Best Hospital in Singapore: Expert Care and Facilities

Singapore is renowned for its world-class healthcare system. In 2000, the World Health Organization ranked it 6th globally, reflecting its commitment to excellence. By 2014, Bloomberg named it the most efficient healthcare system worldwide. The country also ranks as the 4th healthiest globally, making it a trusted destination for medical needs.

Many top facilities here hold Joint Commission International (JCI) accreditation, ensuring high standards of care. Singapore’s blood bank system is also recognized as one of the safest globally. Patients benefit from advanced treatments and technologies, often at a fraction of the cost compared to the US or Europe.

Leading institutions like Mount Elizabeth, Gleneagles, and Singapore General Hospital offer specialized services. These facilities combine expertise, cutting-edge technology, and compassionate care to meet diverse patient needs.

Key Takeaways

- Singapore ranks 6th globally for healthcare by WHO.

- Bloomberg named it the most efficient healthcare system in 2014.

- Top facilities hold JCI accreditation for quality assurance.

- The country has one of the safest blood bank systems worldwide.

- Cost-effective treatments compared to the US and Europe.

- Leading institutions include Mount Elizabeth and Gleneagles.

Introduction to Singapore’s Healthcare System

Singapore’s healthcare system stands out as a model of efficiency and innovation. The country combines a dual public-private system, ensuring accessibility and affordability for all. Government subsidies play a key role in making medical services accessible to residents while maintaining high standards.

Overview of Singapore’s Healthcare Excellence

Singapore’s Ministry of Health regulates both public and private hospitals, ensuring consistent quality. The unique financing model has earned recognition from global organizations like Towers Watson. This approach focuses on community health outcomes and cost-effective care.

Facilities like Mount Elizabeth Novena showcase the country’s commitment to innovation. With 333 beds and hybrid operating theaters, it offers advanced surgical solutions. Similarly, Thomson Medical specializes in IVF treatments, providing hope to families worldwide.

Why Singapore is a Global Leader in Medical Tourism

Before the pandemic, Singapore welcomed 1.3 million medical tourists annually. The world-class facilities and expertise attract patients seeking specialized care. Parkway East Hospital, for example, offers 24/7 emergency services, ensuring round-the-clock support.

Farrer Park Hospital takes a unique approach with its integrated medical-hotel complex. This setup combines comfort with cutting-edge treatments, making it a preferred choice for international patients. Singapore’s healthcare system continues to set benchmarks globally, blending quality, innovation, and patient-centric care.

What Makes a Hospital the Best in Singapore?

When evaluating top-tier healthcare facilities, certain factors set them apart. These include advanced technology, highly skilled doctors, and a focus on patient-centered medical care. Understanding these elements helps identify institutions that truly excel.

Key Factors to Consider

Capacity and specialties play a significant role in defining a facility’s capabilities. For instance, Mount Elizabeth offers 345 beds, while Tan Tock Seng boasts 1,700 beds, catering to different patient volumes. Institutions like Gleneagles are known for their transplant units, showcasing their specialties.

Technological advancements also matter. Raffles Hospital, for example, is a leader in robotic surgery, ensuring precision and faster recovery. Neonatal Intensive Care Units (NICUs) across public and private institutions adhere to high standards, providing critical care for newborns.

Accreditations and Recognitions

Accreditations like Joint Commission International (JCI) ensure adherence to strict infection control and surgical safety protocols. Singapore General Hospital (SGH) ranks 9th globally in Newsweek’s 2023 list, reflecting its commitment to quality.

National University Hospital (NUH) holds the 96th global position, supported by its academic research partnerships. Additionally, 80% of specialists in these facilities hold international fellowships, further solidifying their expertise.

Top Hospitals in Singapore: A Comprehensive Roundup

Singapore’s healthcare landscape is defined by its exceptional institutions. These facilities combine advanced technology, skilled professionals, and patient-centered care to deliver outstanding outcomes. Below, we explore some of the leading medical centers that set the standard for excellence.

Mount Elizabeth Hospital

Mount Elizabeth Hospital is renowned for its luxurious amenities and specialized care. The Royal Suite offers patients a comfortable and private environment, complete with personalized services. With a focus on cardiology, oncology, and orthopedics, this facility attracts patients seeking advanced treatments.

Gleneagles Hospital

Gleneagles Hospital stands out for its 270-bed capacity and VIP interpretation services. Its 16-bed ICU ensures critical care for patients, while air evacuation services cater to international clients. Known for its transplant units, Gleneagles is a leader in complex medical procedures.

National University Hospital

The National University Hospital (NUH) excels in pediatric care, particularly its bone marrow transplant program. As a teaching hospital, NUH integrates academic research with clinical practice, ensuring cutting-edge treatments for patients of all ages.

Singapore General Hospital

Singapore General Hospital (SGH) is a pioneer in cancer treatment, offering proton therapy at its dedicated center. With 40 clinical specialties and 9 operating theaters, SGH provides comprehensive care for a wide range of medical conditions.

Tan Tock Seng Hospital

Tan Tock Seng Hospital (TTSH) is a leader in infectious disease management, especially post-COVID. Handling 100 daily trauma cases, TTSH also specializes in robotic rehabilitation, ensuring patients regain mobility and independence.

| Hospital | Specialties | Unique Features |

|---|---|---|

| Mount Elizabeth Hospital | Cardiology, Oncology, Orthopedics | Royal Suite amenities |

| Gleneagles Hospital | Transplant Units, Critical Care | 16-bed ICU, Air evacuation |

| National University Hospital | Pediatrics, Bone Marrow Transplants | Academic research integration |

| Singapore General Hospital | Cancer Treatment, Proton Therapy | 40 clinical specialties |

| Tan Tock Seng Hospital | Infectious Diseases, Trauma Care | Robotic rehabilitation |

Advanced Medical Services Offered

Singapore’s healthcare facilities are equipped with cutting-edge technology and specialized services. These institutions combine innovation with expertise to deliver exceptional patient outcomes. From advanced surgical procedures to state-of-the-art diagnostic tools, they set the standard for modern healthcare.

Specialized Treatments and Surgeries

Mount Elizabeth Novena stands out with its neurological operating room featuring intraoperative MRI. This technology allows surgeons to perform precise brain surgeries with real-time imaging. Farrer Park Hospital offers a nuclear medicine suite and radiation oncology, providing comprehensive cancer treatment options.

Khoo Teck Puat Hospital is another leader with its 795-bed smart hospital design. The facility integrates technology to enhance patient care and operational efficiency. These advancements ensure that patients receive the most effective and timely treatments available.

State-of-the-Art Facilities

Parkway East Hospital is recognized for its BFHI-certified maternity wards, ensuring the highest standards for maternal and newborn care. National University Hospital (NUH) uses 3D-printed orthopedic implants, offering customized solutions for complex cases.

Changi General Hospital’s JCI-accredited stroke unit provides rapid and effective care for stroke patients. Raffles Hospital leverages AI-powered diagnostics to improve accuracy and speed in identifying medical conditions. These facilities exemplify Singapore’s commitment to innovation in healthcare.

| Facility | Specialized Service | Unique Feature |

|---|---|---|

| Mount Elizabeth Novena | Neurological Surgery | Intraoperative MRI |

| Farrer Park Hospital | Cancer Treatment | Nuclear Medicine Suite |

| Khoo Teck Puat Hospital | Smart Hospital Design | 795 Beds |

| Parkway East Hospital | Maternity Care | BFHI Certification |

| National University Hospital | Orthopedic Implants | 3D Printing Technology |

| Changi General Hospital | Stroke Care | JCI Accreditation |

| Raffles Hospital | Diagnostics | AI-Powered Tools |

Patient Care and Services

Singapore’s healthcare system prioritizes patient care and tailored services for all. From locals to international visitors, every individual receives personalized attention and support. This commitment to excellence ensures a seamless experience from consultation to recovery.

Exceptional Patient Experience

Facilities like Mount Elizabeth and Gleneagles focus on creating a comfortable environment for patients. Mount Elizabeth’s MPAC program offers 12-language support, ensuring clear communication for foreigners. Gleneagles provides visa assistance and a medical concierge to simplify the process for international visitors.

Post-surgery care is equally prioritized. Thomson Medical designs customized nutrition plans to aid recovery. Airport pickup services are available for medical tourists, making their journey hassle-free. These amenities reflect Singapore’s dedication to a holistic patient care approach.

