Preparing for your golden years in Singapore requires smart choices. With rising costs and longer lifespans, securing financial stability is crucial. The average life expectancy here is 83 years, meaning your savings must last decades.

Currently, the official retirement age is 63, increasing to 65 by 2030. However, CPF LIFE payouts only begin at 65. This creates a two-year gap where many need alternative income sources.

While CPF provides a foundation, private plans offer extra security. Leading providers like Manulife and NTUC Income deliver features like guaranteed returns and disability coverage. Comparing these options helps bridge financial gaps during your later years.

Key Takeaways

- Singaporeans live longer (avg. 83 years), requiring extended financial planning

- Retirement age (63) and CPF payouts (65) create a 2-year income gap

- Private plans complement CPF with higher returns and special benefits

- Compare providers like China Taiping and Singlife for optimal coverage

- Look for SRS-eligible plans with disability protection

Why Retirement Planning in Singapore Matters

Singapore’s rising expenses demand proactive savings strategies. Without action, daily costs and healthcare needs could outpace your nest egg. A 2019 study revealed singles need $1,379 monthly for basics, while couples require $2,351—figures growing yearly.

The Rising Cost of Living and Retirement

Inflation quietly erodes purchasing power. Healthcare costs, for example, climb 5% annually. A $300 medical bill today could balloon to $488 in a decade.

Housing loans and childcare often compete with long-term savings. Prioritizing short-term needs risks leaving gaps later. Early savers benefit from compounding, easing pressure as expenses rise.

How CPF Fits Into Your Retirement Strategy

CPF provides a foundation but has limits. Ordinary Accounts (OA) earn 2.5% interest, while Special Accounts (SA) offer 4%—especially with topping-up. Yet payouts start at 65, two years after the retirement age.

Imagine retiring at 63 with no private savings. That gap might force reliance on family or part-time work. Strategic topping-up and private plans can bridge this, ensuring steady income from day one.

- CPF OA vs. SA: SA’s higher rate grows savings faster.

- Payout timing: Private plans can cover the 63–65 gap.

- Healthcare buffers: Account for 5% annual cost hikes.

Key Factors to Consider for Your Retirement Plan

Mapping out your future requires understanding key financial factors. Your savings must align with personal goals, health expectations, and family responsibilities. Here’s how to tailor your strategy.

Your Desired Lifestyle

Envision daily life after work. A basic lifestyle might skip luxuries like aircon or a car, while a comfortable one includes travel and hobbies. Small choices now define your options later.

- Basic: $1,379/month covers essentials (housing, food, utilities).

- Comfortable: $3,000+/month adds leisure and conveniences.

Life Expectancy and Healthcare Costs

With an 83-year average lifespan, your funds must last 20+ years. Medical expenses rise 5% annually—a $300 bill today becomes $488 in a decade. Disability coverage (e.g., Manulife’s ADL-based plans) protects if you struggle with tasks like dressing or eating.

“Private plans with long-term care riders bridge gaps CPF doesn’t cover.”

Dependents and Financial Obligations

Many in their 40s juggle kids’ education and aging parents’ care. This “sandwich generation” needs extra buffers. The SRS scheme helps, allowing $15,300/year in tax-deferred contributions to supplement CPF.

- Prioritize high-interest debts (e.g., credit cards) first.

- Review insurance policies every 5 years as needs evolve.

Understanding Singapore’s Retirement Age and CPF Payouts

Timing is everything when aligning work exits with income streams. Singapore’s structured system defines clear milestones, but gaps between official ages and payouts require careful planning.

Official Retirement Age vs. Re-Employment Age

The retirement age is currently 63, climbing to 65 by 2030. However, employers must offer re-employment until 68 (rising to 70 by 2030) if workers meet medical and performance criteria.

| Age Type | Current | 2030 | Key Terms |

|---|---|---|---|

| Retirement | 63 | 65 | Voluntary exit |

| Re-employment | 68 | 70 | Employer contract renewal |

Early retirement risks income shortfalls. A 35-year-old earning $7,000/month today might face $5,050 in monthly expenses later. Without re-employment, savings deplete faster.

