Finding the right place to grow your money can feel overwhelming. Recent changes in the financial landscape have made it even more important to stay informed. Starting from 1 May 2025, OCBC 360 and UOB One reduced their rates. In June, GXS Boost Pocket also lowered its promotional rate. More adjustments are expected soon, including UOB Stash and MariBank.

When choosing a financial product, it’s crucial to look beyond the headline figures. Effective interest rates and your banking habits play a big role. Whether you’re saving a little or a lot, there’s an option tailored for you. Digital banking solutions like GXS are also gaining popularity for their convenience.

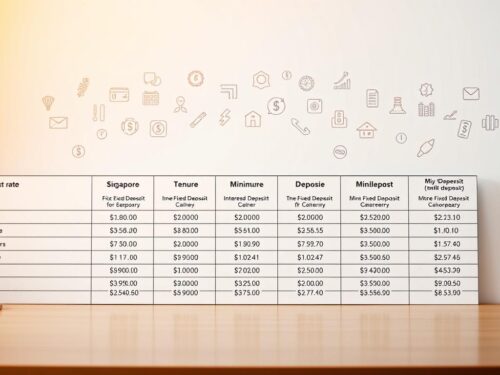

All featured options come with SDIC protection up to S$100,000, ensuring your money is safe. As of 2 June 2025, OCBC 360 and UOB One lead the pack with a 3.30% annual interest rate. Stay tuned as we break down the top picks based on deposit amounts and lifestyle needs.

Key Takeaways

- OCBC 360 and UOB One rates reduced from 1 May 2025.

- GXS Boost Pocket promotional rate lowered in June 2025.

- Upcoming rate cuts for UOB Stash and MariBank.

- Focus on effective interest rates, not just headline figures.

- SDIC protection up to S$100,000 for all accounts.

- Digital banking options like GXS are worth considering.

- Current leaders: OCBC 360 and UOB One at 3.30% annual interest.

Introduction to Savings Accounts in Singapore

Navigating the world of financial tools requires a clear understanding of options. In Singapore, financial products range from traditional offerings to high-yield alternatives. Traditional options often come with a base interest rate as low as 0.05% p.a., while high-yield accounts can offer up to 8.05% p.a., like the Standard Chartered BonusSaver.

Understanding the difference between base and bonus interest structures is crucial. Base rates are guaranteed, but bonus rates often depend on meeting specific criteria, such as credit card spend or crediting your monthly salary. These requirements can significantly impact your earnings.

Recent changes by the Monetary Authority of Singapore (MAS) have influenced account offerings. Hybrid accounts, which combine savings and spending features, are growing in popularity. These accounts often integrate digital banking tools and multi-currency options, catering to modern financial needs.

Major banks have recently reduced their rates, affecting many savers. Despite these changes, SDIC protection ensures your funds are secure up to S$100,000. This safety net is a key factor when selecting a financial product.

Here are some key trends to consider:

- Traditional vs. high-yield account comparisons.

- Base interest rates vs. bonus interest structures.

- Impact of MAS regulations on financial products.

- Rising demand for hybrid and digital banking solutions.

- Multi-currency options for international users.

By staying informed about these trends, you can make better decisions to achieve higher interest on your deposits. Whether you’re a seasoned saver or just starting, understanding these fundamentals is essential.

Why Choose a High-Interest Savings Account?

Maximizing your financial growth starts with the right tools. High-yield options, like Citi Wealth First, offer up to 7.51% p.a., compared to regular products at just 0.05%. This significant difference can lead to substantial gains over time.

One of the key advantages is compound interest. Over 5-10 years, your earnings can grow exponentially. For example, S$100,000 at 3.30% interest will yield far more than the same amount at 0.05% over five years.

High-interest options also provide risk mitigation. Unlike the stock market, these products offer stable returns without the volatility. They also offer liquidity benefits, allowing you to access your funds when needed, unlike fixed deposits.

Building a relationship with major institutions can unlock additional perks. Many high-yield products require salary crediting, which encourages automatic saving. Pairing these with credit card reward stacking strategies can further enhance your financial growth.

Here’s a quick comparison of high-yield vs. regular options:

| Feature | High-Yield | Regular |

|---|---|---|

| Interest Rate | Up to 7.51% p.a. | 0.05% p.a. |

| Risk Level | Low | Low |

| Liquidity | High | High |

| Bonus Interest | Yes | No |

By optimizing your account balance and leveraging these strategies, you can create a robust financial plan. Whether you’re building an emergency fund or planning for the future, high-interest options are a smart choice.

