In 2021, many savers in Singapore noticed a downward trend in returns for their savings products. This made it more important than ever to compare options before committing funds. Understanding the fixed deposit rates offered by different banks can help you make smarter financial decisions.

For example, Bank of China offered a competitive interest rate of 1.65% for a 3-month term, while DBS provided 1.60% for a 12-month term. These examples highlight the need to evaluate offerings from multiple institutions to find the most suitable option for your needs.

Regular updates to such comparisons ensure accuracy and relevance. Additionally, insights from communities like Beansprout can provide valuable information, especially for senior citizens looking for tailored solutions. Smaller deposits often come with unique rate structures, as seen with DBS, making it essential to consider your deposit amount when comparing options.

Key Takeaways

- Declining returns on savings products were a common trend in 2021.

- Comparing fixed deposits from multiple banks is crucial for maximizing returns.

- Bank of China and DBS offered some of the most competitive interest rates.

- Regular updates ensure the accuracy of rate comparisons.

- Community insights can help identify tailored solutions for specific needs.

Introduction to Fixed Deposits in Singapore

For those seeking stability, fixed deposits offer a secure savings option. These low-risk vehicles provide guaranteed returns, making them a popular choice among savers in Singapore. Unlike regular savings accounts with variable interest rates, fixed deposits lock in a specific rate for a set period.

Most banks in Singapore require a minimum deposit ranging from $500 to $20,000. Tenure options typically span from 1 to 36 months, allowing flexibility to match your financial goals. Additionally, the Singapore Deposit Insurance Corporation (SDIC) insures deposits up to $100,000, ensuring your funds are protected.

In 2021, major banks like UOB, OCBC, and CIMB adjusted their deposit rates downward, reflecting broader market trends. This made it essential to compare offerings carefully. Early withdrawals often incur penalties, so it’s crucial to choose a tenure that aligns with your financial plans.

Many banks also require “fresh funds” for promotional rates, meaning the money must not already be held with the institution. Looking ahead, the Monetary Authority of Singapore (MAS) announced an increase in deposit insurance limits to $150,000 starting in 2024, further enhancing security for savers.

“Fixed deposits are a cornerstone of financial planning, offering both safety and predictability.”

Here’s a quick comparison of key features:

| Feature | Fixed Deposits | Regular Savings Accounts |

|---|---|---|

| Interest Rate | Fixed | Variable |

| Minimum Deposit | $500-$20,000 | No minimum |

| Insurance Coverage | Up to $100,000 (SDIC) | Up to $100,000 (SDIC) |

| Early Withdrawal Penalty | Yes | No |

By understanding these features, you can make informed decisions about where to park your savings. Whether you’re planning for short-term goals or long-term security, fixed deposits remain a trusted option in Singapore’s financial landscape.

Why Compare Fixed Deposit Rates?

Savvy savers know that comparing rates is key to maximizing earnings. Even small differences in interest rates can lead to significant financial gains over time. For example, a 0.80% rate from HSBC versus a 1.65% rate from Bank of China can result in an $85 annual difference on a $10,000 deposit.

Promotional rates often come with time-sensitive offers. Banks like UOB provide higher interest rates for a limited period, but these usually require fresh funds. Missing these windows can mean settling for lower returns.

Special considerations apply to senior citizens. DBS, for instance, offers an additional 0.10% for those aged 55 and above. This highlights the importance of tailoring your choices to your specific needs.

“Comparing rates isn’t just about numbers—it’s about finding the best fit for your financial goals.”

Placement methods also matter. Bank of China offers a 1.65% rate for mobile placements, compared to 1.35% over the counter. This demonstrates how convenience can sometimes come at a cost.

Here’s a quick comparison of key factors:

| Factor | Impact |

|---|---|

| Rate Variance | 0.80% (HSBC) vs 1.65% (Bank of China) |

| Deposit Amount | $10,000 deposit: $80 vs $165 annual interest |

| Promotional Rates | Time-sensitive, limited offers |

| Senior Citizen Rates | +0.10% for 55+ (DBS) |

Longer tenures often provide more stable interest rates, but they may limit liquidity. To balance returns and accessibility, consider strategies like FD laddering. This approach spreads your investments across multiple tenures, ensuring both growth and flexibility.

Inflation can erode savings over time. Opting for higher interest rates helps protect your money’s purchasing power. By comparing options, you can make informed decisions that align with your financial goals.