When CPF Payouts Begin

At 55, your CPF funds shift to the Retirement Account (RA). You can withdraw part of the savings, but monthly payouts start only at 65. This 10-year gap demands bridging strategies.

“Private savings or part-time work often fill the 63–65 window before CPF kicks in.”

- RA withdrawals at 55: Up to 20% for immediate needs, but reducing future payouts.

- Delayed payouts: Postponing to 70 increases monthly amounts by 7% annually.

For long-term security, balance early access with sustained income. The right mix depends on health, dependents, and lifestyle goals.

How Much Do You Need to Retire Comfortably?

Determining your ideal savings target depends on lifestyle choices and financial goals. Whether you envision modest living or frequent travel, your funds must cover decades of expenses. Start by comparing two common benchmarks.

Basic vs. Comfortable Retirement Budgets

A basic lifestyle covers essentials—housing, meals, and utilities. At $1,379/month, you’d need $330,960 to last 20 years. This excludes luxuries like dining out or holidays.

Comfortable living demands more. Allocating $3,000/month means saving $720,000 for the same period. This accommodates hobbies, healthcare upgrades, and occasional trips.

| Retirement Age | Basic Sum | Comfortable Sum |

|---|---|---|

| 63 | $330,960 | $720,000 |

| 65 | $358,200 | $792,000 |

| 70 | $435,600 | $972,000 |

Calculating Your Retirement Nest Egg

Use the “Monthly Needs × 12 × Years” formula. For example, $2,500/month over 25 years requires $750,000. Adjust for inflation—a 3% annual rise adds $225,000 to the total.

- CPF SA advantage: 4% interest beats inflation (2.5% avg).

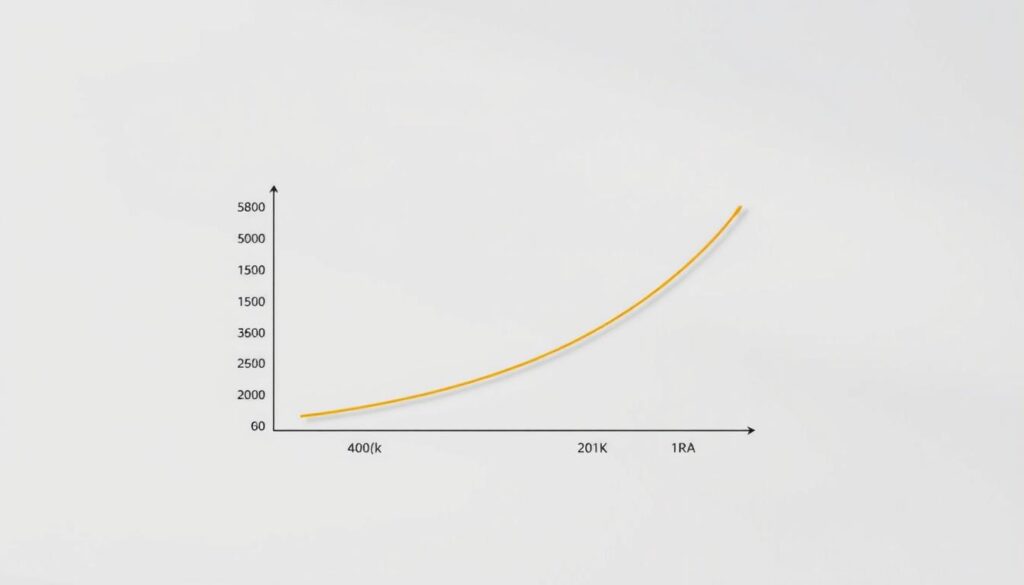

- Early starters win: Saving $500/month at 25 yields $1.2M by 65 (7% returns).

- Late catch-up: Starting at 40 requires $1,300/month for similar results.

“NTUC Income’s calculator shows personalized gaps—many underestimate healthcare costs by 30%.”

