Singapore’s financial landscape offers diverse ways to grow your savings. Whether you prefer fixed deposit options or flexible accounts, understanding current trends helps maximize returns. In 2025, deposit rates fluctuate, but select institutions still provide competitive deals.

SingSaver, operating under an MAS-regulated subsidiary, ensures reliable comparisons. Your funds are protected by SDIC insurance up to S$100,000 per depositor. This guide simplifies your search for the right product in today’s market.

Key Takeaways

- Compare both fixed deposits and savings accounts for optimal gains.

- SDIC safeguards deposits up to S$100,000 per institution.

- Digital banks often offer higher deposit rates than traditional ones.

- Recent MAS policies influence product availability and terms.

- Short-term fixed deposit plans may outperform savings accounts.

Where to Find the Best Bank Interest Rate in Singapore

Digital platforms and traditional branches offer distinct advantages for savers. While physical locations provide face-to-face advice, online tools often feature higher deposit rates and quicker processing.

DBS leads with a 2.45% return for 12-month fixed deposit plans. Meanwhile, SBI caters to mid-term savers with 2.35% for six months, though it requires a S$50,000 minimum. For smaller amounts, Bank of China accepts deposits from S$500 with tenures as short as three months.

Key considerations:

- Promotional deals (like BOC’s 2.15% app-exclusive rate) may require “fresh funds.”

- Regional banks like SBI sometimes outpace local giants in short-term deposit rates.

- June 2025 promotions are time-sensitive—check expiry dates.

“Always compare standard board rates against limited-time offers. A 0.1% difference adds up over large deposits.”

Use comparison tools to filter by tenure, amount, and institution type. Mobile banking apps frequently list unadvertised exclusives, so explore beyond branch notices.

Best Fixed Deposit Rates in Singapore (June 2025)

Locking in competitive returns requires comparing the latest fixed deposit account offerings across Singapore’s financial institutions. June’s promotions feature tiered rates, flexible tenures, and digital-exclusive deals to suit diverse savings goals.

DBS: Highest 12-Month Rate at 2.45% p.a.

DBS leads with a standout 2.45% deposit rate for 12-month terms, ideal for long-term savers. The minimum deposit amount is just S$1,000, accessible via online applications for customers aged 18+. Shorter tenures offer slightly lower returns:

- 2.4% for 10–11 months

- 2.3% for 7-month deposits

State Bank of India (SBI): Best 6-Month Rate at 2.35% p.a.

SBI’s limited-time promo offers 2.35% for six months—0.35% above its standard rate. Note the higher minimum deposit amount of S$50,000 and additional documentation for non-residents. Foreigners should prepare proof of address and passport copies.

Bank of China: Flexible Tenures from 3–9 Months

For smaller deposits, Bank of China accepts S$500 for tenures as short as three months. Their mobile app features a 2.15% rate, with multi-currency options for global savers. Compare this with competitive fixed deposit rates from other providers like ICBC (2.15% via e-banking).

Other Notable Options:

- Hong Leong Finance: 2.05% for 7 months (S$20,000 minimum)

- Maybank: Bundle promotions with rates up to 2.15% for 9 months

- CIMB: 2.15% for 3-month terms (S$10,000 minimum)

“Short-term FDs with higher rates often require larger deposits—weigh liquidity needs against potential gains.”

Best Savings Accounts for High Interest

Modern account features help depositors maximize earnings without locking funds long-term. Unlike fixed deposits, these liquid options combine accessibility with competitive returns. Personal banking customers can choose from tiered structures, bonus categories, or digital-exclusive deals.

OCBC 360 Account: Up to 3.30% p.a.

This popular account rewards multiple banking behaviors with bonus earnings. Customers can earn the full 3.30% by:

- Crediting ≥S$1,600 monthly salary

- Spending S$500 on an OCBC credit card

- Maintaining S$500 in insurance premiums

The category-based structure makes it ideal for those who already use OCBC products. However, tracking all requirements can be challenging for some personal banking customers.

UOB One Account: No-Frills 3.30% p.a.