International Patient Services

Singapore’s healthcare facilities cater to the unique needs of foreigners. Private suites offer luxurious amenities, while subsidized wards ensure affordability without compromising quality. Insurance direct billing options are available, reducing financial stress for international patients.

Specialized packages, such as fertility treatments, often include accommodation for convenience. Facilities also provide Ramadan-friendly meal services, respecting cultural preferences. These thoughtful touches make Singapore a preferred destination for medical tourism.

- Mount Elizabeth’s MPAC program offers 12-language support.

- Gleneagles provides visa assistance and medical concierge services.

- Thomson Medical designs post-surgery nutrition plans.

- Airport pickup services are available for medical tourists.

- Private suites and subsidized wards cater to diverse needs.

- Insurance direct billing simplifies financial transactions.

- Fertility treatment packages include accommodation.

- Ramadan-friendly meal services are offered.

Cost of Medical Treatment in Singapore

Understanding the cost of medical treatment in Singapore helps patients make informed decisions. The sector offers a mix of public and private options, each with its own pricing structure. Whether you’re a local or an international visitor, knowing what to expect financially can ease the process.

Comparing Public and Private Hospitals

Public institutions like Singapore General Hospital (SGH) provide subsidized care, covering up to 80% of costs for citizens. For example, a coronary bypass at a public facility costs around $25,000, compared to $45,000 at a private one. This makes public hospitals a more affordable choice for many.

Private facilities, such as Parkway East, offer luxurious amenities but come with higher price tags. Bed shortages in the private sector have led to a 15% surge in costs. However, these institutions often provide faster access to specialized professionals and advanced treatments.

Factors Affecting Treatment Costs

Several elements influence the cost of medical care. The reputation of the surgeon, for instance, can significantly impact pricing. Highly experienced professionals often charge more for their expertise.

Medication importation also plays a role. Imported drugs can drive up expenses, especially for specialized treatments. Additionally, COVID-related PPE surcharges have added to the overall cost of care in recent years.

Insurance options like MediSave and MediShield further affect affordability. While MediSave covers basic needs, MediShield offers broader protection, reducing out-of-pocket expenses for patients.

| Facility Type | Average Cost (Coronary Bypass) | Key Features |

|---|---|---|

| Public Hospital | $25,000 | Subsidized care, longer wait times |

| Private Hospital | $45,000 | Luxury amenities, faster access |

Why Choose Singapore for Medical Treatment?

Singapore has become a global hub for medical excellence, attracting patients from around the world. The country’s commitment to quality and innovation ensures that every patient receives exceptional care. Whether you’re seeking specialized treatments or routine procedures, Singapore’s healthcare system delivers outstanding results.

Quality of Care and Expertise

Singapore’s medical professionals are among the most skilled globally. Around 40% of specialists have trained at prestigious institutions like Johns Hopkins and Mayo Clinic. This expertise translates into a 98% success rate for cardiac procedures, making Singapore a trusted destination for complex treatments.

Facilities here are equipped with cutting-edge technology, ensuring precision and efficiency. From robotic surgeries to advanced diagnostics, patients benefit from the latest innovations. The integration of academic research with clinical practice further enhances the quality of care provided.

Accessibility and Convenience

Singapore’s healthcare system is designed for ease and efficiency. Private hospitals offer same-day appointments, reducing wait times significantly. Multi-lingual staff across JCI-accredited facilities ensure clear communication for international patients.

Changi Airport’s medical escort clearance protocol simplifies travel for those requiring immediate care. Post-treatment, patients can extend their tourist visas, allowing time for recovery or exploration. Additionally, 24-hour pharmacy services near hospital clusters provide round-the-clock support.

| Feature | Details |

|---|---|

| Specialist Training | 40% trained at Johns Hopkins/Mayo Clinic |

| Cardiac Success Rate | 98% treatment success rate |

| Appointment Wait Times | 2 days (private) vs 14 days (public) |

| Pharmacy Services | 24-hour availability near hospitals |

| Travel Convenience | Medical escort clearance at Changi Airport |

For those considering parathyroid surgery, Singapore offers expert care and proven outcomes. This ensures patients receive the highest standard of treatment tailored to their needs.

Conclusion

The balance between public and private healthcare in Singapore ensures accessibility and quality for all. This unique system offers a cost-quality ratio that rivals Western counterparts, making it a preferred destination for medical needs.

Before seeking treatment, consider insurance pre-authorization to streamline the process. Emerging telemedicine options also provide convenient follow-up care, ensuring continuity even after leaving the country.

For international patients, the NHG hotline is a valuable resource for inquiries. Whether you’re exploring a list of facilities or seeking specialized service, Singapore’s healthcare system delivers excellence at every step. Discover more about the top hospitals in Singapore to make an informed choice.

FAQ

What sets Singapore’s healthcare system apart?

Singapore’s healthcare system is known for its high standards, advanced technology, and skilled medical professionals. It’s a global leader in medical tourism due to its quality care and state-of-the-art facilities.

How do I choose the right medical facility in Singapore?

Consider factors like accreditations, specialties, and patient reviews. Institutions like Mount Elizabeth Hospital and National University Hospital are renowned for their expertise and advanced treatments.

What specialized treatments are available in Singapore?

Facilities like Gleneagles Hospital and Tan Tock Seng Hospital offer a wide range of services, including cardiology, oncology, and orthopedics, using cutting-edge technology.

Are there services for international patients?

Yes, many institutions, such as Singapore General Hospital, provide dedicated support for foreigners, including language assistance and personalized care plans.

How does the cost of treatment compare between public and private facilities?

Public hospitals like Changi General Hospital are more affordable, while private ones like Raffles Hospital offer premium services at higher costs. The choice depends on your budget and needs.

Why is Singapore a preferred destination for medical care?

The country combines world-class expertise, accessibility, and a patient-centered approach, making it a top choice for quality healthcare.

Best Home Loan Singapore: Top Picks & Reviews

Finding the right financial solution for your property needs can be challenging. With over 16 banks offering diverse packages, the market is highly competitive. It’s essential to compare options like fixed vs floating rates, lock-in periods, and TDSR/MSR requirements to make an informed decision.

Leading banks such as DBS, OCBC, UOB, and others provide attractive rates and flexible terms. Platforms like MoneySmart simplify the process by offering free comparison services and access to mortgage specialists. Real customer testimonials highlight the positive experiences many have had with expert loan advisors.

Understanding the differences between HDB loans and bank loans is crucial. While HDB loans offer a fixed rate of 2.6%, bank loans typically range from 3.7% to 5.5% with variable rates. Additionally, the upcoming SORA transition replacing SIBOR/SOR by 2024 will significantly impact the market.

Key Takeaways

- Compare fixed and floating rates to find the most suitable option.

- Check lock-in periods and TDSR/MSR requirements before committing.

- Leading banks like DBS, OCBC, and UOB offer competitive packages.

- Use free comparison services to simplify your decision-making process.

- Understand the differences between HDB loans and bank loans.

- Prepare for the SORA transition set to replace SIBOR/SOR by 2024.

Introduction to Home Loans in Singapore

Navigating the housing market requires careful financial planning. Whether you’re eyeing an HDB flat or a private property, understanding your options is crucial. The right financial plan can help you secure your dream property while saving money in the long run.

Why Choosing the Right Financial Option Matters

Selecting the right financial solution can significantly impact your budget and lifestyle. With rising property prices, making an informed decision is more important than ever. A well-chosen plan can offer stability and flexibility, ensuring you’re prepared for future changes in the market.

Overview of the Singapore Housing Market

The Singapore housing market is diverse, catering to different needs and budgets. In 2023, HDB resale prices increased by 10.4%, reflecting strong demand. On the other hand, private condo transactions saw a 15% drop in Q1 2024, indicating shifting trends.

Here are some key insights:

- 78% of Singaporeans live in HDB flats, making them a popular choice.

- Executive Condominium (EC) eligibility requires a household income ceiling of $16,000.

- BTO application success rates stand at 23% for mature estates.

- Cooling measures include a 35% Additional Buyer’s Stamp Duty (ABSD) for foreign buyers.

- URA Q2 2024 data shows a median price of $1,850 psf for OCR condos.

Whether you’re considering an HDB flat or private property, staying informed about market trends is essential. This knowledge will help you make a decision that aligns with your financial goals.