Investing 20% of your income in mixed assets (stocks, bonds) helps outpace rising costs. Tools like the SRS scheme further boost tax-deferred growth.

Supplementing CPF: The Role of Private Retirement Plans

Smart financial planning goes beyond CPF for long-term security. While CPF LIFE provides steady payouts, private schemes address gaps like lump-sum needs or disability coverage. Diversifying your strategy ensures stability when unexpected costs arise.

Why CPF Alone Falls Short

CPF LIFE lacks flexibility for urgent cash needs. Unlike private plans, it doesn’t offer lump-sum withdrawals or riders for disabilities. For example, China Taiping’s 24-month payouts activate if you struggle with 2 out of 6 daily tasks (e.g., bathing).

Key limitations:

- No disability or critical illness riders

- Payouts start at 65, creating income gaps

- Limited customization for healthcare needs

How Private Plans Enhance Your Strategy

Insurers like Singlife and Manulife add layers of protection. Singlife’s EasyTerm rider boosts death coverage to 5x the premium, while NTUC Income allows partial withdrawals for emergencies.

| Feature | CPF LIFE | Private Plans |

|---|---|---|

| Lump-sum access | ✖ | ✔ (e.g., NTUC) |

| Disability payouts | ✖ | ✔ (China Taiping) |

| Tax deferment (SRS) | ✖ | ✔ ($15,300/year cap) |

The Supplementary Retirement Scheme (SRS) further optimizes savings. Contributing $15,300/year cuts taxable income while growing funds tax-deferred. Pair this with retrenchment protection (e.g., Manulife’s job-loss coverage) for holistic safety.

“Private plans with SRS eligibility reduce taxes today while securing tomorrow’s cash flow.”

The Best Retirement Plan Singapore Offers in 2025

This year’s leading financial products combine growth potential with adaptable features. Whether you prioritize guaranteed returns or emergency access, these four options stand out.

China Taiping i-Retire (II): Guaranteed Growth

With 5–25-year accumulation periods, this plan locks in yields up to 3.5% annually. Its unique *24-month Loss of Independence (LOI) payout* activates if you’re unable to perform daily tasks like dressing or eating.

Singlife Flexi Retirement II: Adaptive Withdrawals

Need cash fast? Singlife’s *Fast Forward* feature allows partial withdrawals after 5 years. It also includes 40% premium coverage during retrenchment, a rarity in the market.

“Manulife’s 50% retrenchment benefit outperforms the industry standard of 30%.”

Manulife RetireReady Plus III: Safety Nets

Beyond retrenchment support, this plan waives premiums if you face disabilities. Its *Activities of Daily Living (ADL) triggers* cover 6 critical tasks, ensuring payouts when you need them most.

NTUC Income Gro Retire Flex Pro: Tax Efficiency

SRS-eligible contributions slash taxable income while growing funds. The 25-year premium term suits mid-career savers, balancing affordability with long-term gains.

