Hiring a domestic helper in Singapore comes with legal responsibilities. The Ministry of Manpower (MOM) requires employers to secure proper coverage for their helpers. This ensures financial protection for both parties.

Starting July 2025, new regulations will enhance protection standards. Policies must now include higher liability limits and broader medical benefits. Leading providers like TIQ, FWD, MSIG, and GREAT Insurance offer compliant plans.

Choosing the right plan saves money and reduces risks. For example, 26-month policies cost 30% less annually than shorter options. Third-party liability coverage up to $50,000 is also crucial for unforeseen incidents.

Key Takeaways

- MOM mandates specific security bond and insurance requirements.

- New 2025 updates expand medical and liability protections.

- Longer policies (26 months) offer significant savings.

- Top providers include TIQ, FWD, MSIG, and GREAT Insurance.

- Always verify third-party liability limits.

Why Maid Insurance Is Essential in Singapore

Employers in Singapore must safeguard their household helpers with proper coverage. The Ministry of Manpower (MOM) mandates specific protections to ensure fair treatment and financial security for foreign domestic workers. Without compliance, employers risk penalties or bond forfeitures.

Legal Requirements by MOM

MOM requires every employer to provide:

- $60,000 for hospitalization and day surgery costs.

- $60,000 personal accident coverage for injuries or death.

- A $5,000 security bond, usually secured via a Letter of Guarantee.

Starting July 2025, insurers must cover 75% of claims above $15,000. This reduces out-of-pocket expenses for employers.

Financial Protection for All Parties

Comprehensive helper insurance shields employers from unexpected costs. For example, the GREAT Silver Plan includes $50,000 third-party liability—crucial for accidental property damage.

Non-compliance risks losing the security bond. Employers may also face fines or work pass cancellations. Premium plans often add benefits like repatriation coverage, easing burdens during emergencies.

Key Features to Look for in Maid Insurance

Critical features like medical and liability safeguards define quality protection plans. Policies must balance legal requirements with practical benefits for employers and helpers alike.

Hospital and Surgical Coverage

MOM mandates $60,000 for hospital surgical expenses, including day surgeries. Compare providers for added perks:

- MSIG’s Standard Plan includes $1,000 outpatient accident support.

- Some policies reimburse wages during a helper’s hospitalization.

“Employers must ensure their policy meets the updated 2025 standards for inpatient care.”

Personal Accident Coverage

Personal accident benefits cover injuries or death permanent disabilities. Key considerations:

| Provider | Coverage Limit | Special Features |

|---|---|---|

| MSIG MaidPlus | $60,000 | Repatriation included |

| FWD Essential | $60,000 | $3,000 third-party liability |

Third-Party Liability

Accidental property damage claims vary widely. GREAT’s Silver Plan offers $50,000 protection, while FWD covers only $3,000.

Security Bond Inclusion

Add-ons can reduce the $5,000 security bond liability to $250. MSIG’s Standard Plan at $439/year includes this benefit.

Always verify if outpatient support is mandatory or optional—it impacts premium costs.

Compare the Best Maid Insurance Providers in Singapore

Selecting the right protection plan for your helper requires careful comparison. Leading providers like TIQ, FWD, MSIG, and GREAT offer varied benefits and premiums. Below, we break down their key features to help you decide.

TIQ Plan A

TIQ’s premium option costs $486.13 annually. It stands out with $5,000 third-party liability, ideal for employers seeking extra safeguards. Outpatient support is optional, keeping base premiums competitive.

FWD Essential Plan

Budget-friendly at $432.37, FWD covers basic needs with $3,000 liability. It’s a solid pick for employers prioritizing affordability. Use code MAID20 for 20% off.

MSIG MaidPlus Standard

Priced at $439, MSIG balances cost and coverage. It includes $5,000 liability and repatriation benefits. Outpatient accident support adds value for active households.

GREAT Maid Protect Silver

The most cost-effective at $416.82 for 26 months. GREAT’s $50,000 liability leads the market. It’s perfect for long-term employers wanting maximum protection.

| Provider | Premium (26mo) | Liability Coverage | Outpatient Support |

|---|---|---|---|

| TIQ Plan A | $486.13 | $5,000 | Optional |

| FWD Essential | $432.37 | $3,000 | No |

| MSIG MaidPlus | $439.00 | $5,000 | Yes ($1,000) |

| GREAT Silver | $416.82 | $50,000 | No |

All plans meet MOM’s 2025 standards. Use MAID20 to save 20%—ideal for employers comparing insurance policies.