Understanding Home Loan Basics

Understanding the basics of financing is essential for making informed decisions. Whether you’re planning to purchase a property or refinance, knowing the core concepts can save you time and money. Let’s break down the essentials to help you navigate with confidence.

What is a Financial Solution?

A financial solution is a structured plan designed to help you achieve your property goals. It typically involves borrowing funds with specific terms, such as the interest rate and lock-in period. These terms determine how much you’ll pay over time and how flexible your plan is.

Key Terms You Need to Know

Here are some important terms to understand:

- Interest Rate: The cost of borrowing, which can be fixed or floating.

- Lock-in Period: A timeframe during which you cannot refinance or repay without penalties.

- Partial Repayment: Allows you to pay off a portion of your loan early, typically 20-50%.

- Conversion Fees: Charges for switching between fixed and floating rates, ranging from $300-$800.

- Legal Subsidies: Up to $2,500 available for refinancing to reduce costs.

“The shift from SIBOR to SORA marks a significant change in how rates are calculated, offering more transparency and stability.”

| Feature | SIBOR | SORA |

|---|---|---|

| Adjustment Frequency | Quarterly | Daily |

| Current Rate (July 2024) | N/A | 3.45% |

| Transparency | Limited | High |

Understanding these terms and trends will help you make smarter financial decisions. For example, the current SORA rate of 3.45% is more stable compared to older benchmarks. Additionally, fixed deposit rates of 2.8-3.2% can influence your choice between fixed and floating rates.

Types of Home Loans in Singapore

Exploring the different financing options available can help you make a smarter decision. Whether you’re buying an HDB flat or a private property, understanding the types of plans is essential. Each option comes with its own benefits and considerations, so it’s important to choose wisely.

HDB Options vs. Bank Plans

HDB plans are designed specifically for public housing and offer a fixed rate of 2.6%. They are ideal for first-time buyers and those with lower budgets. On the other hand, bank plans provide more flexibility, with rates ranging from 3.7% to 5.5%. These are better suited for private properties or those seeking competitive terms.

Fixed Rate vs. Floating Rate Plans

When choosing a plan, you’ll need to decide between a fixed rate and floating rates. Fixed rates offer stability, with 2024 rates ranging from 2.45% to 3.15%. Floating rates, tied to SORA, typically add a spread of 0.5% to 1.2%. While fixed rates provide predictability, floating rates can be more flexible in a changing market.

Here’s a quick comparison of the two:

| Feature | Fixed Rate | Floating Rates |

|---|---|---|

| Stability | High | Variable |

| 2024 Rates | 2.45-3.15% | SORA +0.5-1.2% |

| Early Repayment Penalties | Common | Rare |

Historical data shows that fixed rates have been less volatile compared to floating rates. However, floating rates can be advantageous during periods of declining interest rates. Hybrid packages, which combine both fixed and floating elements, are also gaining popularity for their balanced approach.

Ultimately, the choice depends on your financial goals and risk tolerance. Consulting a specialist can help you navigate these options and find the best fit for your needs.

Best Home Loan Singapore: Top Picks

Comparing various financing options is key to finding the most suitable plan. With multiple banks offering competitive terms, it’s essential to evaluate your choices carefully. This section highlights top picks and provides insights into what makes them stand out.

Top Banks Offering Competitive Rates

Leading banks like DBS, OCBC, and UOB are known for their attractive loan rates. These institutions provide flexible terms and legal subsidies ranging from $1,800 to $2,800. Additionally, their digital application processes are efficient, with timelines as short as 5-7 working days.

Customer service ratings by SingSaver show that these banks consistently score high. Their green loan discounts for eco-friendly homes are another standout feature, offering savings of up to 0.2% on interest rates.

Comparing Loan Packages

When evaluating loan packages, consider factors like hidden fees and total costs. Conversion and valuation fees can add up, so it’s important to account for them. A 5-year total cost simulation can help you understand the long-term impact of your choice.

Here’s a quick breakdown of what to look for:

- Minimum loans ranging from $200k to $1M.

- Hidden fees like conversion and valuation charges.

- Customer service ratings and digital application timelines.

- Green loan discounts for sustainable properties.

By comparing these features, you can identify the plan that best fits your needs. Whether you prioritize low loan rates or flexible terms, understanding the details ensures a smarter decision.

HDB Home Loans: What You Need to Know

Securing the right financing for your HDB flat involves understanding specific options and requirements. Whether you’re a first-time buyer or looking to upgrade, knowing the details can save you time and money. This section breaks down the essentials to help you make an informed decision.

Eligibility Criteria for HDB Loans

To qualify for an HDB loan, you must meet certain conditions. First, your household income must not exceed $14,000 for families or $21,000 for extended families. Additionally, at least one applicant must be a Singapore citizen. You’ll also need to meet the Minimum Occupation Period (MOP) if you’re upgrading from an existing flat.

Other requirements include:

- Using CPF savings for the down payment.

- Adhering to resale restrictions, which limit when you can sell your flat.

- Ensuring the flat’s lease covers at least 20 years beyond the loan tenure.

Pros and Cons of HDB Loans

HDB loans come with unique advantages and limitations. One major benefit is the stable interest rate of 2.6%, which hasn’t changed since 1999. There are also no lock-in periods, giving you flexibility if your financial situation changes.

However, there are some drawbacks to consider:

- Refinancing options are limited compared to bank loans.

- CPF usage is mandatory, which may affect your retirement savings.

- Resale restrictions can delay your ability to sell the property.

“HDB loans offer stability, but it’s important to weigh the long-term implications of CPF usage and resale restrictions.”

| Feature | Pros | Cons |

|---|---|---|

| Interest Rate | Stable at 2.6% | Higher than some bank rates |

| Lock-in Period | None | N/A |

| Refinancing | N/A | Limited options |

Understanding these pros and cons will help you decide if an HDB loan is the right choice for your needs. For example, if you value stability and don’t plan to refinance, this option might suit you. However, if flexibility is a priority, exploring bank loans could be beneficial.

Bank Home Loans: A Comprehensive Guide

Choosing the right financing option for your property can significantly impact your financial health. Bank loans are a popular choice for many due to their flexibility and competitive rates. This guide will help you understand the eligibility criteria, benefits, and potential drawbacks of these financial solutions.

Eligibility and Requirements

To qualify for a bank loan, you’ll need to meet specific criteria. Most banks require a stable income, a good credit score, and proof of financial stability. Additionally, the property you’re purchasing must meet certain valuation standards.

Here are some common requirements:

- Minimum income thresholds, often starting at $3,000 per month.

- A credit score of at least 1,800 for favorable terms.

- Documentation such as payslips, tax returns, and property valuation reports.

Pros and Cons of Bank Loans

Bank loans offer several advantages, including lower interest rates compared to other options. Current rates range from 3.15% to 4.25%, making them an attractive choice. Many banks also provide cashback offers of up to $3,000, adding to the appeal.

However, there are some potential drawbacks to consider:

- Fixed rates provide security but may limit savings during rate drops.

- Prepayment flexibility is common, but cross-collateralization can pose risks.

- Foreign currency loans and portfolio packages add complexity.

| Feature | Pros | Cons |

|---|---|---|

| Interest Rates | Lower than HDB loans | Variable for floating rates |

| Cashback Offers | Up to $3,000 | N/A |

| Flexibility | Prepayment options | Cross-collateralization risks |

Understanding these pros and cons will help you decide if a bank loan is the right fit for your needs. For example, if you value flexibility and lower rates, this option might be ideal. However, if you prefer stability, exploring fixed-rate plans could be beneficial.

Fixed Rate Home Loans: Stability and Predictability

Fixed-rate financial solutions provide a sense of security in an unpredictable market. These plans offer consistent payments, making budgeting easier and reducing the stress of fluctuating rates. If you value stability, this option might be the right fit for your needs.

How Fixed Rate Plans Work

With a fixed-rate plan, your interest rate remains unchanged for a set period, typically 2 to 5 years. This means your monthly payments stay the same, regardless of market changes. After the fixed period ends, the rate usually converts to a floating rate based on benchmarks like SORA.

This option is ideal for those who prefer predictability and want to avoid the risks of rising rates. It’s especially useful during periods of economic uncertainty when rates are volatile.