Understanding Effective Interest Rates

Effective interest rates can make or break your financial strategy. Unlike the base interest rate, which is fixed, the effective interest rate (EIR) reflects the actual return on your money after considering factors like bonus interest and qualifying criteria. For example, OCBC 360 offers a 3.30% EIR on the first S$100,000 if you credit your salary and meet spending requirements.

To calculate EIR, use this formula: (Total Interest / Average Balance) × 100. This helps you compare products like OCBC 360 and UOB One, both offering 3.30% but with different tiered structures. Knowing the EIR ensures you’re not misled by headline rates.

Here are some common pitfalls to avoid:

- Ignoring balance thresholds that limit your interest earned.

- Overlooking bonus interest qualification periods.

- Failing to use digital tools for EIR comparison.

For instance, if you deposit S$75,000, OCBC 360 might yield more than UOB One due to its structure. Always check regulatory requirements for EIR disclosure to ensure transparency.

“Understanding EIR is like having a roadmap to maximize your returns.”

By focusing on the higher interest rate offered through EIR, you can make smarter decisions. Whether you’re saving for short-term goals or long-term growth, EIR is a crucial metric to consider.

Factors to Consider When Choosing a Savings Account

Selecting the right financial product involves careful consideration of multiple factors. From minimum balance requirements to transaction limits, each detail plays a role in maximizing your returns. For instance, UOB Stash requires a monthly average balance of S$100,000, which may not suit everyone.

Another key factor is salary credit thresholds. UOB One, for example, mandates a minimum of S$1,600 monthly salary crediting to qualify for higher interest rates. Similarly, credit card spending requirements, like UOB One’s S$500 monthly spend, can impact your eligibility for bonus returns.

Be mindful of transaction limits and withdrawal penalties. Some products restrict the number of free transactions, while others charge fees for early withdrawals. Always review these terms to avoid unexpected costs.

“Understanding the fine print ensures you get the most out of your financial product.”

Promotional rates are another area to watch. For example, HSBC EGA’s promotional interest rates are valid until July 2025. Once these expire, your returns may drop significantly. Additionally, some account offers come with cross-selling pressures, such as mandatory insurance or investment purchases.

Finally, evaluate digital banking app capabilities and customer service accessibility. A user-friendly app can simplify managing your funds, while reliable customer support ensures help is available when needed. By weighing these factors, you can choose a product that aligns with your financial goals.

Best Savings Account Singapore: Top Options

Exploring the top financial options can help you make smarter decisions. Whether you’re saving for short-term goals or long-term growth, understanding the differences between products is key. Here’s a breakdown of the leading choices based on deposit tiers, promotional rates, and unique features.

For deposits under S$50,000, digital options like GXS offer flexibility and convenience. Traditional choices such as the UOB One account and OCBC 360 account are ideal for those who can meet salary crediting and spending requirements. Hybrid products like the Standard Chartered BonusSaver combine savings and spending benefits, making them versatile for modern users.

If you’re depositing your first 100,000, the OCBC 360 account leads with competitive rates. However, always check promotional rate timelines and lock-in periods to avoid surprises. For larger deposits above S$150,000, consider multi-currency options or joint accounts for shared financial goals.

Here are some additional considerations:

- Foreign currency holdings for international users.

- Senior citizen-specific offerings with higher interest rates.

- Student account alternatives with low minimum balance requirements.

- SME business accounts for entrepreneurs.

“The right financial product can transform your savings strategy.”

By evaluating these factors, you can choose a product that aligns with your lifestyle and financial goals. Whether you prefer digital, traditional, or hybrid options, there’s a solution tailored for you.

OCBC 360 Account: Features and Benefits

The OCBC 360 Account stands out as a versatile financial tool for growing your wealth. It combines competitive interest rates with features tailored to modern banking needs. Whether you’re looking to maximize returns or simplify your finances, this product offers a comprehensive solution.

Interest Rate Structure

The OCBC 360 Account offers an effective interest rate of 3.30% p.a. on the first S$100,000. This rate is achieved by meeting specific criteria, such as crediting salary spending of at least S$1,800 monthly and spending S$500 on OCBC cards. Additional bonus interest is available for activities like saving, insuring, and investing.