How to Choose the Best Maid Insurance in Singapore

Finding the right protection for your helper involves careful planning. Employers must balance legal requirements, budget, and extra benefits. Here’s how to make an informed decision.

Assess Your Coverage Needs

Start by reviewing MOM’s minimum requirements. Ensure the plan includes $60,000 for medical and accident costs. Consider extras like outpatient care or wage coverage during hospitalization.

Evaluate third-party liability needs. For example, GREAT’s Silver Plan offers $50,000, while others cap at $5,000. Homes with valuable assets may prefer higher coverage.

Compare Premiums and Benefits

Longer policies (26 months) save up to 30% annually. Below is a cost breakdown:

| Policy Duration | Average Cost | Savings vs. 14-Month |

|---|---|---|

| 26 months | $417–$518 | 30% |

| 14 months | $280–$350 | — |

Use comparison tools like SingSaver’s tab to find best rates. Look for bond waivers—MSIG’s plan reduces liability to $250.

Check for Add-Ons and Promotions

Providers often run discounts. For instance, FWD’s MAID20 code cuts premiums by 20%. Payment options like via PayNow speed up approvals.

- Prioritize plans with repatriation or outpatient perks.

- Verify if promotions apply to long-term policies.

“Always read the fine print—add-ons can significantly enhance protection.”

Understanding the Security Bond Requirement

Securing a security bond is a critical step when hiring domestic workers in Singapore. This $5,000 deposit acts as an insurance guarantee for compliance with Ministry of Manpower (MOM) regulations. Employers must purchase it at least three days before their helper arrives.

What Is a Security Bond?

Non-Malaysian helpers require this bond under MOM rules. It ensures employers cover:

- Repatriation costs if employment ends early

- Unpaid salaries or medical expenses

- Work permit violations

You can secure it two ways:

| Option | Cost | Processing Time |

|---|---|---|

| Bank Guarantee | $5,000 deposit | 3-5 business days |

| Insurance-Backed Bond | $250-$500 premium | 24 hours |

How to Protect Your Bond Deposit

MSIG’s waiver of indemnity add-on reduces liability to $250. The bond releases within seven days after work permit cancellation.

Avoid forfeiture by:

- Paying salaries on time

- Providing adequate medical care

- Following MOM rest day rules

“Bundling bond coverage with helper policies saves time and paperwork.”

Remember, MOM requires least 60,000 in medical coverage alongside the bond. Plan ahead to meet all legal obligations smoothly.

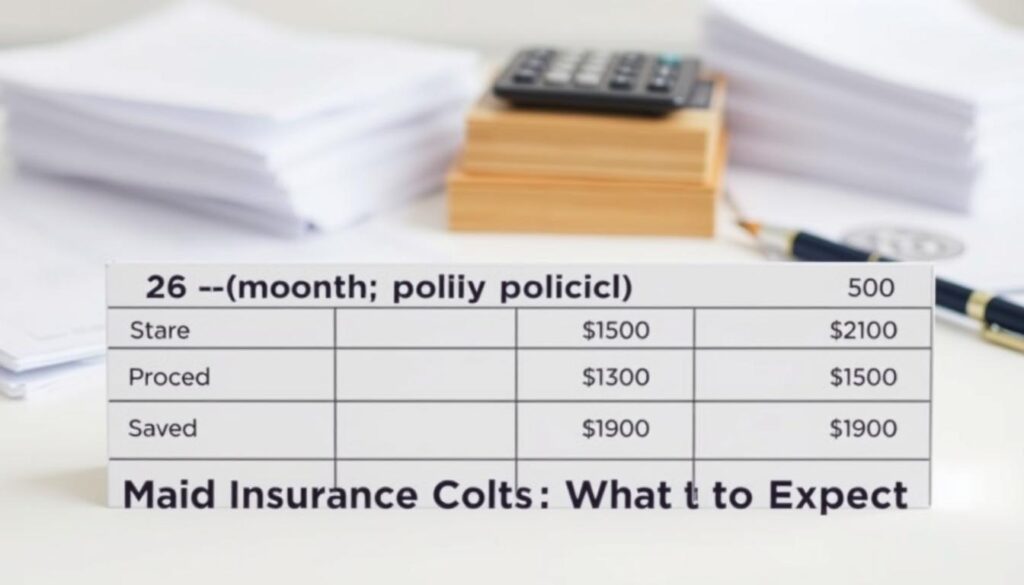

Maid Insurance Costs: What to Expect

Budgeting for your helper’s coverage requires comparing policy durations and costs. Prices vary based on protection levels and contract length. Employers can save significantly by understanding these key factors.