Top Fixed Rate Offers

Several banks offer competitive fixed-rate plans with attractive terms. Here are some of the top options:

- OCBC 3-Year Fixed: 2.48% interest rate with a $1,800 legal subsidy.

- HLF 2-Year Fixed: 2.55% interest rate and partial penalty waivers.

- BOC: Credit card bundling for additional savings.

- RHB: Progressive rate structure for long-term benefits.

| Bank | Fixed Rate | Special Features |

|---|---|---|

| OCBC | 2.48% | $1,800 legal subsidy |

| HLF | 2.55% | Partial penalty waivers |

| BOC | 2.60% | Credit card bundling |

| RHB | 2.50% | Progressive rate structure |

These offers provide a mix of low rates and additional benefits, making them some of the best home financing options available. Be sure to check promotional rate expiry dates to take full advantage of these deals.

Floating Rate Home Loans: Flexibility and Risk

Floating-rate financial solutions offer flexibility but come with their own set of risks. These plans are tied to benchmarks like the overnight rate average, making them adaptable to market changes. However, this adaptability also means your loan interest rate can fluctuate, impacting your monthly payments.

How Floating Rate Plans Work

Floating-rate plans adjust based on market conditions. For example, rates may be tied to the Singapore Overnight Rate Average (SORA), which updates daily. This means your loan interest rate can rise or fall, depending on economic trends. While this can lead to savings during periods of declining rates, it also introduces uncertainty.

Some banks offer additional features to mitigate risks. For instance, UOB provides rate conversion privileges, allowing you to switch to a fixed rate if needed. Citibank offers interest offset accounts, which can reduce your overall costs. These features add a layer of security to an otherwise variable plan.

Top Floating Rate Offers

Several banks stand out for their competitive floating-rate packages. Here are some of the top options:

- CIMB: SORA +0.45%, ideal for those seeking low spreads.

- Maybank: 1M SORA +0.25%, offering transparency and stability.

- HSBC: Expat-friendly terms, catering to international buyers.

- BUC-specific packages: Tailored for properties under construction.

These offers provide a mix of low spreads and unique features, making them attractive for those who value flexibility. Always check the board rate transparency scores to ensure you’re getting a fair deal.

SORA-Pegged Home Loans: The New Benchmark

The financial landscape is evolving, and SORA-pegged plans are leading the way. As the Singapore Overnight Rate Average (SORA) replaces older benchmarks, it’s essential to understand its impact on financial solutions. This shift offers greater transparency and stability, making it a preferred choice for many.

What is SORA?

SORA is a daily rate average based on actual transactions in the unsecured overnight interbank market. Unlike previous benchmarks, it reflects real market conditions, reducing the risk of manipulation. This makes it a reliable and transparent reference for financial plans.

Benefits of SORA-Pegged Loans

SORA-pegged plans come with several advantages. First, they offer daily compounding, which can lead to lower costs over time. Second, the Monetary Authority of Singapore (MAS) oversees SORA, ensuring fairness and stability. Finally, these plans are less susceptible to market manipulation, providing peace of mind for borrowers.

Here are some key benefits:

- Reduced manipulation risk due to transaction-based calculations.

- Daily compounding advantages for cost efficiency.

- MAS oversight ensures transparency and fairness.

- Lower conversion costs compared to older benchmarks.

“SORA’s transaction-based approach offers a level of transparency that older benchmarks simply couldn’t match.”

With 2023 volatility at just ±0.15%, SORA-pegged plans provide a stable foundation for financial planning. Whether you’re exploring loans Singapore or refinancing options, understanding SORA can help you make smarter decisions.

Home Loans for Private Properties

Private properties offer unique financing needs compared to public housing. Whether you’re eyeing a condo or a landed home, understanding your options ensures a smoother purchase process. Tailored financial solutions can help you secure your dream property while maximizing savings.

Loan Options for Condos and Landed Homes

Financing for private properties varies based on the type of property and your financial profile. Condos often come with flexible terms, while landed homes may require specialized plans. Banks like DBS and UOB offer competitive rates, such as DBS’s 2-year fixed rate at 2.45% and UOB’s SORA-pegged rate at +0.55%.

Here are some key features to consider:

- High-net-worth individual packages: Tailored for buyers with significant assets.

- Jumbo loan discounts: Savings on larger financing amounts.

- Developer tie-up promotions: Exclusive deals for new developments.

- Green financing incentives: Lower rates for eco-friendly properties.

- Refinancing cashback offers: Rebates for switching plans.

Best Loan Packages for Private Properties

When choosing a loan package, compare features like interest rates, lock-in periods, and additional benefits. For example, DBS’s fixed-rate plan provides stability, while UOB’s SORA-pegged option offers flexibility. These packages are ideal for buyers of a new home or those looking to upgrade.

Here’s a quick comparison:

| Bank | Interest Rate | Special Features |

|---|---|---|

| DBS | 2.45% (2Y Fixed) | Stable payments |

| UOB | SORA +0.55% | Flexible adjustments |

By evaluating these options, you can find a plan that aligns with your financial goals and property needs.

Home Loans for HDB Flats

Securing financing for your HDB flat requires careful consideration of available options. Whether you’re purchasing a BTO or resale flat, understanding the differences between HDB concessionary loans and bank loans is essential. This knowledge can help you make an informed decision that aligns with your financial goals.

Loan Options for BTO and Resale Flats

HDB concessionary loans are a popular choice for first-time buyers. These loans offer a stable interest rate of 2.6%, making them predictable and easy to budget for. Additionally, they require a lower down payment, which can be covered entirely using CPF savings.

On the other hand, bank loans provide more flexibility. With rates ranging from 3.7% to 5.5%, they can be tailored to your specific needs. Many banks also offer cashback promotions, adding extra value to your plan.

Here’s a quick comparison of the two options:

- HDB Concessionary Loan: Fixed rate of 2.6%, lower down payment, CPF usage mandatory.

- Bank Loan: Variable rates, cashback offers, higher down payment requirements.

Best Loan Packages for HDB Flats

When choosing a financing plan, it’s important to compare packages from different banks. For example, OCBC offers a 3-year fixed rate of 2.48%, providing stability and predictability. HLF’s board rate plan at 3.97% is another option, especially for those who prefer flexibility.

Here’s a breakdown of these packages:

| Bank | Interest Rate | Special Features |

|---|---|---|

| OCBC | 2.48% (3Y Fixed) | Legal subsidy of $1,800 |

| HLF | 3.97% (Board Rate) | Partial penalty waivers |

By evaluating these options, you can find a plan that suits your needs and ensures a smooth financing process.

Refinancing Your Home Loan: When and Why

Refinancing your property financing can unlock significant savings and flexibility. Whether you’re looking to lower your loan interest or adjust your repayment terms, understanding the process is essential. This section explores the benefits of refinancing and provides a step-by-step guide to help you make an informed decision.

Benefits of Refinancing

Refinancing offers several advantages that can improve your financial situation. One of the primary benefits is the potential to secure a lower loan interest rate, which can reduce your monthly payments. Additionally, refinancing allows you to adjust your loan tenure, giving you more control over your repayment schedule.

Legal fee subsidies of up to $2,500 can further reduce costs, making refinancing an attractive option. Valuation requirements are also streamlined, ensuring a smooth process. Here are some key benefits:

- Lower interest rates for reduced monthly payments.

- Flexibility to adjust loan tenure and repayment terms.

- Legal fee subsidies to minimize upfront costs.

- Simplified valuation requirements for faster processing.

How to Refinance Your Home Loan

Refinancing involves several steps, but with proper planning, it can be a straightforward process. Start by evaluating your current home loan terms and comparing them with available offers. This will help you identify potential savings and determine if refinancing is the right choice.

Here’s a step-by-step guide to refinancing:

- Assess your current loan terms and interest rates.

- Compare offers from different financial institutions.

- Check for lock-in periods and penalty fees.

- Gather required documentation, such as income proof and property valuation reports.

- Submit your application and manage the timeline effectively.

