Fixed deposits remain a popular choice for those looking to grow their savings with minimal risk. In Singapore, several banks offer competitive fixed deposit rates that cater to different financial goals and timelines.

For instance, DBS/POSB provides a 1.60% rate for 9 to 12-month tenures, making it an attractive option for medium-term investments. Bank of China’s mobile banking promotion offers 1.55% for 3 to 12 months, while Citibank’s limited-time promotion requires fresh funds but delivers a 1.40% rate for 3 or 6 months.

Other alternatives like StashAway Simple™ Cash also present higher returns, ranging from 2.75% to 4.9%. Understanding these options can help you make informed decisions to maximize your earnings.

Key Takeaways

- DBS/POSB offers a 1.60% rate for 9 to 12-month tenures.

- Bank of China’s mobile banking promotion provides 1.55% for 3 to 12 months.

- Citibank’s promotion requires fresh funds for a 1.40% rate.

- StashAway Simple™ Cash offers returns between 2.75% and 4.9%.

- Compare rates and terms to find the best fit for your financial goals.

What Are Fixed Deposits and How Do They Work?

Fixed deposits are a straightforward investment tool for steady growth. They allow you to lock your funds for a specific period while earning a predetermined interest rate. This makes them a popular choice for those looking for low-risk savings options.

Understanding Fixed Deposits

Fixed deposits are regulated by the Monetary Authority of Singapore (MAS) and insured under the Singapore Deposit Insurance Corporation (SDIC). This ensures your deposit amount is protected up to S$75,000 per depositor per bank.

Unlike savings accounts, fixed deposits offer limited liquidity. Your funds are locked for the chosen tenure, which can range from 1 month to 5 years. However, this trade-off comes with higher deposit interest rates compared to regular savings accounts.

How Fixed Deposit Interest Is Calculated

The interest on fixed deposits is calculated using a simple formula: Principal × Rate × (Tenure/12). For example, if you deposit S$10,000 at a 1.6% interest rate for 12 months, your interest earned would be S$160.

Here’s a breakdown of how interest is calculated for different tenures:

| Deposit Amount | Interest Rate | Tenure (Months) | Interest Earned |

|---|---|---|---|

| S$10,000 | 1.6% | 12 | S$160 |

| S$20,000 | 1.8% | 24 | S$720 |

| S$5,000 | 1.4% | 6 | S$35 |

Minimum deposits for fixed deposit accounts typically range from S$500 to S$30,000, depending on the bank. At maturity, most banks offer an auto-renewal option, allowing your funds to continue earning interest unless you choose to withdraw them.

For more details on how fixed deposits compare to other investment options, check out this comprehensive guide.

Why Fixed Deposits Are a Safe Investment in Singapore

For those seeking stability in their investments, fixed deposits offer a reliable solution. They provide a secure way to grow your savings without exposing your funds to high risks. In Singapore, these accounts are backed by robust regulations and insurance schemes, making them a preferred choice for cautious investors.

Low-Risk Nature of Fixed Deposits

Fixed deposits are known for their low-risk investment profile. Unlike stocks or mutual funds, they are not subject to market fluctuations. This means your principal amount remains safe, and you earn a guaranteed interest rate over the chosen tenure.

Additionally, fixed deposits are regulated by the Monetary Authority of Singapore (MAS). This ensures that participating financial institutions adhere to strict guidelines, further enhancing their safety.

Singapore Deposit Insurance Scheme (SDIC)

The Singapore Deposit Insurance Scheme (SDIC) provides an extra layer of security. In 2024, the coverage limit was expanded to S$100,000 per depositor per institution. This means your funds are protected up to this amount, even in the unlikely event of a bank failure.

It’s important to note that SDIC coverage applies only to Singapore dollar deposits. Foreign currency fixed deposits are excluded, so investors should be aware of this limitation.

Compared to volatile investments like stocks or fluctuating instruments like Treasury bills, fixed deposits offer unmatched stability. They are an excellent choice for those prioritizing capital preservation over high returns.

Best Fixed Deposit Rates in Singapore for 2024

In today’s competitive market, securing higher returns on your deposits is essential. Fixed deposits remain a reliable option for those looking to grow their savings with minimal risk. Let’s explore the top offerings and how they compare.

Top Banks Offering the Highest Rates

Several banks in Singapore provide attractive fixed deposit rates tailored to different financial needs. For instance, DBS offers a tiered structure where deposits between S$1,000 and S$19,999 earn 1.60%, while amounts above S$20,000 receive a lower rate of 0.05%.

Maybank’s iSAVvy account stands out with a 1.85% rate for a 6-month tenure, provided you deposit a minimum of S$20,000. Hong Leong Finance also offers competitive rates, with its online specials providing 1.42% for 9-month deposits exceeding S$20,000.

Promotional Rates vs. Standard Rates

Promotional rates often offer higher interest rates compared to standard rates. For example, Citibank’s limited-time promotion provides 1.40% for 3 or 6-month tenures, while its standard rate is just 0.90%.

Similarly, CIMB differentiates between preferred and personal banking rates, offering 1.55% and 1.50%, respectively. HSBC also adjusts its rates based on wealth tiers, providing higher returns for premium clients.

“Time-sensitive promotions, like UOB’s August 20-30 window, can offer exceptional value for those who act quickly.”

However, it’s important to note that rates may drop for deposits exceeding certain thresholds. Always review the terms carefully to ensure you’re getting the best deal.