Here’s a breakdown of the current rate card post-May 2025 adjustments:

- Salary crediting: 1.60% (first S$75,000), 3.20% (next S$25,000)

- Saving: 0.60% (first S$75,000), 1.20% (next S$25,000)

- Spending: 0.50% (first S$75,000 and next S$25,000)

Eligibility Criteria

To open an OCBC 360 Account, you must be at least 18 years old. Singaporeans and PRs need an NRIC and signature image, while foreigners require a passport and valid pass. A minimum monthly salary crediting of S$1,800 is mandatory, and spending must be done exclusively on OCBC cards.

Pros and Cons

The OCBC 360 Account has several advantages. Its tiered interest rate structure rewards multiple financial activities, and the mobile app simplifies account management. Overdraft protection and integration with the OCBC FRANK account ecosystem add further value.

However, there are some drawbacks. Cross-selling of insurance and investment products can be intrusive, and the spending requirements may not suit everyone. Additionally, the base interest rate of 0.05% p.a. applies to balances beyond the first S$100,000.

“The OCBC 360 Account is a great choice for those who can meet its criteria and want to maximize their returns.”

For more details, visit the official OCBC 360 Account page.

UOB One Account: What You Need to Know

The UOB One Account offers a flexible way to grow your funds while meeting everyday financial needs. With a tiered interest structure and multiple earning opportunities, it’s designed to help you maximize returns. Whether you’re depositing your first 100,000 or managing larger balances, this product provides a range of benefits tailored to your lifestyle.

How to Maximize Interest

To earn the highest interest rate of 3.30% p.a., you’ll need to meet specific criteria. This includes crediting your monthly salary of at least S$1,600 and spending S$500 on eligible UOB cards. The tiered structure rewards different balance segments, with rates ranging from 2.30% to 3.30%.

Additional ways to boost your earnings include setting up GIRO payments or using the auto-sweep feature to transfer excess funds into fixed deposits. These options ensure your money works harder for you.

Card Spend Requirements

Spending on eligible UOB cards is a key requirement for earning bonus interest. The card spend threshold of S$500 monthly is easy to meet with everyday purchases. UOB provides a detailed list of eligible cards and tools to track your spending, making it simple to stay on top of your goals.

Foreign transaction fee waivers are another perk, ideal for frequent travelers or those who shop internationally. This feature adds value beyond the standard benefits.

Additional Promotions

UOB frequently runs promotions like the “Cash is King” campaign, offering bonuses such as S$500 for meeting specific criteria. These promotions provide extra incentives to maximize your returns.

Other features include SMS alert customization for real-time updates and priority banking thresholds for high-net-worth individuals. These options enhance the overall banking experience.

| Feature | Details |

|---|---|

| Interest Rate | 2.30%-3.30% p.a. (tiered) |

| Card Spend | S$500 monthly on eligible cards |

| Salary Credit | Minimum S$1,600 monthly |

| Promotions | “Cash is King” bonus up to S$500 |

| Additional Features | Foreign fee waivers, SMS alerts, auto-sweep |

By leveraging these features, you can make the most of your UOB One Account. Whether you’re saving for short-term goals or long-term growth, this product offers a reliable and rewarding solution.

UOB Stash Account: A No-Frills Option

Looking for a straightforward way to grow your funds? The UOB Stash Account might be the solution. Designed for those who prefer simplicity, this product offers a hassle-free approach to managing your money while earning a higher interest rate.

Interest Rate Details

The UOB Stash Account currently offers tiered rates, with the highest at 2.28% p.a. However, from 1 July 2025, the rate on balances up to S$100,000 will reduce to 2.045%. This change highlights the importance of staying updated on financial product adjustments.

Here’s a comparison of current and upcoming rates:

| Balance Tier | Current Rate (p.a.) | Upcoming Rate (p.a.) |

|---|---|---|

| First S$100,000 | 2.28% | 2.045% |

| Above S$100,000 | 0.05% | 0.05% |

Monthly Average Balance Requirements

To enjoy the benefits of this account, you’ll need to maintain a monthly average balance of S$100,000. This requirement ensures you qualify for the higher interest rate. The calculation is based on your daily balance, so consistent deposits are key.

Cash is King Promotion

UOB’s Cash is King promotion adds extra value. Deposit S$100,000, and you could earn S$320 in cash rewards. This offer is a great incentive for new customers looking to maximize their returns.

Here’s how it works:

- Deposit S$100,000 within the promotional period.

- Maintain the balance for the required duration.

- Receive S$320 as a cash reward.

Compared to MariBank’s 2.28% offer, the UOB Stash Account provides a competitive alternative with additional perks like the Cash is King promotion. However, be mindful of early withdrawal penalties and check deposit limits, which may affect your flexibility.