Negotiating penalty fees and understanding lock-in periods are crucial steps. Proper documentation ensures a smooth application process, while timeline management helps avoid delays.

| Step | Key Considerations |

|---|---|

| 1. Assess Current Loan | Interest rates, tenure, and repayment terms. |

| 2. Compare Offers | Look for lower rates and legal fee subsidies. |

| 3. Check Penalties | Negotiate penalty fees and understand lock-in periods. |

| 4. Gather Documents | Income proof, property valuation, and identification. |

| 5. Submit Application | Manage timeline to avoid delays. |

Total Debt Servicing Ratio (TDSR) Explained

Understanding your financial commitments is crucial when planning for property purchases. The Total Debt Servicing Ratio (TDSR) is a key metric used by financial institutions to assess your ability to manage debt. It ensures borrowers do not overextend themselves financially.

What is TDSR?

TDSR measures the percentage of your gross monthly income used to repay all debt obligations. These include property-related loans, car loans, credit card payments, and other secured or unsecured debts. The formula is simple:

(Total Monthly Debt Obligations / Gross Monthly Income) x 100%.

For example, if your monthly income is $10,000 and your total debt repayments are $4,000, your TDSR is 40%. Financial institutions typically require this ratio to be below 55% for loan eligibility.

How TDSR Affects Your Loan Eligibility

TDSR directly impacts your ability to secure financing. If your ratio exceeds 55%, lenders may reduce your loan amount or deny your application. This ensures borrowers can comfortably manage repayments without financial strain.

Here are some factors that influence TDSR:

- Debt Reduction Strategies: Paying off high-interest debts can lower your TDSR.

- Income Boosting Options: Increasing your income through side gigs or investments can improve your ratio.

- Co-borrower Advantages: Adding a co-borrower with a stable income can strengthen your application.

- Property Type Influences: Different property types may have varying loan requirements.

- Refinancing Implications: Refinancing existing loans at lower rates can reduce your monthly obligations.

For a detailed breakdown of how TDSR is calculated, refer to the MAS TDSR calculator. This tool helps you understand your financial position and plan accordingly.

Mortgage Servicing Ratio (MSR) Explained

Understanding how your income and financial obligations impact your property financing is essential. The Mortgage Servicing Ratio (MSR) is a key factor that determines how much you can borrow for an HDB flat or similar property. It ensures borrowers can manage their repayments without financial strain.

What is MSR?

MSR measures the percentage of your gross monthly income used to repay your property financing. For HDB flats, the MSR limit is 30%. This means your monthly repayment cannot exceed 30% of your income. For example, if your monthly income is $14,000, your maximum repayment would be $4,200.

CPF contributions are also considered in this calculation. The CPF Ordinary Account can be used to offset part of the repayment, reducing the cash portion you need to pay. This makes MSR a crucial factor in determining your loan eligibility.

How MSR Affects Your Loan Eligibility

MSR directly impacts your ability to secure financing for an HDB flat. If your MSR exceeds 30%, lenders may reduce your loan amount or deny your application. This ensures borrowers can comfortably manage repayments without overextending themselves.

Here are some key factors to consider:

- Downpayment Requirements: A higher downpayment can reduce your loan amount, lowering your MSR.

- Loan Tenure Restrictions: Shorter loan tenures increase monthly repayments, affecting your MSR.

- Household Income Calculations: Combining incomes with a co-borrower can improve your MSR.

- Appeals Process: In some cases, you can appeal for a higher MSR if you have strong financial stability.

- Future Policy Predictions: Stay updated on potential changes to MSR limits.

| Factor | Impact on MSR |

|---|---|

| Downpayment | Reduces loan amount |

| Loan Tenure | Affects monthly repayment |

| Household Income | Combined income improves MSR |

| Appeals | Possible exceptions for strong finances |

By understanding MSR and its implications, you can better plan your finances and secure the right hdb bank loan for your needs.

Tips for Choosing the Best Home Loan

Selecting the right financing option requires careful evaluation of multiple factors. From interest rates to repayment flexibility, each detail plays a crucial role in ensuring you get the most value. Here’s how to make an informed decision.

Factors to Consider When Comparing Loans

When evaluating financing options, start by comparing interest rates. Fixed rates offer stability, while floating rates can provide flexibility in a changing market. Look for plans with minimal hidden fees, such as conversion or valuation charges.

Consider the lock-in period and prepayment penalties. Shorter lock-in periods give you more freedom to refinance if better offers arise. Additionally, check for legal subsidies or cashback promotions, which can significantly reduce upfront costs.

Here are some key points to keep in mind:

- Leverage multiple offers to find the most competitive rates.

- Time your application to coincide with promotional periods for added benefits.

- Explore loyalty programs that offer perks like reduced rates or fee waivers.

How to Negotiate Better Loan Terms

Negotiating better terms can lead to substantial savings. Start by building a strong relationship with your bank. Relationship banking often unlocks benefits like lower rates or waived fees. If you’re borrowing a larger amount, inquire about bulk discount thresholds.

Consider hiring a professional negotiator if you’re unsure about the process. They can help you secure favorable terms and navigate complex agreements. Always review the fine print to avoid unexpected charges.

Here are some strategies to improve your negotiation:

- Highlight your financial stability to strengthen your bargaining position.

- Use competing offers as leverage to secure better terms.

- Ask for rate conversion privileges or interest offset accounts.

By taking these steps, you can ensure your financing plan aligns with your financial goals and provides long-term benefits.

Conclusion: Finding the Best Home Loan in Singapore

Making the right choice for your property financing doesn’t have to be overwhelming. By focusing on key factors like interest rates, lock-in periods, and repayment flexibility, you can find a plan that suits your needs. Emerging trends such as green financing and digital mortgages are shaping the market, offering more options for eco-conscious buyers and tech-savvy applicants.

Before finalizing your decision, use this checklist: compare rates, check for hidden fees, and evaluate your long-term financial goals. Staying informed about market changes is crucial, so consider using tools like MoneySmart to monitor rates and explore options.

Whether you’re buying your first property or refinancing, taking the time to research and compare can save you money and stress. Start your journey today and secure the best home loan Singapore has to offer.

FAQ

Why is choosing the right home loan important?

Selecting the right mortgage can save you money, reduce stress, and ensure your financial stability. It’s crucial to compare rates, terms, and packages to find the best fit for your needs.

What are the key differences between HDB loans and bank loans?

HDB loans are backed by the government and offer lower interest rates, while bank loans provide more flexibility and competitive rates. Eligibility and terms vary between the two.

How do fixed-rate and floating-rate loans differ?

Fixed-rate loans offer stable monthly payments, while floating-rate loans fluctuate with market conditions. Your choice depends on your risk tolerance and financial goals.

What is SORA, and why is it important for home loans?

SORA (Singapore Overnight Rate Average) is a benchmark rate used for floating-rate loans. It’s transparent and reflects market conditions, making it a reliable option for borrowers.

What is TDSR, and how does it affect my loan eligibility?

TDSR (Total Debt Servicing Ratio) limits your monthly debt repayments to 55% of your income. It ensures you don’t overextend financially when applying for a mortgage.

What are the benefits of refinancing my home loan?

Refinancing can lower your interest rate, reduce monthly payments, or shorten your loan tenure. It’s a smart move if market conditions or your financial situation changes.

What should I consider when comparing loan packages?

Look at interest rates, lock-in periods, fees, and flexibility. Also, consider your financial goals and how the loan aligns with your long-term plans.

Are there specific loan options for private properties?

Yes, private properties like condos and landed homes often have tailored loan packages. These may include higher loan amounts or unique terms compared to HDB flats.

How does MSR affect my eligibility for an HDB loan?

MSR (Mortgage Servicing Ratio) limits your monthly HDB loan repayment to 30% of your income. It ensures affordability and financial sustainability.

Can I negotiate better terms for my home loan?

Yes, many banks are open to negotiation, especially if you have a strong credit profile. Don’t hesitate to ask for lower rates or waived fees.

Top Picks: Best Indian Vegetarian Restaurant Singapore

Singapore is known for its diverse food culture, and its vegetarian scene is no exception. The city offers a unique blend of traditional and innovative dishes that cater to all tastes. Whether you’re a local or a visitor, there’s something for everyone.

Little India stands out as a budget-friendly hub for authentic flavors. Here, you can enjoy classic dishes that have been passed down through generations. Hawker centers like Tekka Centre also offer affordable meals, with options like naan, palak paneer, and biryani starting at just $12 SGD.

The variety is impressive, ranging from street food to fine dining. This ensures that every meal is a new experience. In this guide, we’ll explore the top picks that combine quality, value, and cultural authenticity.

Key Takeaways

- Singapore’s vegetarian food scene blends tradition and innovation.