14-Month vs. 26-Month Policies

Annualized costs favor longer plans. A 26-month policy averages $417-$518, while 14-month options cost $280-$350. The extended plan saves 30% per year.

| Provider | 26-Month Cost | 14-Month Cost |

|---|---|---|

| GREAT Silver | $416.82 | $295 |

| FWD Essential | $432.37 | $310 |

Breaking Down Premium Ranges

MOM requires coverage for two extra months beyond work permits. This affects pricing:

- Base levy: $300/month ($60 with concession)

- Promo code MAID20 cuts 26-month plans to $333

- GREAT offers lowest long-term rates at $416.82

“26-month policies provide better value and reduce renewal paperwork.”

Mandatory Coverage vs. Optional Add-Ons

Understanding the difference between required and optional protections helps employers make smarter choices. While medical insurance and personal accident coverage are legally mandated, extras like outpatient care or repatriation add layers of security.

Minimum Requirements by MOM

The Ministry of Manpower (MOM) sets strict standards. Employers must provide:

- $60,000 for hospitalization and surgeries.

- $60,000 for personal accident (including death permanent disabilities).

- Liability coverage for third-party claims (varies by provider).

Starting July 2025, policies must cover 75% of claims above $15,000. This reduces out-of-pocket costs for employers.

Benefits of Additional Coverage

Comprehensive plans go beyond basics. Consider these add-ons:

| Feature | Basic Plan | Comprehensive Plan |

|---|---|---|

| Outpatient Accident | No | Up to $1,000 |

| Repatriation | No | Included |

| Personal Belongings | No | $5,000 protection |

Some providers bundle perks like Shark Wandvac discounts for home care products. Always verify exclusions—2025 updates standardize clauses across insurers.

“Optional coverage transforms a policy from compliant to comprehensive.”

How to Buy Maid Insurance in Singapore

Purchasing coverage for your helper is straightforward with multiple options available. Whether you prefer online tools, direct providers, or agency support, each method offers unique advantages. Below, we break down the steps for each approach.

Through Comparison Sites

Platforms like SingSaver simplify finding the right plan. Use their insurance tab filters to compare:

- Premiums by duration (14 vs. 26 months)

- Third-party liability limits

- Add-ons like outpatient care

Results update instantly, highlighting cost-saving options. Some sites offer exclusive promo codes for extra discounts.

Directly from Insurers

Providers like MSIG and GREAT have user-friendly portals. Key benefits:

| Provider | Instant Approval | Payment Options |

|---|---|---|

| MSIG | Yes (24h) | PayNow, Apple Pay |

| GREAT | Yes (1h) | 110 via PayNow |

Upload required documents (work permit #, passport #) during checkout. Most approvals take under a day.

Via Maid Agencies

Agencies often bundle coverage with helper placement. Benefits include:

- Pre-negotiated rates (up to 15% off)

- Bond and levy processing in one package

- Dedicated support for claims

“Bundled deals save time, but always verify policy details match MOM’s 2025 standards.”

Pro Tip: Use via PayNow Apple or 110 via PayNow for fastest processing. Ensure all documents are ready to meet the 3-day pre-arrival requirement.

Making a Maid Insurance Claim: Step-by-Step

Filing a claim for your helper’s protection doesn’t have to be stressful. With the right documents and a clear process, you can ensure quick reimbursements. Below, we break down what you’ll need and how to submit requests efficiently.

Documents You’ll Need

Gather these items before starting your claim:

- Completed claim form (provider-specific).

- Original medical bills and reports.

- Police report (if applicable for accidents).

- Helper’s work permit and ID copies.

Tip: Scan documents to avoid delays. Some providers like FWD accept digital submissions.