“The UOB Stash Account is ideal for those who value simplicity and steady returns.”

For joint accounts, interest accrues based on the combined balance, making it a great option for shared financial goals. Additionally, the auto-top-up feature ensures your account stays funded without manual intervention.

GXS Savings Account: Digital Banking at Its Best

Digital banking has revolutionized how we manage our finances. The GXS Savings Account is a prime example, offering a seamless and innovative way to grow your funds. Backed by the Grab/Singtel consortium, this product combines convenience with competitive returns, making it a standout choice in the digital banking space.

Boost Pocket Feature

One of the key features of the GXS Savings Account is the Boost Pocket. This tool allows you to create separate pockets for specific goals, such as saving for a vacation or an emergency fund. Each pocket earns an interest rate of up to 2.28% p.a., making it a smart way to maximize your returns.

Managing your pockets is straightforward. Simply set up transfers, track your progress, and adjust your goals as needed. This flexibility ensures your money works harder for you without any hassle.

Interest Rate Breakdown

The GXS Savings Account offers a tiered interest structure. For balances up to S$60,000, you can earn up to 2.28% p.a. through the Boost Pocket feature. This rate is significantly higher than traditional options, making it an attractive choice for savers.

Here’s a quick breakdown of the interest components:

- Base interest: 0.05% p.a.

- Bonus interest: Up to 2.23% p.a. via Boost Pockets.

By leveraging these components, you can optimize your account balance and achieve higher returns.

Deposit Limits

The GXS Savings Account has clear deposit limits to ensure transparency. You can deposit up to S$60,000 in each Boost Pocket, with a maximum of five pockets per account. This structure allows you to diversify your savings while maintaining control over your funds.

Transfer limits and processing times are also user-friendly. Most transactions are completed within minutes, ensuring quick access to your money when needed. Additionally, the integration with the GrabPay ecosystem adds extra convenience for everyday spending.

“The GXS Savings Account is a game-changer for those who value simplicity and high returns.”

With features like FDIC-equivalent protections and a referral program, this account is designed to meet modern financial needs. Whether you’re saving for short-term goals or long-term growth, the GXS Savings Account offers a reliable and rewarding solution.

Standard Chartered BonusSaver: High Rewards

Growing your wealth requires smart financial choices. The Standard Chartered BonusSaver offers a unique combination of high returns and flexible features. With an annual interest rate of up to 8.05% p.a., this product stands out for its rewarding structure. However, maximizing these benefits depends on meeting specific criteria.

Interest Rate Tiers

The Standard Chartered BonusSaver provides a base rate of 3.05% p.a., but the real value lies in its bonus interest tiers. To earn the maximum 8.05%, you’ll need to:

- Credit a monthly salary of at least S$3,000.

- Spend S$1,000 monthly on eligible credit cards.

- Invest or insure with the bank, with minimums of S$20,000 and S$2,000 annually, respectively.

These tiers ensure your total interest grows significantly when you meet the requirements.

Insurance and Investment Requirements

To unlock the highest bonus interest, you’ll need to engage with Standard Chartered’s insurance and investment products. Eligible investments include equity trades of at least S$20,000 through their online platform. For insurance, an annual premium of S$2,000 is required. These options not only boost your returns but also help diversify your financial portfolio.

Pros and Cons

The Standard Chartered BonusSaver has several advantages. Its high annual interest rate and tiered structure make it a lucrative choice. Additionally, features like cross-border account linking and Priority Pass benefits add extra value. However, the requirements for bonus interest may not suit everyone, especially those who cannot meet the spending or investment thresholds.

“The Standard Chartered BonusSaver is ideal for those who can meet its criteria and want to maximize their returns.”

For more details on the latest updates, visit Standard Chartered’s latest updates.

HSBC Everyday Global Account: Multi-Currency Savings

Managing your finances across multiple currencies can be a game-changer for international users. The HSBC Everyday Global Account offers a seamless solution, combining flexibility with competitive returns. Whether you’re traveling, working abroad, or managing global investments, this product is designed to meet your needs.

Promotional Interest Rates

The HSBC Everyday Global Account currently offers a promotional interest rate of 3.55% p.a. To qualify, you’ll need to deposit at least S$5,000 and complete five transactions monthly. This rate is significantly higher than traditional options, making it an attractive choice for savers.

