that impressed market observers.

Third quarter performance showed a remarkable 183% year-on-year increase. This brought total net profit to S$1.32 billion for the period. Exceptional gains came from strategic asset sales and regional associate performance.

Underlying earnings increased 11% to S$1.9 billion for the first nine months. This consistent growth demonstrates operational excellence across business units.

EBITDA grew 20% to S$2.9 billion during the same period. This improvement reflects strong management and strategic execution.

“Our digital infrastructure investments and 5G leadership create sustainable competitive advantages in evolving markets.”

Resilient Performance Across Regional Associates

Singtel’s diversified operations show strength across multiple geographic markets. Regional associates contributed significantly to overall performance.

Optus, their Australian operation, demonstrated particularly strong results. Mobile service revenue rose 4% driven by postpaid repricing strategies.

EBIT increased 54% showing improved operational efficiency. This performance highlights successful market positioning.

The Singapore operation maintained steady growth despite market challenges. Mobile service revenue increased 2% supported by roaming recovery.

IoT services showed promising expansion contributing to overall results. The operation achieved full-year cost savings targets within nine months.

Improved Dividend Payouts and Financial Stability

Singtel maintains a strong commitment to shareholder returns through consistent policies. The board declared a total ordinary dividend around 16.5 cents per share for FY2025.

This distribution comprises both core and value realization components. The attractive dividend yield provides reliable income for investors.

Net debt fell 7% to S$7.78 billion demonstrating financial discipline. This improved debt ratio enhances overall stability.

The company raised approximately S$500 million from strategic asset sales. This capital recycling supports future growth initiatives.

| Performance Metric | FY2025 Result | Year-over-Year Change |

|---|---|---|

| Q3 Net Profit | S$1.32 billion | +183% |

| Underlying Net Profit | S$1.9 billion | +11% |

| EBITDA | S$2.9 billion | +20% |

| Total Dividend Per Share | ~16.5 cents | Core and value realization |

| Net Debt | S$7.78 billion | -7% |

NCS division showed impressive growth with revenue increasing 4% year-on-year. Government projects and enterprise platforms drove this expansion.

EBIT surged 31% from higher margins and cost optimization efforts. This performance demonstrates successful operational management.

Digital InfraCo recorded 3% revenue growth from data center expansion. Approximately 50% of regional capacity already secured contracts.

The company secured an S$643 million green loan for DC Tuas development. This supports sustainable infrastructure expansion.

Singtel became the first in Singapore to deploy 700MHz spectrum. This advancement enhances 5G coverage and service quality.

Current price levels offer attractive entry points for this quality stock. The combination of growth and income creates compelling value.

Singtel represents an excellent choice for technology-focused portfolios. Investors benefit from both innovation exposure and reliable dividends.

How to Identify Undervalued Stocks in Singapore

Finding hidden gems in the market requires careful analysis and patience. These opportunities often appear when quality companies face temporary challenges. Smart investors recognize these moments as potential entry points.

Undervalued companies trade below their true worth. This gap between price and value creates exciting opportunities. Market sentiment often drives these discrepancies rather than actual performance.

Key Valuation Metrics: P/E, P/B, and Dividend Yield

Price-to-earnings ratio measures how much you pay for each dollar of earnings. A lower P/E suggests better value compared to peers. Compare this metric against historical averages and industry standards.

Price-to-book ratio shows how the market values a company‘s assets. Values below 1.0 might indicate potential undervaluation. This metric works well for asset-heavy businesses.

Dividend yield compares annual dividends per share to current stock price. Higher yields may signal undervaluation when fundamentals remain strong. Always check payout sustainability.

“Valuation metrics provide the first glimpse into potential opportunities, but true value requires deeper fundamental analysis.”

Looking Beyond the Price: Assessing Fundamentals

Strong revenue trends indicate healthy business operations. Look for consistent growth across business segments. This shows the company maintains its competitive position.

Cash flow strength reveals operational efficiency. Consistent cash generation supports dividend payments and growth investments. This financial health often accompanies undervalued opportunities.