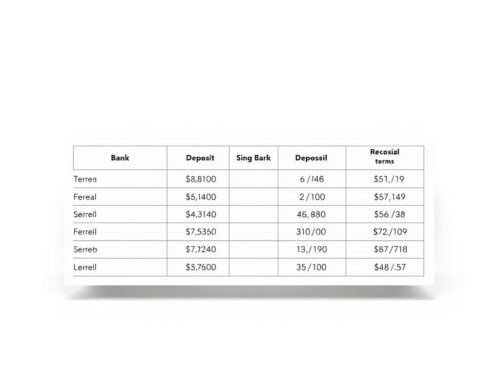

Top Banks Offering the Best Fixed Deposit Rates in Singapore 2021

Choosing the right financial institution can significantly impact your savings. In 2021, several banks in Singapore provided attractive fixed deposit rate options, catering to diverse needs. Here’s a closer look at the top institutions and their offerings.

DBS/POSB

DBS offered a deposit interest rate of 1.60% for tenures between 9 to 12 months, with a minimum deposit of $1,000. For larger deposits above $20,000, the rate dropped to 0.05%. DBS also provided additional benefits for senior citizens, making it a popular choice for older savers.

Bank of China

Bank of China stood out with a mobile placement rate of 1.65% for a 3-month term. The low entry point of $500 made it accessible for smaller savers. This option was ideal for those looking for short-term gains with minimal commitment.

CIMB

CIMB offered two tiers: 1.60% for personal accounts and 1.65% for preferred clients, both for a 3-month term. The minimum deposit 10,000 requirement ensured higher returns for those with larger savings.

Maybank

Maybank’s online placement provided a rate of 1.45% for a 6-month term. However, the higher minimum deposit 10,000 of $20,000 made it suitable for savers with substantial funds.

Hong Leong Finance

Hong Leong Finance offered a digital placement rate of 1.42% for 8 to 9 months. The $20,000 minimum deposit threshold aligned with its focus on larger savers. This option was ideal for those comfortable with digital banking.

| Bank | Rate | Tenure | Minimum Deposit |

|---|---|---|---|

| DBS/POSB | 1.60% | 9-12 months | $1,000 |

| Bank of China | 1.65% | 3 months | $500 |

| CIMB | 1.60%-1.65% | 3 months | $10,000 |

| Maybank | 1.45% | 6 months | $20,000 |

| Hong Leong Finance | 1.42% | 8-9 months | $20,000 |

Shorter tenures often provided higher deposit interest rates, making them attractive for those seeking quick returns. Mobile placements, like those from bank china, offered convenience but required careful consideration of terms. Special features, such as senior citizen rates from DBS, added value for specific demographics.

By comparing these options, savers could identify the most suitable choice for their financial goals. Whether you prioritize low entry points or higher returns, understanding these details ensures smarter savings decisions.

Factors to Consider When Choosing a Fixed Deposit

Selecting the right savings option requires careful evaluation of several key factors. Whether you’re opening fixed deposit accounts for the first time or renewing an existing one, understanding these elements can help you maximize returns and avoid unnecessary penalties.

One of the first decisions involves tenure flexibility. Shorter tenures often offer higher returns but limit liquidity. Longer tenures provide stability but may lock your funds for extended periods. For example, Maybank offers tenures ranging from 1 to 36 months, while CIMB caps at 24 months.

Another critical factor is the requirement for fresh funds. Many banks, like CIMB, offer higher interest rates for new deposits compared to existing balances. This ensures that promotional rates are accessible to new customers.

Deposit insurance is another essential consideration. The Singapore Deposit Insurance Corporation (SDIC) covers up to $100,000 per depositor per bank. However, exceptions apply for corporate accounts, so it’s crucial to verify coverage details.

Placement methods also matter. Online placements often come with higher rates compared to branch transactions. For instance, RHB Singapore allows account openings via mobile banking, offering convenience and better returns.

“Auto-renewal policies can simplify your savings strategy, but always review the updated terms.”

Penalty structures vary widely. Hong Leong Finance, for example, charges $50 plus a reduction in earned interest for early withdrawals. Understanding these penalties ensures you don’t lose out on potential earnings.

Currency options add another layer of complexity. While SGD offers stability, USD and other foreign currencies may provide higher returns but come with exchange rate risks. Always assess your risk tolerance before choosing.

Finally, consider the financial health of the bank. Indicators like credit ratings and profitability can provide insights into the institution’s stability. Whether you’re opening an account for personal banking or corporate needs, these factors ensure your funds are secure.