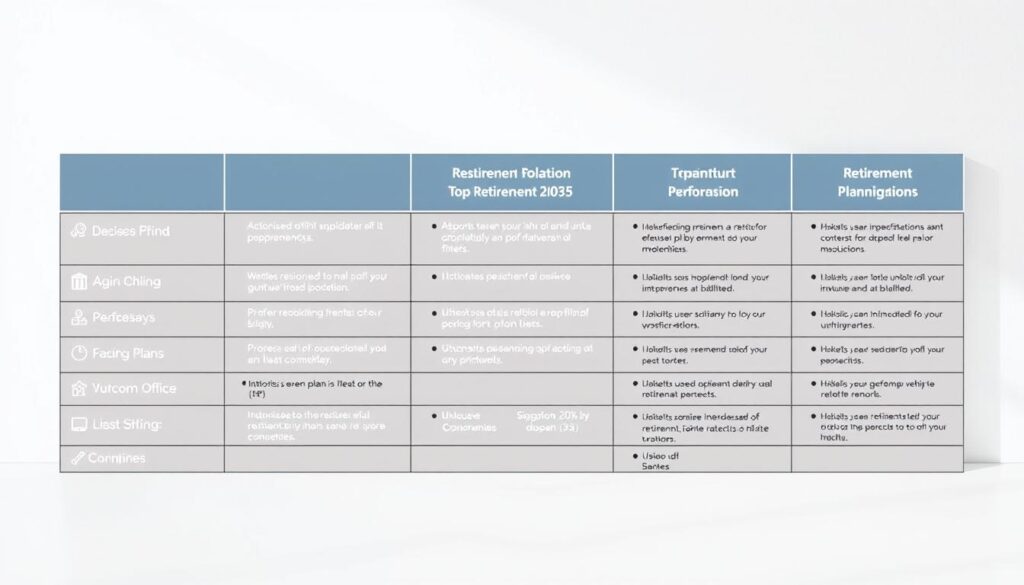

| Feature | China Taiping | Singlife | Manulife | NTUC Income |

|---|---|---|---|---|

| Guaranteed Yields | ✔ (3.5%) | ✖ | ✔ (2.8%) | ✔ (3.0%) |

| Retrenchment Aid | ✖ | 40% | 50% | ✖ |

| SRS Eligibility | ✖ | ✖ | ✖ | ✔ |

Pro Tip: Pair NTUC’s SRS perks with Singlife’s liquidity for a balanced strategy. Early withdrawals fund gaps before CPF payouts begin.

Comparing Top Retirement Plans Side by Side

Choosing the right financial products requires comparing key features side by side. The ideal mix balances guaranteed security with growth potential while offering flexible access to funds. These four dimensions help identify which scheme fits your needs.

Return on Investment Comparison

Projected returns often look appealing, but guaranteed rates provide certainty. China Taiping leads with 2.75% guaranteed yields, while their 4.25% projection requires market cooperation. NTUC Income offers middle ground at 3.0% guaranteed.

- Safe bets: China Taiping (2.75%), NTUC (3.0%)

- Growth potential: Singlife’s market-linked options

- Balance: Manulife’s 2.8% guarantee + bonus dividends

Payment Flexibility Analysis

Premium terms range from 10 to 50 years across providers. Singlife accommodates late starters with 10-year options, while NTUC’s 25-year structure suits mid-career professionals. Consider these factors:

“China Taiping’s 5-year premium term works for those nearing retirement age.”

Special Benefit Showdown

Unique protections separate average plans from exceptional ones. Manulife dominates with 50% retrenchment coverage—the industry’s highest. China Taiping counters with disability triggers based on daily living challenges.

| Provider | Unique Benefit | Activation |

|---|---|---|

| Manulife | 50% retrenchment | Job loss proof |

| China Taiping | 24-month LOI payout | 2/6 ADL failures |

| Singlife | 40% retrenchment | 6-month unemployed |

Pro tip: Pair NTUC’s SRS tax benefits with Singlife’s liquidity for balanced cash flow. Early withdrawals bridge gaps before CPF payouts begin at 65.

Using the Supplementary Retirement Scheme (SRS) for Tax Benefits

Smart savers in Singapore leverage tax-advantaged tools to grow their nest egg faster. The Supplementary Retirement Scheme (SRS) lets you contribute up to $15,300 annually while reducing taxable income. This government-backed program works alongside CPF and private plans for layered financial security.

How SRS Complements Your Financial Strategy

Approved insurers like NTUC Income, Singlife, and Manulife accept SRS funds for qualifying plans. Your contributions enjoy tax deferment—you only pay taxes upon withdrawal after age 62. Here’s how it works:

- Contribution phase: Deduct up to $15,300 from taxable income yearly (Singaporeans/PRs)

- Growth phase: Investments grow tax-free until withdrawal

- Withdrawal phase: Only 50% of withdrawn amounts count as taxable income

Early withdrawals before age 62 incur a 5% penalty plus full taxation. However, exceptions apply for medical emergencies or bankruptcy.