- Little India is a budget-friendly spot for authentic flavors.

- Hawker centers like Tekka Centre offer affordable meals.

- The city provides diverse options from street food to fine dining.

- Top picks focus on quality, value, and cultural authenticity.

Introduction to Indian Vegetarian Cuisine in Singapore

Singapore’s culinary landscape is a melting pot of flavors, with vegetarian cuisine taking center stage. The city seamlessly blends North and South Indian culinary traditions, offering a unique dining experience. From crispy dosas to buttery naan, the variety is endless.

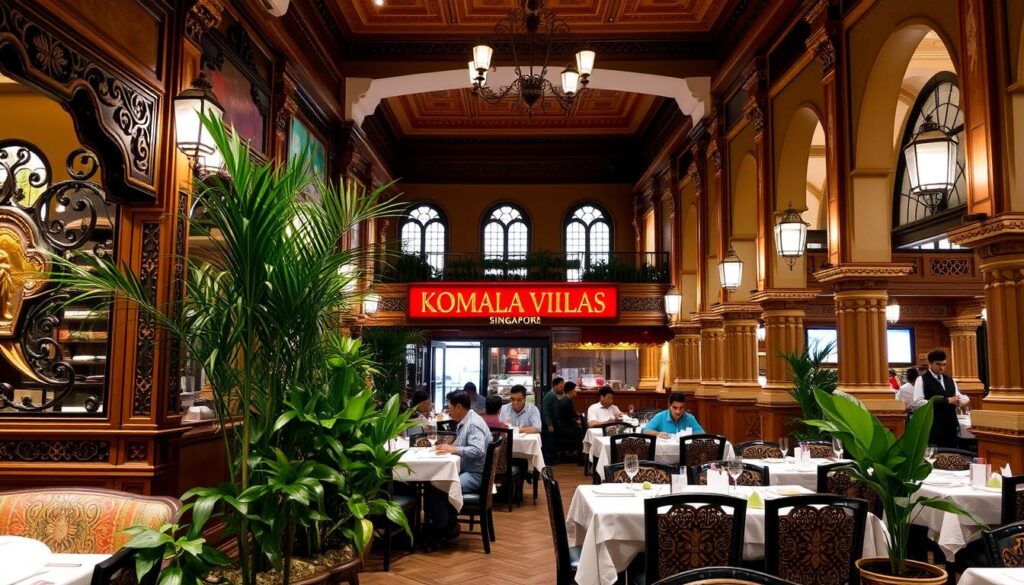

Little India is a treasure trove for food lovers. It’s home to some of the oldest vegetarian spots, like Komala Vilas, established in 1947. Hawker stalls here serve meals under $15 SGD, making it a budget-friendly option. For instance, Indian Palace offers a hearty feast with aloo palak for just $21 SGD.

Must-try dishes include fluffy uthappam, spicy chole bhature, and creamy paneer curries. These dishes are not just food; they’re a cultural experience. Banana leaf service and pay-as-you-wish models add to the authenticity.

During a recent visit, I enjoyed four meals in 24 hours across Little India. Each meal was a new adventure, from street food to sit-down dining. The affordability and quality make it a must-visit for anyone exploring Singapore’s food scene.

| Dish | Description | Price (SGD) |

|---|---|---|

| Dosa | Crispy rice crepe served with sambar and chutney | 5-8 |

| Uthappam | Fluffy pancake topped with vegetables | 6-9 |

| Chole Bhature | Spicy chickpea curry with fried bread | 10-12 |

| Paneer Curry | Creamy cottage cheese in rich tomato gravy | 12-15 |

Whether you’re a local or a visitor, Singapore’s vegetarian restaurants offer something for everyone. The blend of tradition, innovation, and affordability makes it a standout choice for food enthusiasts.

1. Akasa: Regal Indian Dining in the CBD

Nestled in the heart of the CBD, Akasa offers a regal dining experience that blends tradition with modern elegance. Its gold-accented interiors create a luxurious atmosphere, perfect for business lunches or intimate gatherings. The attention to detail in both decor and service sets the stage for an unforgettable meal.

Signature Dishes

The chef’s tasting menus are a highlight, featuring heirloom recipes passed down through generations. Seasonal tasting menus are paired with premium wines and craft beers, elevating classic dishes to new heights. From rich curries to delicate desserts, every bite tells a story of culinary heritage.

Why Visit

Located near Marina Bay’s financial district, Akasa is ideal for both celebrations and impressing clients. Its curated menus and elegant ambiance make it a standout choice for those seeking a fine dining experience. Whether it’s an anniversary or a business meeting, Akasa delivers on every front.

2. Komala Vilas: A Timeless South Indian Classic

Since 1947, Komala Vilas has been serving authentic South Indian flavors in Singapore. This iconic spot in Little India is a testament to consistency, with recipes unchanged for over 75 years. Meals here start at just $5 SGD, making it a go-to for affordable indian vegetarian fare.

Signature Dishes

The Mysore Masala Dosa is a crowd favorite—crispy, spiced, and stuffed with potatoes. Pair it with idlis dunked in coconut chutney for a classic combo. Don’t miss the tomato uthappam, served with three gravies that burst with flavor.

For a hearty meal, try the Chappati Set ($6.50 SGD). It comes with dhal, raita, and your choice of curry. “The open-kitchen breakfast service lets you watch chefs craft each dish,” says a local blogger.

Why Visit

Komala Vilas stands out among vegetarian restaurants singapore for its heritage and value. Arrive early to beat lunchtime queues, and bring cash—it’s the only payment accepted. Whether you’re craving indian food or a taste of tradition, this spot delivers.

3. MTR Indian Vegetarian Restaurant: Tradition Meets Excellence

A wartime innovation put MTR on the map—the iconic rava idli. Founded in 1924 Bangalore, this spot reinvented semolina-based idlis during WWII ingredient shortages. Today, it’s a cornerstone of traditional Indian cuisine in Singapore.

Signature Dishes

The Pudi Dosa steals the show with its spicy chutney powder crust. Tiffin lunch sets arrive in steel compartment trays, offering dhal, rice, and seasonal curries. Families love the vegetarian thalis, featuring unlimited refills of fluffy puris and tangy rasam.

| Dish | Description | Price (SGD) |

|---|---|---|

| Rava Idli | Steamed semolina cakes with coconut chutney | 6.50 |

| Pudi Dosa | Crispy crepe layered with spicy lentil powder | 8.90 |

| Mysore Thali | 6-course meal with sweets and pickles | 15.00 |

Why Visit

Located near Mustafa Centre, MTR is perfect for post-meal shopping. Its pay-as-you-wish Sundays and heritage recipes make it a standout among vegetarian restaurants. “The rava idli tastes like history,” remarks a regular patron.

4. Annalakshmi Restaurant: Dining for a Cause

At Annalakshmi, every meal supports a greater mission while delivering unforgettable flavors. This volunteer-run vegetarian restaurant operates on a “pay as you wish” model, blending generosity with authentic south indian cuisine. Located near a temple, it’s a cultural hub with live performances and hearty buffets.

Signature Dishes

The lunch buffet features 20+ rotating dishes, from tangy sambhar to spiced jackfruit curries. Standouts include:

- Rasam Rice: A comforting lentil soup paired with steamed rice.

- Vegetable Korma: Creamy coconut curry with seasonal veggies.

- Vegan Jackfruit Biryani: Aromatic and tender, with no dairy.

| Dish | Description | Suggested Contribution (SGD) |

|---|---|---|

| Buffet | Unlimited servings of 8+ curries, rice, and desserts | 15–20 |

| Thali Set | Curated platter with sweets and pickles | 12–18 |

Why Visit

Annalakshmi offers more than a meal—it’s a dining experience with purpose. Proceeds fund educational initiatives, making each visit impactful. “The jackfruit curry changed my view on vegan food,” shares a regular patron. Arrive early for the buffet, and soak in the temple’s serene ambiance.

5. Kailash Parbat: Street Food Haven

Step into Kailash Parbat and experience Mumbai’s bustling street food scene right in Singapore. The vibrant décor—think colorful murals and hanging lanterns—mimics the energy of Indian bazaars. It’s a feast for the senses before the first bite.

