Looking for a reliable way to grow your savings? Exploring deposit options can be a smart move. In Singapore, several banks offer competitive rates, making it easier to maximize your returns. For example, DBS/POSB leads the market with a 2.45% p.a. rate for 12-month deposits under S$20,000.

Other banks like Bank of China, Citibank, and CIMB also provide attractive rates, ranging from 2.05% to 2.15%. These offers are updated monthly and remain valid until June 2025. If you’re seeking alternatives, options like StashAway Simple™ offer even higher returns at 2.8% p.a.

Singapore’s deposit landscape has evolved since the 2023 rate peak, offering diverse opportunities for savers. Whether you’re a seasoned investor or just starting, understanding these options can help you make informed decisions.

Key Takeaways

- DBS/POSB offers a market-leading 2.45% p.a. for 12-month deposits.

- Top rates from Bank of China, Citibank, and CIMB range from 2.05% to 2.15%.

- Rates are updated monthly and valid until June 2025.

- StashAway Simple™ provides an alternative with 2.8% p.a.

- Singapore’s deposit landscape has diversified post-2023 rate peak.

Introduction to Fixed Deposits in Singapore

Fixed deposits are a popular choice for those looking to earn steady returns without taking on too much risk. These accounts require a lump sum investment at a predetermined rate, offering a secure way to grow your savings over time. For example, some banks provide rates as high as 2.45% p.a. for a 12-month tenure.

What is a Fixed Deposit?

A fixed deposit is a low-risk financial instrument where you lock in your money for a specific period, typically ranging from 1 to 36 months. Unlike market-linked investments, these accounts offer predictable returns and are ideal for those prioritizing capital preservation. Early withdrawals, however, may incur penalties, so it’s essential to choose a tenure that aligns with your financial goals.

Why Choose a Fixed Deposit?

Fixed deposit accounts are known for their stability and security. They are insured by the Singapore Deposit Insurance Corporation (SDIC) up to S$100,000, ensuring your capital is protected. This makes them a safer alternative to volatile investments. Additionally, the minimum deposit requirements vary across banks, starting as low as S$500 and going up to S$30,000 or more.

One of the key advantages of fixed deposits is their predictable returns. You know exactly how much you’ll earn at the end of the tenure, making it easier to plan your finances. For more insights on managing your cash effectively, check out this resource.

“Fixed deposits offer a balance of security and steady returns, making them a cornerstone of many financial plans.”

Whether you’re saving for a short-term goal or looking to diversify your portfolio, fixed deposits provide a reliable option. With competitive deposit interest rates and the backing of SDIC, they remain a trusted choice for savers in Singapore.

Best Fixed Deposit Singapore: Top Rates for June 2025

The financial landscape in 2025 offers unique opportunities for savers. With fixed deposit rates evolving since the 2023 peak, understanding the current trends can help you secure better returns. Let’s explore the top offers and how they’ve changed over time.

Overview of the Best Rates

As of June 2025, several banks are leading the market with competitive offers. DBS continues to stand out with a 2.45% p.a. rate for 12-month tenures, especially for smaller deposits. Bank of China’s mobile banking promo offers 2.15% p.a. for 3-month deposits, while CIMB Preferred provides 2.20% p.a. for the same tenure.

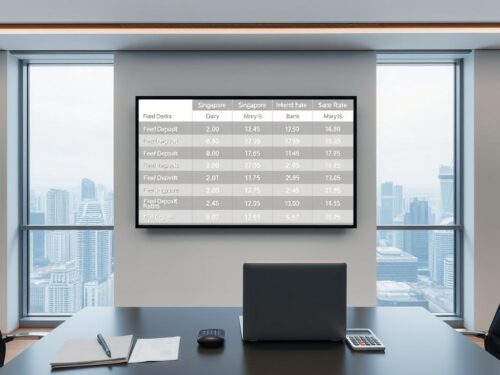

Here’s a quick comparison of the top rates:

| Bank | Tenure | Rate (p.a.) |

|---|---|---|

| DBS | 12 months | 2.45% |

| Bank of China | 3 months | 2.15% |

| CIMB Preferred | 3 months | 2.20% |

How Rates Have Changed Over Time

Since the 2023 peak, there has been a noticeable drop in rates. For example, HSBC’s rates have decreased by 0.25% since January 2025. This trend is partly influenced by the Monetary Authority of Singapore’s (MAS) monetary policy, which has shifted to support economic growth.