UOB simplifies high-yield savings with a straightforward tier system. Deposit S$150,000 and credit S$1,600 monthly to earn the maximum 3.30%. Unlike OCBC’s complex categories, this single-tier approach appeals to savers preferring predictability.

Early withdrawals don’t incur penalties, but the rate resets if minimums aren’t met. This makes it suitable for those with stable cash flow.

GXS Boost Pocket: Digital Banking at 2.28% p.a.

This mobile-only option offers 2.28% for a 3-month lock-up period, beating many traditional accounts. The S$60,000 cap makes it ideal for emergency funds rather than large deposits.

Digital banks like GXS often provide higher interest rates than conventional options. However, MariBank’s upcoming rate reduction to 1.88% shows the volatility of digital yields.

Alternative options worth considering:

- Standard Chartered’s 8.05% when bundled with insurance

- HSBC EGA’s tiered rates requiring fresh funds

- Trust Bank’s accessible features for new savers

“Digital accounts shine for smaller balances, while traditional banks offer stability for larger deposits above S$60,000.”

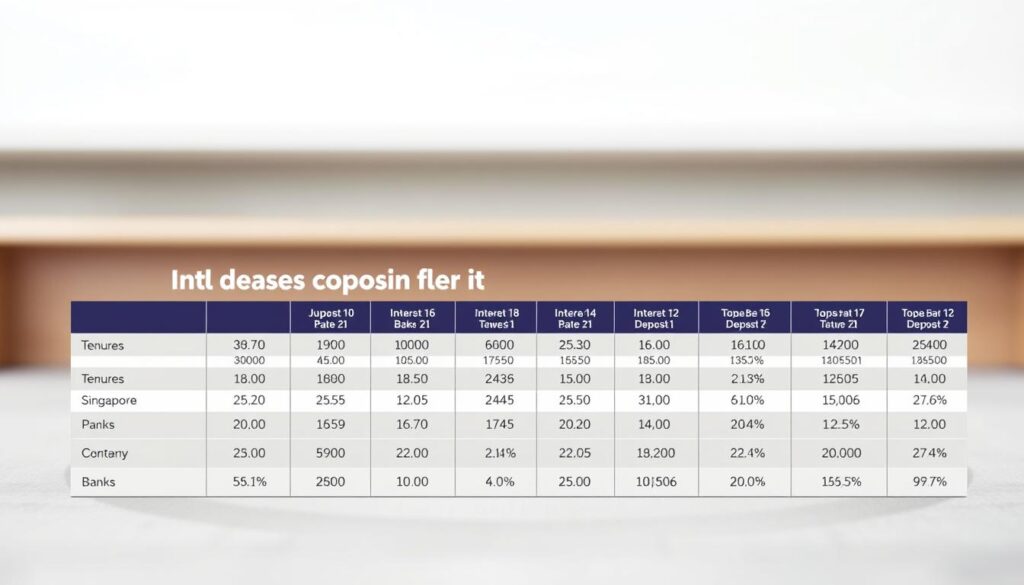

How to Choose the Right Tenure for Fixed Deposits

Selecting the ideal timeframe for your savings can significantly impact your returns. Shorter tenures offer flexibility, while longer terms often provide higher fixed deposit interest earnings. Your choice should balance accessibility needs with growth potential.

Current yield curves show notable differences between 6-month and 12-month options:

| Tenure | Average Rate | Best Offer | Liquidity |

|---|---|---|---|

| 6 months | 2.25% | 2.35% (SBI) | High |

| 12 months | 2.40% | 2.45% (DBS) | Medium |

Financial planners recommend a laddering strategy for uncertain rate environments. Divide your savings across multiple tenures to benefit from rising interest rates while maintaining access to portions of your funds.

Match deposit periods with specific goals. Use 3-month terms for emergency funds and 12-month options for planned expenses. The MAS projects gradual rate increases through 2026, favoring longer tenures.

Federal Reserve decisions affect SGD fixed deposit interest levels. When USD rates rise, local banks often follow suit within 3-6 months. Time your longer tenures accordingly.

“Automatic renewals frequently default to lower standard rates. Always mark renewal dates and negotiate better terms.”