Debt levels and interest coverage ratios matter greatly. Lower debt provides flexibility during challenging periods. Strong coverage ratios indicate comfortable debt management.

Sectors Often Home to Undervalued Opportunities

Real estate investment trusts often show value characteristics. Their asset-heavy nature creates natural valuation metrics. Temporary sector weakness can create buying opportunities.

Financial institutions sometimes trade below intrinsic value. Market concerns about interest rates or economic cycles can suppress prices. Strong fundamentals may indicate mispricing.

Industrial and transport companies offer cyclical opportunities. These businesses may face short-term challenges while maintaining long-term value. Patient investors can benefit from eventual recovery.

| Valuation Metric | Ideal Range | What It Indicates |

|---|---|---|

| P/E Ratio | Below industry average | Potential undervaluation relative to earnings |

| P/B Ratio | Below 1.0 | Market price below asset value |

| Dividend Yield | Above historical average | Higher income potential |

| Debt-to-Equity | Below industry norm | Strong financial position |

Combining valuation metrics with technical analysis enhances timing. Look for stocks trading near support levels after prolonged declines. Institutional buying or insider activity often confirms potential value.

Building long-term wealth requires recognizing quality companies during temporary challenges. These moments create exceptional opportunities for disciplined investors. The market eventually recognizes true value.

Remember that undervaluation might persist for some time. Patience and conviction in your analysis become crucial. The reward comes when market sentiment aligns with fundamental reality.

Other Top Performers and Stocks to Watch

The market’s breadth reveals additional opportunities beyond our primary selections that merit consideration. Several enterprises demonstrate exceptional performance that complements a well-rounded investment approach.

These companies show strong momentum across various sectors. Their recent results highlight the diverse opportunities available in today’s market environment.

Yangzijiang Shipbuilding: Leading the STI in Returns

Yangzijiang Shipbuilding emerged as the top performer among STI constituents. The company achieved an impressive 47.7% total return during the third quarter.

Founded in 1956, this enterprise maintains a market capitalization of approximately S$13.3 billion. Shipbuilding and marine engineering form its core business segments.

The group reported record earnings of 4.2 billion yuan for the first half. This represented a substantial 36.7% increase from the previous year.

Despite a slight 1.3% decline in revenue, the company‘s dividend yield stands at an attractive 3.7%. This combination of growth and income creates compelling value.

Real Estate Players: CDL and UOL Group

Real estate developers demonstrated particularly strong performance recently. Both CDL and UOL Group ranked among the top five STI performers.

City Developments Limited achieved 33.5% total returns during the quarter. The company‘s net profit increased 3.9% to S$91.2 million for the first half.

Earnings per share rose to S$0.097 from S$0.092 previously. Strong contributions from property development segments drove this improvement.

UOL Group maintained its fifth position with 28.6% returns. The property player reported a remarkable 58% jump in net profit to S$205.5 million.

This growth came from strong performance across development and investment segments. Strategic asset sales further enhanced results.

Singapore Airlines: A Recovery Story

Singapore Airlines represents a compelling recovery narrative post-pandemic. The airline demonstrated strong operational performance throughout the recovery period.

Recent challenges included a 60% net profit drop in the first quarter. Lower interest income and associate losses contributed to this decline.

Despite these temporary setbacks, the airline maintains strong fundamentals. Its recovery trajectory remains positive for long-term investors.

The company‘s premium reputation and market position support future growth. Careful management of operations enhances stability during challenging periods.