Signature Dishes

The pani puri is a must-try, served with tamarind and mint waters that explode with flavor. For heartier options, the chole bhature pairs spicy chickpeas with fluffy fried bread. Share the chaat platter ($4.90 SGD) to sample crispy papdi, tangy sev, and creamy yogurt.

| Dish | Description | Price (SGD) |

|---|---|---|

| Pani Puri | Crisp shells filled with spiced water | 4.90 |

| Chole Bhature | Chickpea curry + fried bread | 8.50 |

| Samosa Chaat | Crumbled samosas with chutneys | 5.90 |

Why Visit

Groups love the sharing platters, while office workers rely on tiffin deliveries for lunch. Pro tip: Ask for “mild” if you prefer less heat. With its lively vibe and wallet-friendly prices, Kailash Parbat is a top pick for vegetarian food that packs a punch.

6. Colony Restaurant at Ritz-Carlton: Fine Dining with Indian Flair

White-glove service meets bold spices at this Michelin-recognized venue. The Ritz-Carlton’s flagship eatery transforms Sunday brunch into a lavish event, complete with champagne pairings and live cooking stations. Expect gold-rimmed plates and personalized spice tutorials from chefs.

Signature Dishes

The tandoori pizza surprises with its smoky crust topped with roasted vegetables. For sharing, order the naan platter paired with black lentil dal simmered for 12 hours. Afternoon tea sets feature miniature samosas and cardamom-infused desserts.

| Brunch Highlight | Details | Price (SGD) |

|---|---|---|

| Chef’s Table | Spice blending workshop + 5-course meal | 128 |

| Champagne Brunch | Unlimited pours with 15 live stations | 98 |

| Vegetarian High Tea | Tiered stand with savory & sweet bites | 45 |

Why Visit

Smart casual attire sets the tone for this polished dining experience. Book two weeks ahead for weekend slots—the curry tasting menus sell out fast.

“The saffron-infused naan bread alone is worth the visit,”

shares a frequent guest.

Perfect for celebrations, Colony delivers both luxury and authentic flavors. Their sommelier-curated wine list complements fiery dishes beautifully.

7. Ananda Bhavan Vegetarian Restaurant: Singapore’s Oldest Veggie Spot

Stepping into Ananda Bhavan feels like opening a culinary time capsule. Since 1924, this iconic eatery has preserved fourth-generation family recipes without MSG or artificial additives. Its 24-hour Serangoon Road outlet ensures cravings for comfort food are always met.

Signature Dishes

The Rava Thosai—a crispy semolina crepe—is a must-try, paired with coconut chutney. For something sweet, the Jackfruit Lassi blends tropical fruit with creamy yogurt (or cashew cream for vegans). Weekday lunch specials start at $8.90 SGD, featuring rotating curries and fluffy puris.

| Dish | Description | Price (SGD) |

|---|---|---|

| Paneer Dosa | Cottage cheese-stuffed crepe with mint chutney | 7.50 |

| Vegetable Biryani | Fragrant rice with seasonal veggies | 9.90 |

| Herbal Tea Set | Spiced chai + homemade snacks | 5.00 |

Why Visit

Beyond the plate, browse their heritage shop for spices and cookbooks. The legacy of plant-based dining shines here—loyal regulars swear by the *”unmatched depth of flavors.”* Whether it’s 3 AM or noon, Ananda Bhavan delivers tradition with every bite.

Conclusion

From crispy dosas to creamy curries, the city’s plant-based dining scene offers endless variety. Whether you crave street food or fine dining, there’s a spot for every taste and budget.

Start your day with fluffy idlis at Komala Vilas, then explore Kailash Parbat’s spicy chaat for lunch. Don’t miss hidden gems like Madras New Woodlands, where paneer butter masala shines. Adventurous eaters should try ragi dosa—a nutritious twist on the classic.

Over 70% of local eateries cater to plant-based diets, including Jain options upon request. Each venue tells a story through flavor, blending tradition with innovation.

Pro tip: Mix budget-friendly hawker meals with splurge-worthy tasting menus for a full culinary journey. Every bite celebrates the rich tapestry of flavors found here.

FAQ

What makes Akasa stand out in the CBD?

Akasa offers a regal dining experience with a focus on North Indian flavors. Their signature dishes like paneer tikka and vegetable curry are crowd favorites.

Why is Komala Vilas considered a classic?

Komala Vilas is known for its authentic South Indian cuisine, especially their dosa and idli. It’s a go-to spot for traditional comfort food.

What’s unique about MTR Indian Vegetarian Restaurant?

MTR combines tradition with excellence, serving dishes like rava idli and masala dosa that are both flavorful and timeless.

How does Annalakshmi Restaurant support a cause?

Annalakshmi operates on a “pay-as-you-wish” model, with proceeds going to charitable initiatives. Their vegetable biryani and lentil curry are must-tries.

What can I expect at Kailash Parbat?

Kailash Parbat is a haven for street food lovers, offering dishes like pani puri and chaat that bring the vibrant flavors of Indian streets to your plate.

What sets Colony Restaurant apart?

Located at the Ritz-Carlton, Colony offers fine dining with an Indian twist. Their naan and cottage cheese dishes are crafted to perfection.

Why is Ananda Bhavan a historic spot?

As Singapore’s oldest vegetarian spot, Ananda Bhavan serves classic dishes like thali and vegetable curry, preserving decades of culinary heritage.

Discover Best Home Loan Rates Singapore Options

Finding the right mortgage can feel overwhelming, especially in a competitive market like Singapore. With over 10 major lenders offering various packages, it’s crucial to compare your options carefully. This ensures you secure a deal that aligns with your financial goals and saves you money in the long run.

At MoneySmart, we simplify the process with our free comparison tools and expert guidance. Our team, including mortgage specialists like Joey Wong, helps you navigate the complexities of interest rates, loan types, and eligibility criteria. Whether you’re considering fixed or floating rates, we’ve got you covered.

Our 3-step process—Compare, Consult, Apply—has helped many customers, like Jasmine Koh and Brian Lee, find the perfect fit for their needs. With current fixed rates ranging from 2.45% to 2.55% for HDB flats and 2.30% to 2.55% for private properties, now is the time to explore your options.

Key Takeaways

- Singapore’s mortgage market is highly competitive, with over 10 major lenders.

- Comparing options can lead to significant long-term savings.

- MoneySmart offers a 3-step process: Compare, Consult, Apply.

- Fixed rates currently range from 2.45% to 2.55% for HDB flats.

- Mortgage specialists like Joey Wong provide personalized assistance.

- Understanding TDSR (55%) and MSR limits is essential for loan approval.

- The transition from SIBOR to SORA is underway, with SIBOR phasing out by 2024.

Introduction to Home Loans in Singapore

Securing financing for property purchases is a critical step in Singapore’s property market. A home loan is a type of secured financing specifically designed for buying property. It allows you to borrow funds while using the property as collateral. Understanding the different types of financing options can help you make informed decisions.

What is a Home Loan?

A home loan is a financial product that helps individuals purchase property. It is secured by the property itself, meaning the lender can claim ownership if repayments are not made. In Singapore, there are two main types of financing: HDB loans and bank loans. HDB loans are available to Singaporean citizens, while bank loans often cater to higher income earners.

Why Compare Home Loan Rates?

Comparing interest rates is crucial to finding the right financing option. For example, HDB loans offer a fixed rate of 2.6%, while bank loans are often pegged to the SORA rate, which can vary. A difference of just 0.25% in interest rates on a S$500,000 loan over 25 years can save you over S$18,000.

Here are some key reasons to compare your options:

- Hidden fees: Some packages may include charges that are not immediately obvious.

- Lock-in terms: Unfavorable terms can limit your flexibility in refinancing or repaying early.

- Refinancing subsidies: Platforms like MoneySmart offer up to S$2,000 in subsidies for refinancing.

Additionally, the Monetary Authority of Singapore (MAS) has introduced regulations to ensure transparency in home loans post-SIBOR. This makes it easier for borrowers to understand their financing options and make informed decisions.

Types of Home Loans Available in Singapore

Understanding the different financing options is essential for making informed property decisions. In Singapore, you’ll find two primary types of mortgages: HDB loans and bank loans. Each has unique features tailored to different needs and financial situations.

HDB Loans vs. Bank Loans

HDB loans are designed for Singaporean citizens with a monthly income below S$14,000 and no private property ownership. They offer up to 80% Loan-to-Value (LTV) ratio, making them accessible for first-time buyers. In contrast, bank loans provide more flexibility but require a higher down payment, with a 75% LTV ratio.