By evaluating these aspects, you can make informed decisions about your fixed deposit accounts. For more insights, explore this guide on navigating Singapore’s savings landscape.

How Fixed Deposits Compare to Other Savings Options

Exploring savings options can help you make informed financial decisions. While fixed deposits offer stability, other tools like Singapore Savings Bonds and high-yield accounts provide unique benefits. Understanding their differences ensures you choose the right option for your goals.

Fixed Deposits vs. Singapore Savings Bonds

Fixed deposits and Singapore Savings Bonds cater to different needs. Fixed deposits lock in a specific rate, while savings bonds offer step-up interest structures. For example, a 1-year SSB provides 2.06%, compared to a 1.60% fixed deposit rate.

Liquidity is another key factor. Fixed deposits often penalize early withdrawals, whereas savings bonds allow redemption after just one month. This makes SSBs a flexible choice for those needing access to funds.

Risk profiles also differ. Fixed deposits are insured by the SDIC up to $100,000, while savings bonds are backed by the Singapore government. Both options are low-risk, but the backing institutions vary.

Fixed Deposits vs. High-Yield Savings Accounts

High-yield accounts offer higher interest but come with conditions. For instance, the UOB One Account provides up to 5.30% but requires salary crediting and minimum spending. Fixed deposits, on the other hand, guarantee returns without such requirements.

Minimum investments also vary. While fixed deposits often start at $1,000, high-yield accounts may have no minimum deposit. However, achieving the advertised rates usually involves meeting specific criteria.

Rate stability is another consideration. Fixed deposits provide predictable returns, while high-yield accounts may adjust rates based on market conditions. This makes fixed deposits ideal for those prioritizing certainty.

“Choosing the right savings tool depends on your financial goals and risk tolerance.”

Tax implications and portfolio allocation strategies further influence your decision. Fixed deposits are taxed on interest earned, while some high-yield accounts may offer tax advantages. Diversifying across multiple savings tools can balance returns and flexibility.

For example, combining a deposit 10,000 in fixed deposits with investments in savings bonds can create a balanced portfolio. This approach ensures both stability and growth potential.

By comparing these options, you can make informed decisions that align with your financial priorities. Whether you prioritize liquidity, returns, or flexibility, understanding the differences ensures smarter savings choices.

Promotional Rates and Special Offers

Many banking customers in Singapore are drawn to promotional rates and special offers for their savings. These deals often provide higher returns, but they come with specific terms and conditions. Understanding these can help you make the most of your money.

Limited-time offers are a common strategy. For example, Maybank’s 6-month bundle promotion offered a rate of 2.90% between March and August 2025. Such deals are ideal for those looking to maximize returns within a short period.

New customers often receive additional incentives. Maybank, for instance, provided $50 vouchers for first-time banking customers. These perks can add significant value to your savings strategy.

Many promotions require fresh funds, meaning the money must not already be held with the bank. This ensures that the offers attract new deposits rather than existing balances. Always check the definitions of fresh funds across different banks.

“Special offers can boost your savings, but always read the fine print to avoid surprises.”

Tiered rate structures are another feature to consider. Citibank, for example, offers rates based on deposit amounts, ranging from $50,000 to $3 million. Higher deposits often come with better returns, making this option suitable for larger savers.

Cross-product promotions are also popular. Some banks bundle deposit promotion offers with insurance products, providing added benefits. These deals can be a great way to diversify your financial portfolio.

Holiday season specials and corporate partnership deals are other avenues to explore. Early bird placement bonuses, like those from RHB, reward customers who act quickly. These offers can provide an extra edge for savvy savers.

To compare promotional rates effectively, evaluate the terms, conditions, and potential returns. This ensures you choose the best option for your financial goals.

Understanding Fixed Deposit Terms and Conditions

Understanding the terms and conditions of your savings plan is crucial for maximizing benefits. Whether you’re opening a new account or renewing an existing one, knowing the details can help you avoid surprises and make informed decisions.

Interest calculation methods vary between banks. Some use simple interest, while others apply compound interest. For example, Standard Chartered offers compound interest on certain accounts, which can significantly boost your earnings over time.

Placement channels also matter. Many banks, like Standard Chartered, require specific mobile app features for online placements. Ensure your device meets these requirements to avoid delays.

Maturity instructions are another key consideration. You can choose between auto-renewal or payout at the end of the term. Auto-renewal ensures your funds continue earning, while payout provides immediate access to your money.