Senior savers gain extra advantages. DBS Premier offers a 0.1% bonus for customers aged 55+, making longer tenures more attractive for retirement funds.

Remember that early withdrawals cancel earned interest rates. Choose tenures that align with your cash flow needs to avoid penalties.

Minimum Deposit Requirements Compared

Entry requirements for savings products vary widely across Singaporean financial institutions. While digital platforms accept deposits as low as S$500, premium tiers demand larger commitments for better returns.

Basic accounts help new savers start small. Bank of China and Hong Leong Finance both offer minimum deposit options at S$500. Digital banks like Trust Bank often waive opening fees entirely.

| Institution | Entry-Level | Premium Tier | Rate Difference |

|---|---|---|---|

| Citibank | S$1,000 | S$50,000 (2.15 p.a.) | +0.40% |

| Maybank | S$500 | S$22,000 | +0.35% |

| DBS | S$1,000 | S$30,000 | +0.25% |

Higher deposit amounts typically unlock bonus rates. Maybank’s S$22,000 tier offers 0.35% more than its basic account, though it carries a S$10 setup fee.

Foreign currency options have different floors. USD fixed deposits often start at S$5,000 equivalent, while corporate accounts require S$25,000 minimums at most banks.

“Small savers should prioritize accessibility, while larger depositors can negotiate better terms above S$50,000.”

Digital platforms continue lowering barriers. GXS Bank accepts deposits from S$1 without paperwork, though their deposit amount limits cap potential earnings.

Promotional Rates vs. Standard Rates

Temporary deals can boost your earnings, but knowing the difference between promotional rates and standard terms is key. CIMB’s June offer illustrates this gap perfectly—2.15% for new deposits versus their 0.35% regular yield.

UOB follows a similar pattern with a limited-time 2% return that drops to 1.5% afterward. These short-term spikes help institutions attract personal banking clients while maintaining lower long-term costs.

Watch for these common promotion structures:

- Lock-in periods that prevent withdrawals during the high-rate phase

- New customer exclusives unavailable to existing banking customers

- Minimum deposit requirements that exceed standard account thresholds

Some institutions offer rate match guarantees if you find better terms elsewhere. Always check the fine print—many require written proof and apply only to identical products.

“Promotions with ‘fresh funds’ clauses often exclude balance transfers from your existing accounts. True comparisons require evaluating net gains after all conditions.”

Digital platforms frequently use promotional rates for customer acquisition. Their standard yields typically settle 0.5-1% below introductory offers. Traditional banks reserve their best deals for personal banking clients with multiple products.

Seasoned savers track promotion cycles. Most institutions launch campaigns quarterly, with June and December featuring the most aggressive terms for banking customers.

Eligibility and Documentation Needed

Opening a fixed deposit account requires meeting specific eligibility criteria. Most institutions ask for basic documents like your NRIC and proof of address. Foreign nationals often need additional paperwork, such as employment pass copies.

Digital onboarding simplifies the process. Many banks accept e-copies of documents for online applications. In-person branch visits may still be required for larger deposits or corporate accounts.

Key Requirements by Account Type

| Account Type | Documents Needed | Special Notes |

|---|---|---|

| Personal | NRIC, proof of address | Some banks accept utility bills |

| Corporate | ACRA BizFile, director IDs | Hong Leong Finance requires board resolution |

| Trust | Trust deed, beneficiary IDs | Notary certification may apply |

Senior citizens enjoy privileges like higher rates or waived fees. For example, some finance fixed deposit plans offer 0.1% bonuses for customers aged 55+.

Non-residents face stricter rules. Many banks require minimum deposits of S$50,000 and additional identity verification. Always check if your visa type qualifies.

“Digital applications save time, but complex cases—like trust accounts—often need branch visits for compliance checks.”

To compare fixed deposit options, gather your documents in advance. This ensures quick approval and lets you lock in the best terms.