DBS’s inverse rate structure is another notable change. Smaller deposits now receive higher interest rates, making it more accessible for individuals with limited capital. Additionally, digital placement bonuses from ICBC and CIMB have made online deposits more attractive.

“Understanding these trends ensures you make informed decisions and maximize your returns.”

Whether you’re looking for short-term gains or long-term stability, staying updated on the latest fixed deposit rates is essential. The offers available in June 2025 provide diverse options to suit various financial goals.

Bank of China Fixed Deposit Rates

Exploring competitive rates can help you make the most of your savings. Bank of China offers a range of options tailored to different financial goals. Whether you prefer traditional counter services or digital banking, there’s a solution for you.

Counter Deposit Rates

For those who prefer in-person banking, counter deposits provide a reliable option. Rates typically range from 1.85% to 1.95% p.a., with a minimum deposit amount of S$20,000. This option is ideal for larger investments and those who value face-to-face service.

Mobile Banking Promo Rates

Bank of China’s mobile banking platform offers attractive promotional rates. With rates between 2.10% and 2.15% p.a., this option is perfect for smaller investments. The minimum deposit amount starts at just S$500, making it accessible to a wider audience.

Here’s a comparison of rates across different tenures:

| Tenure (Months) | Counter Rate (p.a.) | Mobile Rate (p.a.) |

|---|---|---|

| 1 | 1.85% | 2.10% |

| 9 | 1.95% | 2.15% |

| 24 | 1.90% | 2.12% |

Notably, the 9-month tenure offers rate parity across both channels. However, promotional rates often require new placements, so be sure to check the terms before committing.

“Choosing the right channel can significantly impact your returns, so weigh your options carefully.”

Whether you opt for counter or mobile banking, Bank of China provides flexible solutions to help you achieve your financial goals. Understanding these options ensures you make the most of your savings.

Citibank Fixed Deposit Rates

Citibank provides tailored options for those seeking secure and rewarding savings solutions. Whether you’re looking for exclusive promotions or standard rates, their offerings cater to a wide range of financial goals.

New Funds Promotion

Citibank’s promotional fixed deposit rates are designed for fresh funds transfers. With an interest rate offered at 2.10% p.a., this promotion is ideal for those investing between S$50,000 and S$3 million. The exclusivity of this offer ensures higher returns compared to standard rates.

This promotion is particularly suitable for high-net-worth individuals. The deposit amount requirement aligns with larger investments, making it a strategic choice for maximizing returns. However, early withdrawals may incur penalties, so it’s essential to plan your tenure carefully.

Standard Fixed Deposit Rates

For those not eligible for the promotion, Citibank’s standard rates range from 1.40% to 1.60% p.a. While lower than the promotional rates, they still provide a secure way to grow your savings. The minimum deposit requirement is more accessible, starting at S$1,000.

Here’s a quick comparison:

- Promotional Rate: 2.10% p.a. (S$50,000-S$3M)

- Standard Rate: 1.40%-1.60% p.a. (S$1,000 and above)

The 0.5%-0.7% gap between promotional and standard rates highlights the benefits of fresh funds transfers. Additionally, Citibank’s savings account alternatives may offer flexibility but typically yield lower returns.

“Choosing the right option depends on your financial goals and investment capacity. Citibank’s diverse offerings ensure there’s a solution for everyone.”

Whether you opt for the promotion or standard rates, Citibank’s fixed deposit accounts provide a reliable way to grow your savings. Understanding these options ensures you make informed decisions tailored to your needs.

