Singapore stands as a leading financial hub, offering diverse opportunities for wealth growth. Its stable economy and strong regulatory framework attract investors seeking both security and returns.

This guide explores reliable options like Singapore Savings Bonds (SSBs), STI ETFs, and REITs. Whether you prefer low-risk choices or growth-focused assets, there’s something for every strategy.

Before diving in, it’s essential to assess your financial goals. Building a solid foundation ensures smarter decisions tailored to your risk appetite.

Key Takeaways

- Singapore provides a stable environment for wealth growth.

- Diverse options suit both conservative and aggressive investors.

- Government-backed instruments like SSBs offer safety.

- REITs and ETFs allow passive income and market exposure.

- Always align choices with personal financial goals.

Introduction to Investing in Singapore

With S$4.9 trillion in assets under management, Singapore solidifies its reputation as Asia’s premier wealth hub. Its AAA credit rating and stable economy attract global investors seeking reliable returns.

The Monetary Authority of Singapore (MAS) regulates the market tightly, ensuring transparency. Over 53% of residents actively participate—proof of trust in local opportunities.

Key advantages include:

- SGD stability shields against currency volatility.

- Tax incentives, like no capital gains tax, boost net earnings.

- Global market ties offer diversification beyond local assets.

“Singapore’s framework turns risks into calculated opportunities.”

Before you start investing, align strategies with your financial goals. Inflation rates and global trends should guide decisions. The right plan balances safety and growth.

Understanding Your Financial Goals

61% of Singaporeans focus on retirement—what’s your priority? Whether it’s education, passive income, or wealth preservation, clarity turns aspirations into action.

SMART Goals for Smarter Planning

Use the SMART framework: Specific, Measurable, Achievable, Relevant, Time-bound. Instead of “save more,” aim for “SGD 500/month for 10 years.”

“Your goals dictate your strategy. A dream without a plan is just a wish.”

Time Horizons Matter

Short-term (1–3 years)? Prioritize liquidity. Long-term (10+ years)? Growth assets like stocks or REITs may suit your portfolio.

| Goal Type | Liquidity Needs | Growth Potential |

|---|---|---|

| Emergency Fund | High | Low |

| Retirement | Low | High |

| Education | Medium | Medium |

Assess Your Risk Tolerance

Online tools like the FinaMetrica questionnaire help gauge comfort with market swings. High-risk options offer higher returns but demand resilience.

Case Studies: Goals in Action

- Retirement: A 35-year-old invests in SSBs and STI ETFs for steady growth.

- Education: Short-term bonds and savings accounts ensure funds are accessible.

- Passive Income: Dividend stocks and REITs generate monthly cash flow.

Aligning goals with time and risk ensures your money works efficiently. Start small, think big.

Building a Solid Financial Foundation

A strong financial foundation starts with smart money habits and disciplined planning. Tackling debt, saving for emergencies, and preparing for the future are key steps to long-term stability.

Pay Down High-Interest Debt

Credit card rollover balances in Singapore hit S$7.9B in Q3 2024, per MAS data. High interest rates can derail your progress. Two proven strategies:

- Avalanche method: Prioritize debts with the highest interest rate first.

- Snowball method: Pay off smaller balances for quick wins.

Digital tools like debt trackers help monitor repayment progress. Hybrid approaches—like investing while paying debt—can also work.

Establish an Emergency Fund

Aim for 3–6 months’ expenses in cash. Store it in:

- High-yield savings accounts (up to 3.8% p.a.).

- Money market funds for easy access.

“An emergency fund turns crises into inconveniences.”

Contribute to Retirement Plans

Singapore’s CPF Special account offers a 4% guaranteed interest rate. Compare options:

| Plan | Tax Benefits | Liquidity |

|---|---|---|

| CPF | No | Low |

| SRS | Dollar-for-dollar relief | Medium |

Start early—even small savings grow significantly over time.

Exploring Singapore Savings Bonds (SSBs)

Government-backed SSBs provide predictable returns with minimal risk. These government bonds are ideal for conservative investors, offering a 10-year average yield of 2.69% (November 2024).

Step-Up Interest Structure

SSBs feature a unique step-up system. Interest rates rise annually, rewarding long-term holders. For example, Year 1 might yield 1.5%, climbing to 3% by Year 10.