Early Withdrawal Penalties to Watch For

Breaking a fixed deposit agreement triggers financial consequences that vary by institution. While emergencies happen, understanding these costs helps avoid surprises that could slash your earnings.

| Bank | Penalty Type | Effective Loss |

|---|---|---|

| DBS | Full interest rate forfeiture + S$50 fee | Up to 100% of earned interest |

| SBI | Pro-rated board deposit rate application | 30-50% of projected earnings |

Calculate your potential loss before making an early withdrawal. A S$10,000 deposit at 2.45% would lose S$245 in interest with DBS, while SBI might deduct S$73.50.

For urgent needs, consider alternatives:

- Partial withdrawals (available at UOB and OCBC for 50% of balance)

- Overdraft facilities against your deposit

- Personal loans with lower effective costs

Death or medical emergencies often qualify for penalty waivers. Bring official documentation like medical certificates or death notices to your branch. Some institutions process these requests within 48 hours.

“Always compare the penalty cost against your emergency need—sometimes borrowing at 4% beats losing 100% of your interest.”

Disputes go through each bank’s customer service escalation path. The Financial Industry Disputes Resolution Centre handles unresolved cases, typically within 60 days.

Digital Banks vs. Traditional Banks

The rise of digital platforms has reshaped how Singaporeans manage their money. While traditional institutions offer stability, app-based services provide higher interest and innovative features. This comparison helps you choose the right fit for your singapore fixed deposit needs.

Current via e-banking options outperform branch rates significantly. GXS offers 2.28% for three-month deposits, while MariBank trails at 1.88%. Even established players like DBS provide better terms digitally—their 12-month FD yields 2.45% via e-banking versus 2.3% at branches.

Key differences to consider:

- Accessibility: Digital platforms operate 24/7 with instant approvals, while branches offer face-to-face advisory services

- Transaction limits: App transfers often cap at S$50,000 daily, whereas branches handle larger amounts

- Security: Both use MAS-approved measures, but traditional banks provide physical verification for suspicious activities

Niche products vary too. Digital-only banks feature micro-investment tools, while traditional institutions offer premium wealth management. Customer service response times average 2 hours for apps versus 15 minutes at premier banking lounges.

“Digital excels for convenience, but complex needs may still require branch expertise—especially for corporate accounts or trust setups.”

For most personal savings, via e-banking options deliver better returns with lower minimums. Always verify SDIC coverage and read app permissions before committing.

How Interest Rates Are Calculated

The math behind your money’s growth involves several key factors worth knowing. Financial institutions use benchmarks like SIBOR or SORA to set deposit rates, adjusting them based on market conditions. These rates directly impact what you earn on savings or fixed deposit interest plans.

Simple vs. Compound Interest

Simple interest pays a flat percentage on your initial deposit. For example, S$10,000 at 2% earns S$200 yearly. Compound interest reinvests earnings, growing your balance faster. The same deposit compounding monthly would yield S$202.40 annually.

| Type | Calculation | 1-Year Earnings (S$10k) |

|---|---|---|

| Simple | Principal × Rate | S$200 |

| Compound (Monthly) | Principal × (1 + Rate/12)12 | S$202.40 |

Other Key Factors

- Tax: Interest income is tax-free for individuals in Singapore.

- Inflation: A 2% return with 1.5% inflation means a 0.5% real gain.

- Bonus periods: Some accounts pay higher interest rates for 3–6 months before reverting to standard yields.

“Always ask whether quoted rates are gross or effective—the latter accounts for compounding and fees.”

Digital tools like bank apps often show projections. Input your deposit and tenure to compare deposit rates across products. This helps maximize earnings without complex math.

Singapore Deposit Insurance: What’s Covered?

Your deposits deserve protection, and Singapore’s insurance scheme delivers peace of mind. The deposit insurance corporation (SDIC) safeguards up to S$100,000 per depositor per institution. This applies to savings, fixed deposits, and current accounts.

Not all products qualify, though. Structured deposits, investment-linked plans, and offshore accounts are excluded. Always verify coverage before committing funds.

Key protections include:

- Joint accounts: Each holder gets S$100k coverage, doubling protection for couples.

- Foreign currencies: SGD equivalents are insured, but exchange rate fluctuations affect payouts.

- Fast claims: Payouts begin within 3 months if a bank fails.

Compared to ASEAN neighbors, Singapore’s singapore deposit insurance limits are higher. Malaysia caps at RM250k (≈S$72k), while Thailand covers ฿1 million (≈S$37k).