CIMB Fixed Deposit Rates

CIMB offers tailored solutions for savers looking to maximize their returns with minimal risk. With competitive rates and flexible tenures, their options cater to both preferred banking customers and general banking customers. Whether you’re investing for short-term goals or long-term stability, CIMB provides reliable choices.

Preferred Banking Rates

CIMB’s Preferred Banking customers enjoy a premium rate of 2.20% p.a. for a 3-month tenure. This is 0.05% higher than the standard rate, making it a valuable option for those with larger investments. The minimum deposit amount is S$10,000, ensuring accessibility for serious savers.

This tier also offers relationship banking benefits, such as personalized financial advice and exclusive promotions. These perks make it an attractive choice for those seeking a more tailored banking experience.

Personal Banking Rates

For general customers, CIMB’s Personal Banking rates stand at 2.15% p.a. for the same 3-month tenure. While slightly lower than the Preferred rate, it remains competitive in the market. The minimum deposit amount is also S$10,000, ensuring consistency across both tiers.

Both options require online-exclusive placement, emphasizing CIMB’s focus on digital banking. This approach not only simplifies the process but also ensures faster access to funds.

- Preferred Banking offers a 0.05% premium for higher returns.

- 3-month tenure ensures quick access to funds.

- Online-exclusive placement streamlines the process.

- Relationship banking benefits add value for Preferred customers.

“CIMB’s tiered rates and digital focus make it a standout choice for savers in Singapore.”

Whether you’re a Preferred Banking customer or a general saver, CIMB’s offerings provide a secure and rewarding way to grow your savings. Understanding these options ensures you make the most of your investment.

DBS/POSB Fixed Deposit Rates

Maximizing your savings with DBS/POSB requires understanding their unique rate structure. Their tiered approach ensures that savers of all levels can benefit, with rates tailored to specific deposit amounts and tenures. This strategy is designed to cater to a wide audience, from small investors to those with larger sums to lock in.

Tiered Interest Rates

DBS/POSB offers a tiered rate system where the deposit interest varies based on the amount invested. For deposits between S$1,000 and S$19,999, the rates are highly competitive, reaching up to 2.45% p.a. for tenures of 12 months or more. However, for amounts above S$20,000, the rate drops significantly to just 0.05% p.a. across all tenures.

This inverse correlation between deposit amount and rate is a strategic move to attract smaller investors. It ensures that even those with limited capital can enjoy substantial returns. For example, a 6-month tenure offers 2.15% p.a. for deposits under S$20,000, making it an attractive option for short-term savers.

Special Offers for Small Deposits

DBS/POSB also provides exclusive perks for specific groups. Senior citizens aged 55 and above receive an additional 0.10% p.a. bonus, enhancing their returns. This initiative aligns with their goal of supporting the mass market and encouraging long-term savings.

Additionally, their rate strategy complements the DBS Multiplier account, which offers higher returns for customers who maintain multiple accounts or meet specific criteria. This synergy allows savers to maximize their earnings across different financial products.

“DBS/POSB’s tiered rates and special offers make it a standout choice for savers looking for flexibility and competitive returns.”

However, it’s essential to note that promotional rates are subject to change. Once the promotion period ends, the rates may drop significantly, so it’s crucial to stay informed and plan accordingly. For more insights on managing your savings effectively, explore this resource.

- Higher rates for deposits under S$20,000 (up to 2.45% p.a.).

- Senior citizen bonus of +0.10% p.a. for those aged 55+.

- Synergy with DBS Multiplier account for enhanced returns.

- Promotional rates may drop post-campaign, so plan carefully.

HSBC Fixed Deposit Rates

HSBC offers tailored savings solutions for diverse financial needs. Whether you’re a high-net-worth individual or a casual saver, their options cater to a wide range of banking customers. With competitive interest rates and flexible tenures, HSBC ensures your savings grow securely.