How to File a Claim

Providers offer different methods:

| Provider | Process | Deadline |

|---|---|---|

| TIQ | Call 24-hour hotline or email claims@tiq.com.sg | 14 days |

| FWD | Submit via online portal with digital docs | 14 days |

Under 2025 updates, hospitals can bill insurers directly for inpatient care. Check if your policy includes this feature.

“Missing deadlines or incomplete forms are the top reasons for claim rejections.”

Watch for exclusions: Pre-existing conditions or non-MOM-approved treatments may not be covered. Always verify with your provider.

Employer Obligations for Foreign Domestic Helpers

Managing a domestic helper involves meeting key financial and care obligations. Singapore’s Ministry of Manpower (MOM) sets clear rules to protect both employers and foreign domestic workers. These cover salaries, levies, medical care, and living conditions.

Salary and Levy Payments

Employers must pay domestic workers between $600 and $1,200 monthly. The exact amount depends on experience and job scope. All payments require itemized payslips with:

- Basic salary

- Overtime hours

- Deductions (if any)

A $10,000 fine applies for illegal salary cuts. First-time employers must complete the Employer Orientation Programme (EOP).

| Levy Type | Monthly Cost | Payment Method |

|---|---|---|

| Standard | $300 | GIRO mandatory |

| Concessionary | $60 | Auto-debit |

Medical and Housing Requirements

Helpers need medical insurance covering $60,000 for hospital stays. Employers must arrange:

- 6-month health checkups at MOM-approved clinics

- Private sleeping space (minimum 4.5m²)

- Access to toilets and cooking facilities

“Proper housing ensures helpers’ well-being and productivity.”

Failure to meet standards may result in work permit revocation. Always verify your helper’s policy meets 2025 updates for insurance compliance.

Recent Changes to Maid Insurance Requirements (July 2025)

New regulations effective July 2025 redefine helper protection standards. The Ministry of Manpower (MOM) introduces stricter safeguards for employers and domestic workers. These updates aim to reduce financial risks and streamline claims.

Enhanced Coverage Standards

Starting July 2025, insurers must cover 75% of claims above $15,000. This reduces out-of-pocket costs for employers. Key changes include:

- Age-based premiums: Costs adjust based on the helper’s age group.

- Standardized exclusions: Policies now uniformly exclude pre-existing conditions.

- Direct hospital payments: Insurers reimburse hospitals upfront for inpatient care.

“These updates ensure fairer pricing and faster medical support for helpers.”

New Insurer Responsibilities

Providers now handle claims differently under the July 2025 framework:

| Change | Impact |

|---|---|

| Extended overseas claim periods | Helpers treated abroad get 60 extra days to file. |

| Mandatory renewals | Policies auto-update to meet new standards. |

Warning: Employers must review renewed policies for updated clauses. Non-compliance risks bond forfeiture or fines.

Tips for Saving on Maid Insurance Premiums

Smart employers know that helper protection doesn’t have to break the bank. Strategic choices like longer policies and promotions can slash costs while meeting legal requirements. Below, we outline proven ways to reduce expenses.

Opt for Extended Policy Terms

26-month plans offer the best value. They cost 30% less annually than 14-month options. For example:

| Provider | 14-Month Cost | 26-Month Cost |

|---|---|---|

| GREAT Silver | $295 | $416.82 |

| FWD Essential | $310 | $432.37 |

Tip: Use paynow apple or 110 via PayNow for instant discounts at checkout.

Leverage Limited-Time Offers

Providers frequently run promotions. FWD’s MAID20 code cuts premiums by 20% until September 2025. Other savings include:

- Bundling with home coverage for 15% off.

- Early renewals for loyalty rewards.

- Referral programs ($50 rebates per sign-up).

“Comparing three providers annually ensures you never overpay.”

Conclusion

Choosing the right coverage ensures peace of mind for both employers and helpers. The GREAT Silver Plan stands out for its high liability limits, while TIQ offers comprehensive safeguards. Both meet updated 2025 standards.

Remember these key points:

- New regulations require higher medical claim limits.

- Third-party liability protects against unexpected costs.

- Use promo codes like MAID20 for instant savings.

Compare providers using online tools before deciding. Secure your policy early to avoid last-minute stress. For more details on recent changes, check MOM’s latest updates.

Ready to protect your household? Start comparing plans today.