Joint accounts come with their own set of rules. Both account holders must agree on decisions like withdrawals or renewals. This can be beneficial for shared financial goals but requires clear communication.

Currency conversion fees may apply if you’re depositing in a foreign currency. Always check the bank’s policy to avoid unexpected charges. For large deposits, additional documentary requirements might be necessary, such as proof of income or source of funds.

Rate lock guarantees protect your fixed deposit interest from market fluctuations. This ensures your rate remains unchanged for the agreed term. However, force majeure clauses can override these guarantees in extreme circumstances, so review the fine print carefully.

By understanding these terms, you can make smarter choices about your savings. Whether you’re using internet banking or visiting a branch, knowing the details ensures a smooth experience.

Tips for Maximizing Your Fixed Deposit Returns

Maximizing returns on your savings requires strategic planning and awareness of available options. By implementing smart techniques, you can make the most of your investments. Here are some actionable tips to help you achieve better results.

One effective strategy is the laddering approach. This involves splitting your funds into multiple accounts with different tenures, such as 3-, 6-, and 12-month combinations. This ensures liquidity while taking advantage of higher deposit rates over time.

Subscribing to rate alert services can also be beneficial. These notifications keep you informed about promotional offers and changes in finance fixed options. Staying updated allows you to act quickly when favorable opportunities arise.

Relationship banking offers additional perks. Many institutions provide better deposit rates or exclusive promotions for loyal customers enjoy benefits like priority services or fee waivers. Building a strong relationship with your bank can pay off in the long run.

New customer promotions often provide attractive incentives, but don’t overlook loyalty programs. Comparing both can help you decide which option aligns with your financial goals. Additionally, consider diversifying your portfolio with SGD and foreign currency allocations to balance risk and returns.

“Strategic planning and staying informed are key to maximizing your savings potential.”

Insurance-linked options can optimize your returns while providing added security. These products combine savings with coverage, offering a dual benefit. Timing your investments with monetary policy announcements can also yield better results, as rate changes often follow these updates.

For larger deposits, negotiating bulk rates is another way to enhance returns. Many banks are willing to offer better terms for significant investments. By exploring these strategies, you can make smarter decisions and achieve your financial objectives.

Common Mistakes to Avoid with Fixed Deposits

When it comes to saving money, avoiding common pitfalls can make a big difference in your returns. Many people overlook key details when opening a fixed deposit, which can lead to missed opportunities or unexpected penalties. Here are some mistakes to watch out for:

One common error is ignoring placement channel requirements. Some banks offer higher interest rates for online placements but lower rates for in-branch transactions. Always check the terms to ensure you’re getting the best deal.

Another mistake is not considering inflation-adjusted returns. While a fixed deposit offers stability, its returns may not keep up with rising prices. This can erode your purchasing power over time.

- Misunderstanding “effective” vs advertised rates: Advertised rates may not include fees or taxes, so always calculate the effective rate to understand your actual earnings.

- Early withdrawal miscalculations: Withdrawing funds before the maturity date often results in penalties. Plan your tenure carefully to avoid unnecessary losses.

- Auto-renewal rate assumptions: Auto-renewal doesn’t always guarantee the same interest rate. Review the terms to avoid surprises.

Currency risk is another factor to consider. Depositing in foreign currencies like USD can offer higher returns but comes with exchange rate risks. Always assess your comfort level with such fluctuations.

“Understanding the fine print is essential to maximizing your savings and avoiding costly mistakes.”

Lastly, don’t overlook FDIC/SDIC coverage. While most deposits are insured up to $100,000, corporate accounts may have different rules. Verify your coverage to ensure your funds are protected.

By avoiding these common errors, you can make the most of your fixed deposit and achieve your financial goals with confidence.

Conclusion

Making the most of your savings involves understanding the landscape and choosing wisely. In 2021, institutions like Bank of China, DBS, and CIMB stood out with competitive offerings. Monitoring deposit rates regularly ensures you stay ahead of market trends.

Consider hybrid approaches, combining fixed deposits with options like SSBs or T-Bills for balanced returns. Digital placements often provide higher rates and convenience, making them a smart choice for tech-savvy savers.

Avoid chasing marginal rate differences, as the effort may outweigh the benefits. Diversification remains key to managing risk and maximizing returns. Looking ahead, projections for 2022 suggest continued opportunities for savvy investors.

Stay informed by signing up for rate alerts and exploring comparison tools. With the right strategy, you can make the most of your singapore deposit options and achieve your financial goals.