Premier & Premier Elite Rates

HSBC’s Premier and Premier Elite tiers provide exclusive benefits for high-value clients. Premier Elite customers enjoy a higher interest rate of 2.00% p.a. for a 3-month tenure, with a minimum deposit of S$30,000. This tier is designed for those with significant assets, offering personalized wealth management services.

To qualify for Premier Elite, clients must meet specific wealth management requirements. These include maintaining a minimum balance across accounts or holding eligible investment products. The benefits extend beyond fixed deposits, offering a holistic financial experience.

Personal Banking Rates

For general customers, HSBC’s Personal Banking rates stand at 1.55% p.a. for the same 3-month tenure. While lower than the Premier Elite rate, it remains competitive in the market. The minimum deposit requirement is also S$30,000, ensuring consistency across tiers.

Notably, app-exclusive placements are available until 31 May 2025. This digital-first approach simplifies the process and ensures faster access to funds. However, rates may degrade over longer tenures, so it’s essential to choose a tenure that aligns with your financial goals.

| Tier | Tenure | Rate (p.a.) | Minimum Deposit |

|---|---|---|---|

| Premier Elite | 3 months | 2.00% | S$30,000 |

| Personal Banking | 3 months | 1.55% | S$30,000 |

HSBC’s global fixed deposit rates often differ from local offers. For example, rates in other regions may be higher or lower, depending on economic conditions. Comparing these options can help you make informed decisions.

Additionally, the HSBC Everyday Global Account (EGA) offers an alternative for those seeking flexibility. While it doesn’t provide the same returns as fixed deposits, it allows easy access to funds and supports multiple currencies.

“HSBC’s tiered rates and digital-first approach make it a reliable choice for savers looking for security and convenience.”

Whether you’re a high-net-worth individual or a casual saver, HSBC’s offerings provide a secure way to grow your savings. Understanding these options ensures you make the most of your investment.

Hong Leong Finance Fixed Deposit Rates

Saving smartly requires exploring options that balance returns and flexibility. Hong Leong Finance offers a range of solutions tailored to meet diverse financial goals. Whether you’re a new customer or a seasoned saver, their competitive rates and unique features make them a strong contender in the market.

HLF Digital Deposit Rates

For those who prefer online banking, HLF’s digital deposit rates are a standout option. With a rate of 2.05% p.a. for a 7-month tenure and a minimum deposit of S$20,000, this option is ideal for tech-savvy savers. The process is streamlined, ensuring quick and hassle-free transactions.

HLF also offers unique tenures of 7, 10, and 13 months, providing flexibility to align with your financial goals. Additionally, the cash credit redemption process is straightforward, allowing you to access your earnings with ease.

New Customers Promotion

New customers can enjoy an attractive promotion with a rate of 1.85% p.a. and a S$10 bonus. This offer is perfect for those starting their savings journey. The minimum deposit requirement is S$5,000, making it accessible to non-high-net-worth individuals.

Here’s a quick comparison of branch vs. digital rates:

| Channel | Tenure | Rate (p.a.) | Minimum Deposit |

|---|---|---|---|

| Branch | 7 months | 1.95% | S$20,000 |

| Digital | 7 months | 2.05% | S$20,000 |

For corporate clients, HLF also provides tailored finance fixed deposit options. These solutions are designed to meet the specific needs of businesses, ensuring both security and growth.

“Hong Leong Finance’s diverse offerings make it a reliable choice for savers and businesses alike.”

Whether you’re looking for short-term gains or long-term stability, HLF’s solutions provide a secure way to grow your savings. Understanding these options ensures you make the most of your investment.

ICBC Fixed Deposit Rates

ICBC offers flexible savings solutions tailored to meet diverse financial needs. Whether you prefer digital banking or in-person services, their options cater to both individual and corporate clients. With competitive interest rates and unique features, ICBC stands out as a reliable choice for savers.