Maximizing Your Tax Savings

Strategic SRS use can slash your tax bill significantly. A $15,300 contribution saves:

| Tax Bracket | Annual Savings | 10-Year Total* |

|---|---|---|

| 7% | $1,071 | $10,710 |

| 11.5% | $1,759 | $17,590 |

| 15% | $2,295 | $22,950 |

*Assumes consistent contributions and tax rates

Your SRS funds can invest in diverse options—from fixed deposits to unit trusts. NTUC Income’s SRS-eligible plans offer guaranteed returns, while Singlife provides market-linked growth potential.

“Pairing SRS with CPF SA top-ups creates a tax-efficient dual engine for retirement growth.”

Remember to coordinate withdrawals with CPF LIFE payouts. Spreading SRS withdrawals over 10 years keeps you in lower tax brackets while maintaining cash flow.

Insurance and Investments: Building a Holistic Retirement Portfolio

A well-rounded financial strategy combines protection and growth for lasting security. Addressing health risks and market volatility ensures your funds endure through decades of changing needs.

Health and Long-Term Care Insurance

ElderShield provides basic coverage—$400/month for 72 months if you’re unable to perform daily tasks. Private insurers like NTUC Income enhance this with higher payouts and added critical illness riders.

| Feature | ElderShield | Private Plans |

|---|---|---|

| Monthly Payout | $400 | $600–$2,000 |

| Coverage Period | 6 years | Lifetime |

| Critical Illness | ✖ | ✔ (e.g., cancer, stroke) |

Pro Tip: Pair ElderShield with a private plan for gaps like home nursing or therapy.

Investing for Compounding Growth

CPF Investment Scheme (CPFIS) lets you invest OA/SA funds above $20k/$40k. Historical returns average 4–7%, outperforming standard interest rates.

- Term vs. Whole Life: Term insurance costs 60% less but lacks cash value.

- ILPs vs. Endowments: ILPs offer flexibility; endowments guarantee capital.

“A $10,000 investment at 7% ROI grows to $76,123 in 30 years—compounding works silently but powerfully.”

Prioritize tax-efficient options like SRS-eligible funds. Review policies every 5 years to align with life changes.

When to Start Planning: Retirement Strategies by Age

Building financial security is a journey that changes with each life stage. The earlier you begin, the more time works in your favor. Waiting even five years can cost you six-figure sums in potential growth.

In Your 20s and 30s: The Power of Compounding

Starting young lets small amounts grow significantly. $500 monthly at 5% becomes $760,000 by age 65. This decade is about establishing strong habits.

Key moves for early career professionals:

- Allocate 70% of investments to low-cost index funds

- Secure term insurance (10x annual income coverage)

- Begin SRS contributions once hitting tax brackets

“A 25-year-old who invests $300/month could outpace a 35-year-old saving $600/month.”

In Your 40s and 50s: Peak Earning and Catch-Up Strategies

These are your highest-income years with less time for compounding. Focus shifts to maximizing existing assets and protection.

| Strategy | 40s | 50s |

|---|---|---|

| CPF Top-ups | SA $40k for 4% | RA for payouts |

| Insurance | Disability riders | Long-term care |

| Investments | CPFIS OA $20k | Capital preservation |

Critical moves for pre-retirees:

- Review all policies for healthcare coverage gaps

- Shift 20% of portfolio to stable-value funds

- Project withdrawal rates against expected lifespan

Remember, it’s never too late to improve your financial position. Even starting at 50, strategic moves can add $100k+ to your eventual income streams.

Conclusion

Securing your future starts with action today. Leading options like China Taiping offer stable yields, while Singlife provides adaptable access to funds. Combining these with SRS tax perks creates a three-layer safety net.

Waiting too long cuts your growth potential. Starting in your 40s means saving nearly double to match early starters. Small steps now prevent big gaps later.

Consult a MAS-licensed advisor to tailor strategies. Compare payout terms, disability coverage, and withdrawal flexibility. Your ideal mix depends on health needs and income goals.

Ready to explore options? Use comparison tools to match plans with your timeline and risk comfort. The right choice brings peace of mind for decades ahead.