“SSBs turn time into an ally, with higher payouts for patience.”

Redemption and Flexibility

Withdrawals are penalty-free after the first month. Interest is paid every six months, making SSBs liquid compared to other government bonds. Learn more about SSB interest structures.

SSBs vs. T-Bills

| Feature | SSBs | T-Bills |

|---|---|---|

| Tenure | Up to 10 years | 6–12 months |

| Yield (2024) | 2.69% (avg.) | 2.38% (6-month) |

| Liquidity | Monthly redemption | At maturity |

Laddering Strategy

Buy SSBs with staggered maturities to balance interest rates and liquidity. For example, invest equal amounts annually to create a rolling income stream.

Capital Preservation

Retirees favor SSBs to protect capital. With a low S$500 entry and tax-free earnings, they’re a cornerstone of low-risk portfolios.

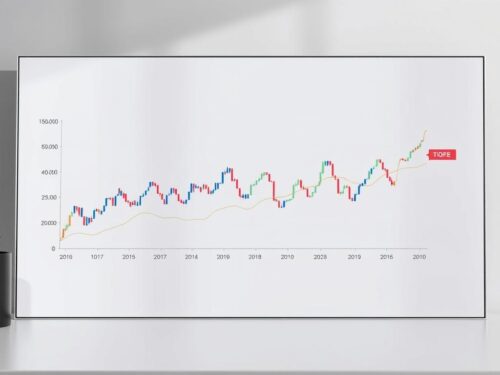

Investing in the Straits Times Index (STI)

The Straits Times Index (STI) serves as a key benchmark for tracking Singapore’s top-performing stocks. Its 30 constituents represent leaders like DBS, Singtel, and CapitaLand, offering a snapshot of the market’s health.

With an average dividend yield of 5.2% in 2024, the STI blends growth and income. Investors gain exposure to sectors like banking, telecom, and real estate—all in one portfolio.

ETF Options: Nikko AM vs. SPDR

Two popular ETFs track the STI:

- Nikko AM STI ETF: Lower fees (0.3% p.a.) and full replication of the index.

- SPDR STI ETF: Larger AUM (S$1.4B) and tighter bid-ask spreads.

“ETFs simplify index investing—no need to pick individual stocks.”

Dollar-Cost Averaging (DCA)

DCA smooths out volatility. Invest fixed amounts monthly, buying more shares when prices dip. Over time, this strategy lowers average costs and boosts performance.

Historical Resilience

The STI has weathered crises like the 2008 recession and COVID-19, recovering within 12–18 months. Long-term holders benefit from compounding dividends and market rebounds.

Sector Diversification

STI components span:

- Financials (40% weight): DBS, UOB, OCBC.

- Telecom (15%): Singtel’s regional reach.

- Real Estate (12%): CapitaLand’s diversified assets.

This mix reduces risk while capturing Singapore’s economic growth.

Diversifying with Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) have surged in popularity among Singaporean investors. With S$8.4B in assets under management (2024), the market grew 22% year-over-year, reflecting strong demand for diversified, low-cost options.

ETFs track an index, like the STI or S&P 500, offering instant exposure to multiple assets. Unlike mutual funds, they trade like stocks, combining flexibility with broad market access.

“ETFs democratize investing—you can own a slice of the global economy for less than a latte.”

Local vs. Global ETF Options

Singapore-focused ETFs, such as the Nikko AM STI ETF, provide exposure to top local companies like DBS and Singtel. Global ETFs, like the Vanguard S&P 500, spread risk across international markets.

| ETF Type | Expense Ratio | Key Features |

|---|---|---|

| STI ETF | 0.3% | High dividends, SGD-denominated |

| Global ETF | 0.7% | Currency risk, higher growth potential |

Sector-Specific ETFs

Targeted ETFs let you bet on trends:

- Technology: iShares Asia Tech ETF (10.4% 5-year return).

- Healthcare: SPDR Healthcare ETF (8.1% dividend yield).

- ESG: Lion-OCBC ESG ETF aligns with sustainability goals.

Robo-advisors like Endowus bundle ETFs into ready-made portfolios. Note: US-domiciled ETFs may incur 30% dividend withholding tax.