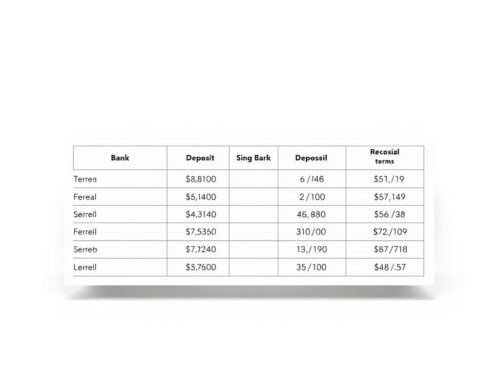

| Bank | Rate | Tenure | Minimum Deposit |

|---|---|---|---|

| DBS | 1.60% | 9-12 months | S$1,000 |

| Maybank | 1.85% | 6 months | S$20,000 |

| Hong Leong Finance | 1.42% | 9 months | S$20,000 |

By comparing these options, you can identify the most suitable 12-month fixed deposit or other tenures that align with your financial goals. Whether you’re looking for promotional rates or standard offerings, understanding these details can help you maximize your savings.

Comparing Fixed Deposits with Other Low-Risk Investments

When exploring low-risk investment options, it’s essential to weigh the pros and cons of each. Fixed deposits are a popular choice, but alternatives like Singapore Savings Bonds, Treasury Bills, and high-yield savings accounts also offer unique benefits. Understanding these differences can help you make informed decisions tailored to your financial goals.

Fixed Deposits vs. Singapore Savings Bonds

Singapore Savings Bonds (SSB) provide a higher interest rate of 3.09% over 10 years, compared to fixed deposits’ short-term rates of around 1.60%. However, SSBs require a minimum holding period of 6 months, which limits liquidity. Fixed deposits, on the other hand, offer more flexibility with tenures as short as 1 month.

Another key difference is the investment process. SSBs are issued monthly, while fixed deposits can be opened anytime. For those prioritizing liquidity and shorter commitments, fixed deposits may be the better choice.

Fixed Deposits vs. Treasury Bills

Treasury Bills (T-Bills) are another low-risk option, yielding 1.77% for a 6-month tenure. Unlike fixed deposits, T-Bills operate through an auction system, meaning the interest rates can vary. Fixed deposits, however, provide guaranteed returns, making them more predictable.

Additionally, T-Bills are exempt from income tax, which can be a significant advantage for some investors. Fixed deposits, while taxable, offer the convenience of fixed returns and easier access to funds upon maturity.

Fixed Deposits vs. High-Yield Savings Accounts

High-yield savings accounts, like OCBC 360, offer higher interest rates (up to 2.45%) but often require meeting specific conditions, such as salary crediting or spending on linked credit cards. Fixed deposits, in contrast, provide straightforward returns without additional effort.

However, high-yield accounts offer greater flexibility, allowing withdrawals at any time. Fixed deposits lock your funds for the chosen tenure, which can be a drawback if you need quick access to your money.

“Each investment option has its strengths. The right choice depends on your financial needs and risk tolerance.”

Other alternatives, like foreign currency fixed deposits, offer even higher returns (up to 4.00% for USD rates) but come with currency risk. Cash management accounts provide flexibility but lack the guarantees of fixed deposits. StashAway Simple™ offers a 1.45% guaranteed rate, serving as a middle ground for those seeking both security and accessibility.

Factors to Consider When Choosing a Fixed Deposit

Selecting the right fixed deposit involves more than just comparing interest rates. To make an informed decision, you need to evaluate several factors, including tenure, minimum deposit requirements, and potential penalties for early withdrawal. Here’s a detailed look at what to consider.

Interest Rates and Tenures

The relationship between interest rates and tenure is crucial. Longer tenures often come with higher rates, but they also lock your funds for an extended period. For example, a 12-month deposit might offer a 1.60% rate, while a 6-month deposit could yield 1.40%.

It’s essential to align the tenure with your financial goals. If you need access to your funds sooner, a shorter tenure might be more suitable, even if the rate is slightly lower.

Minimum Deposit Requirements

Different banks have varying minimum deposit amounts. For instance, Bank of China allows deposits as low as S$500 through mobile banking, while over-the-counter deposits require S$20,000. DBS sets its minimum at S$1,000, and OCBC requires S$30,000.

Here’s a quick comparison of minimum deposits across major banks:

- Bank of China: S$500 (mobile), S$20,000 (counter)

- DBS: S$1,000

- OCBC: S$30,000

- CIMB: S$10,000

Early Withdrawal Penalties

Withdrawing funds before the maturity date can result in penalties. DBS charges a 0.05% penalty plus the loss of accrued interest. Hong Leong Finance imposes a S$50 fee along with prorated interest deductions.

Always review the penalty structure before committing to a fixed deposit. This ensures you’re aware of the costs if you need to access your funds early.

“Understanding the terms and conditions of your fixed deposit can save you from unexpected penalties and help you maximize your returns.”

Additionally, some banks offer preferential rates for personal banking or premier clients. For example, CIMB provides higher rates for preferred banking customers. Always check if you qualify for these benefits.

For more insights on finding the right fixed deposit, visit this comprehensive guide.

Maximizing Your Savings with the Best FD Rates in Singapore 2024

To make the most of your savings, strategic planning is key. One effective approach is the laddering strategy, where you spread your funds across multiple tenures. This ensures liquidity while earning higher deposit rates on longer-term investments.

Keep an eye on bank websites for quarterly promotions. These often provide better fixed deposit offers than standard rates. Additionally, compare SDIC coverage across institutions to ensure your funds are fully protected.

Mobile banking can also unlock better deals. Many banks offer exclusive deposit rates for digital transactions. Always align your fixed deposits with your financial timelines to avoid penalties for early withdrawals.

For those seeking liquidity, alternatives like StashAway Simple™ can be a great option. They offer flexibility while still providing competitive returns. By combining these strategies, you can optimize your savings effectively.