Here’s a breakdown of the promotional rate structure:

| Requirement | Details |

|---|---|

| Minimum Deposit | S$5,000 |

| Monthly Transactions | 5 |

| Promotional Rate | 3.55% p.a. |

Everyday+ Rewards

The Everyday+ Rewards program adds extra value to your account. Earn points on eligible credit card spending, which can be redeemed for cashback, vouchers, or travel perks. This feature enhances your financial growth while simplifying everyday transactions.

Key benefits of the program include:

- Points earned on every S$1 spent.

- Flexible redemption options.

- Exclusive offers for account holders.

Flexibility for International Users

For those managing finances across borders, the HSBC Everyday Global Account offers unmatched flexibility. The 10-currency wallet allows you to hold and manage funds in multiple currencies, reducing forex conversion costs. Additionally, features like SWIFT transfers and international ATM access make it a convenient choice for global users.

Here’s a quick comparison of key features:

| Feature | Details |

|---|---|

| Currency Wallet | 10 currencies supported |

| ATM Withdrawals | No fees at HSBC ATMs worldwide |

| SWIFT Transfers | Fast and secure international transfers |

“The HSBC Everyday Global Account is a versatile tool for managing finances across borders.”

With features like Safe2Pay security and travel insurance inclusions, this account ensures your funds are safe and accessible wherever you are. Whether you’re a frequent traveler or managing global investments, the HSBC Everyday Global Account offers a reliable and rewarding solution.

Best Savings Account for S$100,000 Deposits

When managing a significant deposit, it’s essential to choose a financial product that maximizes returns while meeting your needs. For deposits of first 100,000, options like UOB Stash and MariBank offer competitive rates, but understanding their differences is key.

UOB Stash currently provides an interest rate of 3.00%, compared to MariBank’s 2.28%. This difference highlights the importance of evaluating effective interest rates and promotional offers. Threshold management strategies, such as maintaining a monthly average balance, can help you qualify for higher returns.

Diversification across multiple accounts is another effective approach. By spreading your deposit, you can optimize liquidity while taking advantage of different rate structures. Promotional rate stacking, where you combine short-term offers, can further enhance your earnings.

Relationship banking perks, such as priority services and exclusive offers, add value for high-deposit customers. For those seeking alternatives, private banking options provide tailored solutions with additional benefits like wealth management services.

Tax implications and succession planning are also crucial considerations. Understanding how your deposit affects your financial portfolio ensures long-term growth and stability. By carefully evaluating these factors, you can make informed decisions that align with your goals.

Best Savings Account Without Salary Credit

Not everyone has a fixed salary, but that shouldn’t stop you from growing your money. Whether you’re a freelancer, gig worker, or retiree, there are financial products designed to meet your needs. These options don’t require salary crediting, making them accessible to a wider audience.

One standout choice is the GXS Savings Account, which offers an interest rate of 2.28% with no requirements. This makes it ideal for those who don’t have a steady paycheck but still want to earn competitive returns. The flexibility of this product is a game-changer for many.

For freelancers and business owners, the UOB Stash Account is another excellent option. It requires a monthly average balance of S$100,000 but doesn’t mandate salary crediting. This makes it a viable choice for those with irregular income streams.

Here’s a quick comparison of these two products:

| Feature | GXS Savings | UOB Stash |

|---|---|---|

| Interest Rate | 2.28% | 2.28% |

| Requirements | None | S$100,000 monthly balance |

| Flexibility | High | Moderate |

Students and retirees can also benefit from these options. Many products cater specifically to these groups, offering low minimum balances and no salary requirements. Joint accounts and trust structures are additional strategies to maximize returns without relying on salary crediting.

For non-residents, eligibility varies by product. Some accounts require a valid pass, while others are open to all. Cash deposit limitations are another factor to consider, as they can impact your ability to fund the account.

“Flexible financial options ensure everyone can grow their money, regardless of their income source.”

By exploring these alternatives, you can find a product that fits your lifestyle and financial goals. Whether you’re saving for short-term needs or long-term growth, there’s a solution tailored for you.

Best Savings Account for S$75,000 Deposits and Investments

For those with S$75,000 to invest, finding a financial product that balances growth and flexibility is key. The Standard Chartered BonusSaver stands out with its impressive annual interest rate of up to 8.05%. This rate is achieved by combining savings with insurance and investment options, making it a versatile choice for growing your funds.

To maximize your returns, you’ll need to meet specific criteria. Crediting a monthly salary of at least S$3,000 and spending S$1,000 on eligible credit cards are key requirements. Additionally, investing or insuring with the bank unlocks higher bonus interest tiers, ensuring your money works harder for you.