“SDIC coverage resets per institution—spreading funds across banks maximizes protection.”

For businesses, corporate accounts share the same S$100k limit. Larger enterprises often use multiple banks or specialized instruments beyond standard deposit insurance corporation protections.

Alternative Options Beyond Fixed Deposits

Exploring diverse savings instruments can boost your financial growth beyond traditional methods. While fixed deposits offer stability, other vehicles provide better liquidity or higher interest rates. Understanding these alternatives helps build a balanced portfolio.

Singapore Savings Bonds (SSBs)

These government-backed securities offer flexible tenures from 1-10 years. June 2025 issues yield 2.6% on average, slightly above most fixed deposit options. Unlike bank products, SSBs allow penalty-free redemptions every month.

Effective strategies include:

- Laddering: Spread investments across multiple issue dates

- Reinvesting matured bonds in higher-yield new issues

- Using SSBs for medium-term goals (3-5 years)

| Feature | SSBs | Fixed Deposits |

|---|---|---|

| Minimum Investment | S$500 | S$1,000+ |

| Early Withdrawal | No penalty | Full interest loss |

| June 2025 Rate | 2.6% | 2.45% (max) |

High-Yield Savings Accounts

For daily access to funds, these accounts outperform standard options. UOB Stash offers 3.3% for balances up to S$75,000, while OCBC 360 requires multiple banking activities. Both beat the 1.8% average for basic savings products.

Other alternatives worth considering:

- T-bills (6-month tenor at 3.1%)

- Robo-advisor cash management accounts (2.8-3.5%)

- Corporate bonds (higher risk, 4-6% yields)

“SSBs work best as the core of a conservative portfolio, while high-yield accounts suit emergency funds. Always match the instrument to your timeline.”

Insurance savings plans and peer-to-peer lending carry higher risks but may complement traditional savings. Compare all fees and lock-in periods before committing.

Tips to Maximize Your Interest Earnings

Smart savers know small tweaks can significantly boost returns on deposits. Whether you’re starting with a minimum deposit 10,000 or larger sums, optimization strategies help squeeze extra value from every dollar.

Salary crediting unlocks bonus rates at most institutions. Arrange for your employer to direct ≥S$1,600 monthly to qualifying accounts like OCBC 360 or UOB One. This simple move alone can triple your base earnings.

Look for deposit bundle promotions that reward multiple behaviors. Many banks offer stacking bonuses for:

- Maintaining minimum balances

- Using linked credit cards

- Purchasing insurance products

Personal banking customers often get preferential treatment. Relationship managers can waive fees or secure better terms for clients holding multiple products. Always ask about loyalty perks when your combined balances exceed S$50,000.

High-net-worth individuals have negotiation power. Deposits above S$200,000 frequently qualify for custom rates—sometimes 0.25% above published offers. Bring competing quotes to your bank meeting for leverage.

| Strategy | Potential Gain | Effort Required |

|---|---|---|

| Salary crediting | +1.5% | Low |

| Card spending | +0.8% | Medium |

| Deposit bundle promotion | +2.1% | High |

Track promotion cycles like a hawk. Banks frequently launch specials at quarter-ends (March/June/September/December). Mark your calendar for these peak periods when even minimum deposit 10,000 accounts get temporary rate bumps.

“Referral bonuses add quick wins—many apps pay S$20-50 for successful signups. Combine these with other earnings boosters for compound growth.”

Diversify across institutions to maximize SDIC coverage and access different perks. Allocate funds between digital platforms for higher base rates and traditional banks for relationship benefits.

Conclusion

Growing your money wisely starts with choosing the right tools for your goals. For stability, DBS’s fixed deposit at 2.45% stands out, while OCBC 360 suits those needing liquidity with bonus earnings.

Act now to secure current deposit rates before Q3 adjustments. Gather your NRIC, proof of address, and minimum funds (S$1,000+ for most plans). Digital applications save time—submit documents early.

Markets may see slight rate hikes later this year. Revisit your strategy annually to adapt. Small steps today lead to bigger rewards tomorrow.