E-banking Rates

For those who prefer online transactions, ICBC’s e-banking platform provides a deposit rate of 2.15% p.a. for a 3-month tenure. The minimum deposit requirement is just S$500, making it accessible for small investors. This option is ideal for tech-savvy individuals seeking convenience and competitive returns.

Over-the-Counter Rates

If you prefer face-to-face service, ICBC’s over-the-counter rates offer 2.05% p.a. for the same tenure. However, the minimum deposit amount is higher at S$20,000, catering to those with larger sums to invest. This option ensures personalized service and security for your savings.

| Channel | Tenure | Rate (p.a.) | Minimum Deposit |

|---|---|---|---|

| E-banking | 3 months | 2.15% | S$500 |

| Over-the-Counter | 3 months | 2.05% | S$20,000 |

ICBC also offers unique advantages, such as USD/SGD arbitrage opportunities. This feature allows savers to benefit from currency fluctuations, enhancing their returns. Additionally, bulk deposits of S$200,000 or more qualify for special bonuses, making it an attractive option for high-net-worth individuals.

Corporate clients can explore tailored solutions, including dual currency fixed deposits. These accounts support multiple currencies, providing flexibility for businesses with international operations. Weekend placement availability further adds to the convenience, ensuring you can manage your savings on your schedule.

“ICBC’s diverse offerings and competitive rates make it a standout choice for both individual and corporate savers.”

Whether you’re looking for short-term gains or long-term stability, ICBC’s solutions provide a secure way to grow your savings. Understanding these options ensures you make the most of your investment, especially with rates valid until June 2025.

Maybank Fixed Deposit Rates

Maybank offers competitive rates for both online and bundled deposits. Their solutions cater to diverse financial needs, ensuring flexibility and attractive returns. Whether you’re saving for short-term goals or exploring long-term options, Maybank provides reliable choices.

iSAVvy Online Rates

For those who prefer digital banking, Maybank’s iSAVvy platform offers a rate of 1.85% p.a. for a 9-month tenure. This option is ideal for tech-savvy savers, with a minimum deposit requirement of just S$2,000. The process is streamlined, ensuring quick and hassle-free transactions.

Additionally, iSAVvy accounts can be linked to savings accounts for added convenience. This feature allows seamless fund transfers and better financial management. The effective yield is enhanced when combined with other Maybank products, making it a smart choice for maximizing returns.

Deposit Bundle Promotion

Maybank’s deposit bundle promotion is another standout option. With a rate of 2.15% p.a. for a 9-month tenure, this offer is perfect for those looking to bundle their savings. The minimum deposit requirement is S$2,000, making it accessible to a wide audience.

This promotion also includes unique benefits, such as higher effective yields when combined with other Maybank accounts. For example, linking your deposit to a SaveUp account can unlock additional perks and bonuses. This makes the bundle promotion a strategic choice for long-term savers.

| Option | Tenure | Rate (p.a.) | Minimum Deposit |

|---|---|---|---|

| iSAVvy Online | 9 months | 1.85% | S$2,000 |

| Deposit Bundle | 9 months | 2.15% | S$2,000 |

Maybank also offers ASEAN currency options for those looking to diversify their savings. These accounts support multiple currencies, providing flexibility for international savers. Additionally, Premier Banking customers enjoy exclusive benefits, such as personalized financial advice and higher rates.

“Maybank’s diverse offerings and competitive rates make it a reliable choice for savers looking for flexibility and attractive returns.”

Whether you’re exploring online options or bundled promotions, Maybank’s solutions ensure your savings grow securely. With rates valid until May 2025, now is the perfect time to explore these opportunities.

OCBC Fixed Deposit Rates

Choosing the right savings option can make a big difference in your financial growth. OCBC offers competitive rates for both online and branch placements, ensuring flexibility for savers. Whether you’re saving for short-term goals or exploring long-term options, their solutions cater to diverse needs.