Government Bonds: A Safe Haven for Investors

For investors seeking stability, government bonds offer a reliable way to grow wealth with minimal risk. Singapore’s 10-year bond yield hit 3.1% in December 2024, making them a top pick for cautious portfolios.

Bond Ladder Strategies

Spread purchases across maturities to balance liquidity and returns. For example:

- Buy equal amounts of 2-, 5-, and 10-year bonds.

- Reinvest matured bonds at higher interest rates.

Secondary Market vs. Buy-and-Hold

Trading bonds before maturity can lock in gains but adds volatility. Buy-and-hold investors benefit from steady payouts and avoid price swings.

“Laddering turns bond maturity dates into a predictable income stream.”

Inflation-Linked Bonds (SGSi)

SGSi adjusts payouts based on CPI changes. Ideal for hedging against rising costs, they offer:

- Principal protection against inflation.

- Tax-free returns tied to economic trends.

| Bond Type | Avg Yield | Risk Level |

|---|---|---|

| SGS (10-year) | 3.1% | Low |

| Corporate | 4.5% | Medium (0.8% default rate) |

Managing Duration Risk

Longer maturities are sensitive to interest rate changes. Shorten duration if rates are rising to protect your government bonds’ value.

Real Estate Investment Trusts (REITs)

REITs offer a unique way to earn passive income while owning a slice of prime real estate. Singapore’s REIT market averages a 6.8% dividend yield (Q4 2024), making it a top pick for steady cash flow.

- Industrial REITs: 8.1% yield, fueled by logistics demand.

- Healthcare REITs: 7.2% yield, backed by aging populations.

“REITs turn brick-and-mortar assets into liquid investments—no property headaches required.”

Key Features of S-REITs

Singapore REITs must distribute 90% of taxable income as dividends. Their gearing ratio caps at 45%, ensuring balanced leverage. Explore investing in REITs for sector-specific strategies.

| REIT Type | Yield (2024) | Risk Factor |

|---|---|---|

| Retail | 5.9% | Medium (consumer spending) |

| Commercial | 6.3% | Low (long-term leases) |

Interest rate hikes can pressure valuations, but diversified portfolios mitigate risks. For stability, mix REITs with bonds or ETFs.

Blue-Chip Stocks: Stability and Growth

Blue-chip stocks in Singapore provide a balanced mix of stability and growth potential. Companies like DBS Group, Singtel, and UOB dominate the STI, offering reliable performance and dividends. Over five years, DBS delivered an 89% total return—proof of their resilience.

Fundamental Analysis of STI Blue Chips

Focus on key metrics:

- P/E ratios: Lower ratios may signal undervalued stocks.

- Dividend yield: Look for consistent payers like Keppel Corp (5.4%).

- Debt-to-equity: Below 50% ensures financial health.

“Blue-chips are the bedrock of a diversified portfolio—steady earners with room to grow.”

Dividend Aristocrats and DRIPs

Singapore’s dividend aristocrats—companies with 10+ years of payout growth—include:

- ST Engineering (4.8% yield).

- CapitaLand Integrated Commercial Trust (5.1%).

Enroll in Dividend Reinvestment Plans (DRIPs) to compound returns over time. Reinvested dividends buy more shares automatically, boosting long-term gains.

| Sector | Avg P/E (2024) | Top Performer |

|---|---|---|

| Banking | 11.2 | DBS Group |

| Telecom | 14.5 | Singtel |

| Real Estate | 9.8 | CapitaLand |

Growth vs. Value Strategies

Growth stocks (e.g., Sea Limited) prioritize expansion, while value stocks (e.g., OCBC Bank) trade below intrinsic value. Balance both for a resilient portfolio.

Tip: Pair high-yield blue-chips with ETFs for diversification. Investors with a 10-year horizon often see the best results.

Mutual Funds vs. Index Funds: Which is Right for You?