“Market breadth indicators suggest diverse opportunities beyond traditional blue-chip selections, with several sectors showing accelerated momentum.”

| Company | Q3 Total Returns | Market Capitalization | Dividend Yield | Key Performance Metric |

|---|---|---|---|---|

| Yangzijiang Shipbuilding | 47.7% | S$13.3B | 3.7% | Record H1 earnings of 4.2B yuan |

| City Developments | 33.5% | S$6.3B | 1.2% | Net profit up 3.9% to S$91.2M |

| DFI Retail Group | 33.3% | S$5.5B | 3.3% | Underlying profit up 38.9% |

| Jardine Matheson | 31.0% | US$18.3B | 3.57% | Underlying profit up 45% |

| UOL Group | 28.6% | S$6.6B | 2.3% | Net profit jumped 58% to S$205.5M |

Government stimulus measures supported market performance throughout 2025. The STI gained approximately 14% year-to-date, reflecting positive sentiment.

New initiatives like the Equity Market Development Programme enhanced market liquidity. The iEdge Singapore Next 50 Index launched recently tracks additional opportunities.

Investors should balance high returns with fundamental analysis. Sustainable investment choices consider both current performance and long-term prospects.

These additional performers complement core portfolio holdings nicely. They provide diversified exposure across different market segments and growth drivers.

Building a Balanced Singapore Investment Portfolio

Creating a well-rounded investment strategy requires careful planning and thoughtful selection. A balanced approach combines different types of assets to achieve your financial goals. This method helps manage risk while pursuing growth and income opportunities.

Diversification stands as the cornerstone of smart investing. Spreading investments across various sectors reduces overall risk. If one industry faces challenges, others may perform well.

Consider allocating assets across banking, telecommunications, and real estate sectors. This approach provides exposure to different economic drivers. Each sector responds uniquely to market conditions.

Blue-chip companies form the foundation of many successful portfolios. These established businesses offer stability and consistent performance. Their strong financial health supports reliable dividend payments.

“A diversified portfolio containing quality companies across sectors provides both stability and growth potential for long-term investors.”

Growth-oriented investments complement income-producing assets. Younger investors might allocate more toward growth opportunities. Those nearing retirement often prioritize income generation.

Regular portfolio reviews ensure your investments remain aligned with goals. Market conditions change, and so should your strategy. Rebalancing helps maintain your desired risk level.

Consider this sample allocation for moderate risk tolerance:

| Investment Type | Allocation Percentage | Example Companies | Primary Objective |

|---|---|---|---|

| Banking Sector | 30% | DBS, OCBC, UOB | Stability & Dividends |

| Telecommunications | 20% | Singtel | Growth & Income |

| Real Estate | 20% | CDL, UOL Group | Income & Appreciation |

| Industrial/Shipping | 15% | Yangzijiang Shipbuilding | Growth |

| Cash Reserves | 15% | N/A | Opportunity Fund |

Dividend income plays a crucial role in total returns. Reinvesting dividends accelerates wealth accumulation through compounding. This strategy works particularly well over longer time horizons.

Risk management involves understanding your comfort level with market fluctuations. Conservative investors might prefer higher dividend yields. Growth-oriented individuals may accept more volatility for higher potential returns.

Utilize available tools and resources for ongoing portfolio optimization. The Straits Times Index provides valuable market insights. Valuation metrics help identify attractive entry points.

Long-term holding periods benefit from compounding returns. Patient investors often achieve better results than frequent traders. Quality companies tend to increase in value over time.

Remember that all investments carry some level of risk. Even blue-chip companies can experience temporary setbacks. A diversified approach helps weather these periods more comfortably.

Your personal financial situation should guide allocation decisions. Consider your time horizon, income needs, and risk tolerance. Regular reviews ensure your portfolio remains appropriate for your circumstances.

Building wealth through investing requires discipline and patience. A balanced portfolio provides the foundation for financial success. Start with quality companies and maintain a long-term perspective.

Conclusion

Building a strong portfolio starts with quality companies that offer both growth and reliable income. Our highlighted picks—like DBS, OCBC, UOB, and Singtel—provide stability and consistent returns.

Diversification helps manage risk while capturing opportunities across sectors. A balanced approach supports long-term value creation for investors.

Always tailor choices to your personal goals and risk tolerance. The Singapore market remains full of potential for those who stay informed and patient.

Thank you for exploring these insights with us. Happy investing!