Online Rates

For those who prefer digital banking, OCBC’s online platform offers a rate of 1.90% p.a. for a 9-month tenure. The minimum deposit amount is S$30,000, making it ideal for medium to large investments. This option is perfect for tech-savvy individuals seeking convenience and competitive returns.

Branch Placement Rates

If you prefer in-person service, OCBC’s branch placements provide a rate of 1.80% p.a. for the same tenure. The minimum deposit amount remains S$30,000, ensuring consistency across channels. This option is ideal for those who value face-to-face interactions and personalized advice.

OCBC maintains rate parity across deposit sizes, ensuring fairness for all savers. Additionally, their Premier Private Client tier offers exclusive benefits, including higher rates and personalized financial planning. This makes it a standout choice for high-net-worth individuals.

The 9-month tenure is a sweet spot for many savers, balancing returns and flexibility. It’s also worth noting that rates are subject to change, especially after June 2025. Comparing these options with the OCBC 360 account can help you maximize your returns.

| Channel | Tenure | Rate (p.a.) | Minimum Deposit |

|---|---|---|---|

| Online | 9 months | 1.90% | S$30,000 |

| Branch | 9 months | 1.80% | S$30,000 |

For corporate clients, OCBC offers tailored solutions to meet specific business needs. These accounts provide flexibility and security, ensuring your savings grow efficiently. Whether you’re an individual or a business, OCBC’s diverse offerings make it a reliable choice.

“OCBC’s competitive rates and flexible options ensure your savings grow securely and efficiently.”

RHB Fixed Deposit Rates

RHB provides flexible savings solutions tailored to meet diverse financial goals. Whether you’re saving for short-term needs or long-term stability, their offerings cater to both personal banking customers and preferred banking customers. With competitive rates and unique features, RHB stands out as a reliable choice for savers.

Personal Banking Rates

For general customers, RHB offers a flat rate of 2.00% p.a. across all tenures. This consistency ensures predictability, making it easier to plan your savings. The minimum deposit amount is S$20,000, making it accessible for medium to large investments.

Premier Banking Rates

Preferred banking customers enjoy a higher rate of 2.10% p.a. for all tenures. To qualify for this tier, customers must meet specific wealth management criteria, such as maintaining a minimum balance or holding eligible investment products. This tier also offers personalized financial advice and exclusive promotions.

RHB’s rate structure ensures fairness across tenures, whether you’re saving for 3 months or 36 months. Additionally, their RHB Easy account integration allows seamless fund transfers, enhancing convenience for savers.

For those interested in alternative options, RHB also offers Islamic FD accounts. These accounts comply with Sharia principles, providing a unique choice for ethical savers.

| Tier | Rate (p.a.) | Minimum Deposit |

|---|---|---|

| Personal Banking | 2.00% | S$20,000 |

| Premier Banking | 2.10% | S$20,000 |

Notably, RHB’s MYR FD rates differ from SGD rates, offering opportunities for those looking to diversify their savings across currencies. This flexibility makes RHB a versatile choice for both local and international savers.

“RHB’s tiered rates and flexible options ensure your savings grow securely and efficiently, catering to diverse financial needs.”

Whether you’re a personal banking customer or a preferred client, RHB’s solutions provide a secure way to grow your savings. Understanding these options ensures you make the most of your investment.

Standard Chartered Fixed Deposit Rates

Standard Chartered offers flexible savings solutions tailored to diverse financial needs. Whether you’re saving for short-term goals or long-term stability, their options cater to both casual savers and high-net-worth individuals. With competitive rates and unique features, they stand out as a reliable choice.

No Minimum Deposit Requirement

One of the standout features of Standard Chartered’s fixed deposit accounts is the no minimum deposit requirement. This makes it accessible for savers with varying financial capacities. Whether you’re starting small or investing a larger sum, this flexibility ensures inclusivity.

This feature is particularly beneficial for those new to savings or with limited capital. It allows you to grow your funds without the pressure of meeting high deposit thresholds. Additionally, it complements their Bonus$aver account, which offers higher returns for customers who maintain multiple accounts.