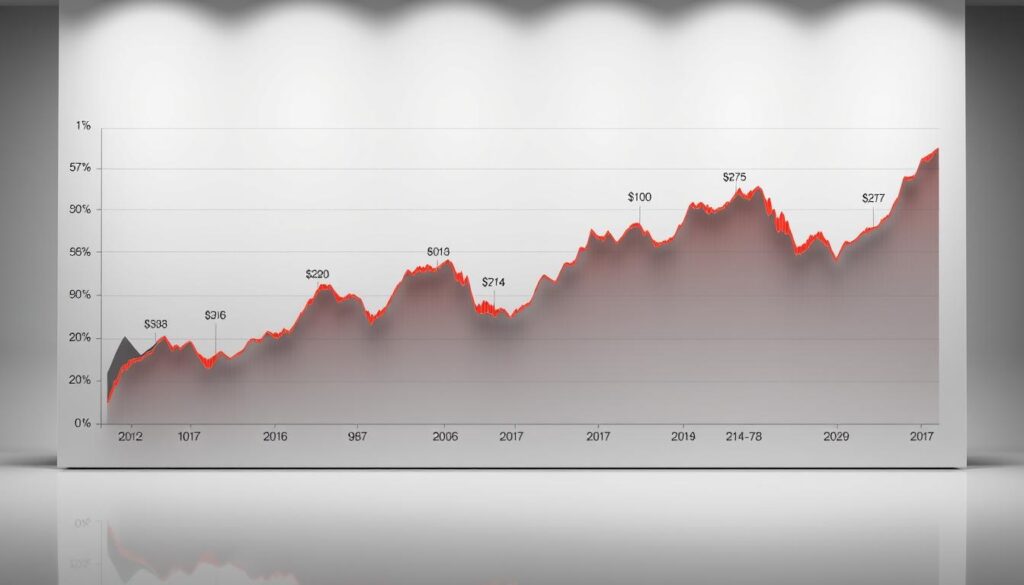

Choosing between mutual funds and index funds depends on your financial goals and risk tolerance. Active funds, like mutual funds, rely on management teams to pick stocks, while index funds passively track market benchmarks.

![]()

SPIVA data shows active funds underperform benchmarks 78% of the time over 10 years. This gap often stems from higher fees and inconsistent stock-picking.

“Passive investing removes human error—but active management can capitalize on market anomalies.”

Cost and Performance Breakdown

Expense ratios reveal stark differences:

| Fund Type | Avg Expense Ratio | 10-Year Success Rate |

|---|---|---|

| Active Mutual | 1.5% | 22% |

| Index | 0.2% | 78% |

Tax efficiency favors index funds. Lower turnover reduces capital gains distributions, keeping more money in your pocket.

Hybrid Options

Some funds blend both approaches, like smart-beta ETFs. They track indices but tweak weightings based on factors like dividends or volatility.

Consider your approach:

- Active: Best for niche markets or when betting on star managers.

- Passive: Ideal for long-term, low-cost growth.

Fund manager tenure matters. A 5+ year track record suggests consistency, but past performance never guarantees future results.

Risk Management in Investments

Smart investors know that managing risk is just as crucial as chasing returns. The classic 60/40 portfolio delivered 6.4% annual returns from 2014-2024 by balancing stocks and bonds.

Modern Portfolio Theory shows how diversification reduces volatility. By mixing assets with low correlation, you protect your capital during market swings.

“A diversified portfolio is like an umbrella—it won’t stop the rain, but you’ll stay dry.”

Essential Risk Control Strategies

- Correlation matrices: Identify assets that move differently in various conditions

- Tail-risk hedging: Use put options or gold to cushion crashes

- Volatility targeting: Adjust exposure when markets get turbulent

Stress testing reveals how your portfolio handles crises. Simulate events like the 2008 crash or COVID-19 to check resilience.

| Strategy | Protection Level | Cost |

|---|---|---|

| Diversification | Medium | Low |

| Hedging | High | 1-3% annually |

| Cash Buffer | Low | Opportunity cost |

Remember: All market participants face risk, but prepared investors turn it into opportunity. Start with small protective moves and scale up as needed.

Conclusion: Making the Best Investment in Singapore

Building wealth in Singapore requires a mix of safety, income, and growth strategies. SSBs protect capital, REITs deliver steady cash flow, and ETFs offer diversified exposure. Balance these tools to match your goals.

Regularly review your portfolio. Rebalancing ensures alignment with market shifts and personal milestones. Tap into local resources like SGX Academy or MoneySense for guidance.

Checklist for success:

- Define clear financial targets.

- Mix assets based on risk tolerance.

- Stay informed—markets evolve over time.

Start small. Consistency beats timing. Every investor begins somewhere—your journey starts now.