Here’s how you can make the most of this product:

- Leverage bundled product discounts for added savings.

- Use robo-advisor integration for automated investment management.

- Explore ESG investment options to align with your values.

- Consider insurance premium financing for flexible payments.

For those looking to diversify, the Standard Chartered BonusSaver offers capital-guaranteed products and portfolio rebalancing services. These features ensure your investments remain aligned with your risk profile and financial goals.

“Combining savings with investments and insurance creates a powerful strategy for long-term growth.”

By understanding the requirements and leveraging the available features, you can optimize your returns. Whether you’re saving for short-term goals or planning for the future, the Standard Chartered BonusSaver offers a comprehensive solution tailored for S$75,000 deposits.

How to Maximize Your Savings Account Interest

Unlocking the full potential of your funds requires strategic planning and smart tactics. By optimizing your banking habits, you can significantly boost your interest earned and achieve your financial goals faster. Here’s how to make the most of your financial tools.

Start by managing promotional periods effectively. Use calendar reminders to track promotions like the UOB Cash is King campaign, which offers bonuses of S$320 to S$500. These limited-time offers can add a substantial boost to your returns.

Automated sweep arrangements are another great way to optimize your funds. Set up automatic transfers to move excess cash into high-yield options. This ensures your money is always working for you, even when you’re busy.

For those who rely on card spending, meeting minimum spend requirements is key. Use your credit card for everyday purchases to qualify for bonus interest. Combining this with salary credit strategies, such as splitting your salary across multiple accounts, can further enhance your earnings.

Here are additional tips to consider:

- Diversify across multiple banks to take advantage of different account offers.

- Set up balance alerts to stay on top of your funds and avoid penalties.

- Use statement analysis tools to track your spending and identify areas for improvement.

- Leverage relationship managers for personalized advice and exclusive perks.

By implementing these strategies, you can achieve a higher interest rate on your deposits. Whether you’re saving for short-term goals or long-term growth, these tactics will help you maximize your returns.

“Small adjustments to your banking habits can lead to significant financial gains.”

What Would Beansprout Do?

Choosing the right financial strategy depends on your unique goals and habits. Whether you’re saving for the short term or planning for long-term growth, there’s a product tailored for you. Here’s a breakdown of recommendations based on different scenarios.

If you have S$100,000 and regularly credit your salary, the OCBC 360 account is a top pick. Its tiered interest rate structure rewards multiple financial activities, making it ideal for maximizing returns. Meeting criteria like salary crediting and card spending can unlock up to 3.30% p.a.

For those with S$150,000 and consistent spending habits, the UOB One account is a great choice. It offers up to 3.30% p.a. when you meet requirements like monthly salary crediting and card spending. This account is perfect for those who want flexibility and high returns.

If you don’t have a fixed salary, consider the UOB Stash or GXS Savings Account. Both offer competitive interest rates without requiring salary crediting. UOB Stash requires a monthly average balance, while GXS provides digital convenience with its Boost Pocket feature.

Insurance buyers should look at the Standard Chartered BonusSaver. It offers up to 8.05% p.a. when you combine savings with insurance and investment products. This account is ideal for those who want to diversify their financial portfolio.

For digital nomads, the HSBC Everyday Global Account is a standout. Its multi-currency wallet and global accessibility make it perfect for managing finances across borders. The promotional interest rate of 3.55% p.a. adds extra value.

Security-focused individuals can explore “money lock” accounts, which provide enhanced protection for your funds. For short-term parking, MariBank offers competitive rates with minimal requirements. If you’re planning for the long term, consider fixed deposit laddering to maximize returns over time.

“The right financial product can transform your savings strategy, aligning with your unique needs and goals.”

By understanding these recommendations, you can make informed decisions that align with your financial habits and objectives. Whether you’re a high earner, freelancer, or global traveler, there’s a solution tailored for you.

Conclusion

With recent rate adjustments, selecting the right financial tool has become more critical than ever. The 2025 changes highlight the importance of staying informed and adapting to evolving trends. Digital banking solutions are gaining traction, offering convenience and competitive interest rates for modern users.

Regularly reviewing your portfolio ensures you’re maximizing returns. Keep an eye on upcoming regulatory changes and consider behavioral finance principles to make smarter decisions. A financial health check can help identify areas for improvement and align your strategy with your goals.

For ongoing support, join communities like Beansprout Telegram for insights and updates. Take action today by evaluating your options, meeting requirements like credit card spend or monthly salary crediting, and exploring digital tools. Staying proactive is the key to long-term financial success.