Mid- to Long-Term Rates

Standard Chartered provides attractive rates for mid- to long-term tenures. For example, a 15-month tenure offers a rate of 1.50% p.a., while their Priority Banking customers enjoy 1.80% p.a. for a 5-month tenure with a minimum deposit of S$25,000. These options are ideal for those looking to lock in their savings for extended periods.

Their USD fixed deposit cross-sell opportunities further enhance the appeal. This allows savers to benefit from currency fluctuations, adding an extra layer of flexibility. For expats, Standard Chartered offers tailored banking packages that cater to international financial needs.

Notably, rate lock extensions are available, ensuring you can secure favorable rates for longer periods. This feature is particularly useful in a fluctuating interest rate environment, providing peace of mind for savers.

“Standard Chartered’s diverse offerings and competitive rates make it a reliable choice for savers looking for flexibility and higher interest rates.”

Whether you’re exploring short-term options or long-term stability, Standard Chartered’s solutions ensure your savings grow securely. Their focus on cash management and inclusivity makes them a standout choice in the market.

Factors to Consider When Choosing a Fixed Deposit

Understanding the key factors can help you make smarter savings decisions. Whether you’re saving for short-term goals or long-term stability, evaluating these aspects ensures you choose the right option for your needs.

Interest Rates

Interest rates are a crucial factor when selecting a savings option. Higher rates mean better returns, but they often come with specific conditions. For example, some banks offer promotional offers with attractive rates for new customers or fresh funds.

It’s also important to compare rates across different tenures. A longer tenure might offer higher returns, but it could limit your access to funds. Balancing rate and tenure is key to maximizing your earnings.

Tenure Options

Tenure options vary widely, from as short as one month to as long as 36 months. Shorter tenures provide flexibility, while longer ones offer higher returns. Consider your financial goals and liquidity needs before making a decision.

For instance, if you’re saving for a specific goal, like a vacation or a down payment, a shorter tenure might be ideal. On the other hand, long-term savers can benefit from locking in higher rates for extended periods.

Minimum Deposit Requirements

Different banks have varying minimum deposit requirements. Some start as low as S$500, while others require S$20,000 or more. Choose an option that aligns with your budget and financial capacity.

If you’re a high-net-worth individual, you might qualify for premium rates with higher deposit amounts. Always check the terms to ensure you meet the requirements.

Promotional Offers

Banks often run promotional offers to attract new customers. These can include higher interest rates, cash bonuses, or waived fees. However, these offers are usually time-bound and may require fresh funds or specific account types.

For example, some promotions offer up to 4.60% p.a. for foreign currency deposits like USD or HKD. While these can be lucrative, they also come with currency risk, so weigh the pros and cons carefully.

| Factor | Key Considerations |

|---|---|

| Interest Rates | Compare rates across tenures and banks. |

| Tenure Options | Choose based on financial goals and liquidity needs. |

| Minimum Deposit Requirements | Ensure the amount aligns with your budget. |

| Promotional Offers | Check terms and conditions for eligibility. |

Additionally, consider alternatives like cash management accounts or T-bills, which may offer better liquidity or returns. Always evaluate your options to make the most informed decision.

“Choosing the right savings option requires balancing returns, flexibility, and security. Understanding these factors ensures your money works harder for you.”

Conclusion

Making the most of your savings requires careful planning and the right tools. DBS leads the market with a 2.45% p.a. rate, making it a top choice for many savers. To further maximize returns, consider laddering strategies across different tenures. This approach balances flexibility and higher earnings.

Staying updated on fixed deposit rates is essential. Platforms like Beansprout can help you monitor and compare offers effectively. Remember, these accounts are just one part of a broader financial portfolio. Diversifying your investments ensures long-term stability.

Ready to take the next step? Start by comparing the latest offers from top banks to find the best fit for your goals. With the right strategy, your savings can grow steadily and securely.