Here’s a quick comparison:

- HDB Loans: Fixed rate of 2.6%, ideal for stable budgeting.

- Bank Loans: Rates range from 3.7% to 5.5%, offering competitive packages for higher earners.

Fixed Rate vs. Floating Rate Loans

Fixed-rate loans provide stability with consistent monthly payments over 2-5 years. This option is perfect for those who prefer predictability. On the other hand, floating-rate loans adjust with market conditions, offering potential savings when interest rates drop.

Popular packages include:

- DBS FHR8: Tied to the bank’s fixed deposit rate.

- UOB SORA+0.50%: Linked to the Singapore Overnight Rate Average.

- OCBC 1-month SORA: Allows faster rate adjustments.

For uncompleted properties, BUC loans are available with no lock-in periods, providing flexibility during construction.

Understanding Interest Rates

Choosing the right financing option starts with understanding how interest rates work. These rates determine the cost of borrowing and can significantly impact your long-term financial planning. In Singapore, you’ll encounter three main types: fixed, floating, and board rates. Each has its own mechanics and risks, making it essential to compare them carefully.

Fixed Interest Rates

Fixed rates offer stability by locking in your interest rate for a set period, usually 2-5 years. This predictability makes budgeting easier, especially during periods of economic uncertainty. For example, DBS offers a 2-year fixed rate at 2.50%, while UOB provides a 3-year fixed rate at 2.47%.

In 2022, rising rates led to increased demand for fixed-rate options. However, they are often slightly higher than floating rates, as they protect borrowers from market volatility.

Floating Interest Rates

Floating rates adjust with market conditions, making them more dynamic. They are often tied to benchmarks like SORA (Singapore Overnight Rate Average), which is based on actual transactions. For instance, OCBC offers a floating rate of 2.899% (3M SORA + 0.500%).

Compared to the older SIBOR system, SORA is less volatile and more transparent. This makes floating rates a popular choice for those comfortable with some variability in their payments.

Board Rates

Board rates are determined internally by banks and lack transparency. For example, Maybank’s BOARD-2.96% is set without clear public benchmarks. This can make it harder to predict future changes, posing a risk to borrowers.

Historically, board rates have been less popular due to their unpredictability. It’s crucial to weigh this risk against potential benefits when considering such options.

| Type | Example | Key Feature |

|---|---|---|

| Fixed Rate | DBS 2Y Fixed at 2.50% | Stable payments for 2 years |

| Floating Rate | OCBC 3M SORA + 0.500% | Adjusts with market conditions |

| Board Rate | Maybank BOARD-2.96% | Internally determined, less transparent |

For more insights on comparing these options, check out this detailed guide. Understanding these rates can help you make informed decisions and save money in the long run.

Best Home Loan Rates Singapore: A Comprehensive Comparison

Navigating the mortgage landscape in Singapore requires a clear understanding of the latest offers and trends. With multiple lenders providing competitive packages, it’s essential to compare options to find the most suitable deal. This section breaks down the top lenders and their offers, along with tips for effective comparison.

Top Lenders and Their Offers

Singapore’s leading banks, including DBS, OCBC, and UOB, offer a variety of packages tailored to different needs. For instance, DBS provides a 3M SORA+0.60% package, while OCBC offers a 2-year fixed rate at 2.45%. UOB’s 1M SORA+0.25% is another popular choice for those seeking flexibility.

Here’s a quick overview of current offers:

- DBS: 3M SORA+0.60%, ideal for those comfortable with floating rates.

- OCBC: 2Y Fixed at 2.45%, perfect for stable budgeting.

- UOB: 1M SORA+0.25%, offering competitive rates for short-term flexibility.

How to Compare Rates Effectively

When comparing options, consider the all-in rate, which includes legal fees and valuation costs. This provides a clearer picture of the total expense. Additionally, platforms like MoneySmart offer rate alert systems to notify you of refinancing opportunities.

Be cautious of promotional traps, such as low Year 1 rates with steep increases in Year 3. Always use tools like MAS’s comparator for APR transparency. Here’s a comparison of HDB vs. private property rates:

| Property Type | Fixed Rate | Floating Rate |

|---|---|---|

| HDB | 2.45% – 2.55% | 3M SORA + 0.50% |

| Private | 2.30% – 2.55% | 1M SORA + 0.25% |

Understanding these details can help you make informed decisions and secure a deal that aligns with your financial goals.

Eligibility Criteria for Home Loans

Understanding the eligibility criteria is the first step toward securing financing for your property purchase. Lenders evaluate your financial health to determine if you qualify for a mortgage. Two key factors are your income requirements and the total debt servicing ratio (TDSR).

Income Requirements

Your monthly income plays a crucial role in determining your eligibility. For example, a single applicant typically needs at least S$4,500 per month, while joint applicants may require a combined income of S$9,000. These thresholds ensure you can comfortably manage your monthly payments.

For a loan amount of S$500,000, lenders usually expect a minimum income of S$6,000. This ensures you meet the income requirements and can handle the financial commitment.

Total Debt Servicing Ratio (TDSR)

The TDSR is a key metric used by lenders to assess your ability to repay. It calculates the percentage of your income that goes toward debt payments, including the new mortgage. In Singapore, the TDSR is capped at 55%.

Here’s how it works:

- Add up all your monthly debt payments, including the new mortgage installment.

- Divide this total by your gross monthly income.

- The result should not exceed 55%.

For example, if you earn S$10,000 per month, your total debt payments should not exceed S$5,500. This includes credit card bills, car loans, and other obligations.

Additionally, HDB loans have stricter criteria, with the Mortgage Servicing Ratio (MSR) limiting payments to 30% of your gross income. This ensures affordability for public housing buyers.

For those with fluctuating incomes, the Enhanced Financing Arrangement (EFA) allows you to use 30% of your assets or 48 months of income as a supplement. This provides flexibility for self-employed individuals or those with irregular earnings.

How to Apply for a Home Loan in Singapore

Applying for a mortgage in Singapore is a straightforward process when you know the steps and requirements. Whether you’re a first-time buyer or looking to refinance, understanding the application process can save you time and effort. Below, we break down the key steps and documents needed to secure your financing.

Step-by-Step Application Process

Here’s a simple guide to help you navigate the application process:

- Check Your Credit Score: Start by reviewing your credit report to ensure it’s in good standing. A strong credit score increases your chances of approval.

- Get In-Principle Approval (IPA): Submit your details to lenders for a preliminary assessment. IPA is valid for 30 days and gives you a clear idea of your borrowing capacity.

- Submit Your Option to Purchase (OTP): Once you’ve found your property, submit the OTP to your chosen lender.

- Final Approval: The lender will verify your documents and conduct a property valuation before granting final approval.

- Disbursement: After signing the loan agreement, the funds will be disbursed to complete your purchase.

Documents Needed

To streamline your application, ensure you have the following documents ready:

| Document | Purpose |

|---|---|

| NRIC | Proof of identity |

| CPF Statements | Verification of CPF contributions |

| 12-Month Payslips | Proof of income stability |

| Notice of Assessment (NOA) | Tax records for income verification |

For digital applications, MyInfo integration simplifies the process by auto-filling your details. Foreign applicants will need additional documents, such as an Employment Pass and tax statements.

If you’re purchasing an HDB Build-To-Order (BTO) flat, remember to secure your financing within 21 days of receiving the OTP. This ensures you meet the HDB’s strict deadlines.

For more details on the application process, visit OCBC’s loan page.

In-Principle Approval (IPA) Explained

The in-principle approval (IPA) is a crucial step in the mortgage application journey. It acts as a preliminary commitment from the lender, giving you a clear idea of how much you can borrow. This step is especially important in Singapore’s competitive property market, where timing and preparation are key.

What is IPA?

An IPA is a conditional approval from a lender, indicating the maximum amount you can borrow for a mortgage loan. It is based on your income, credit score, and financial commitments. Unlike the HDB Loan Eligibility (HLE) letter, which is specific to public housing, IPA applies to both HDB and private properties.

Here’s how IPA differs from HLE:

- IPA: Offered by banks for both HDB and private properties.

- HLE: Issued by HDB for public housing purchases only.

How to Get IPA

Obtaining an IPA is a straightforward process. Start by submitting your financial details to a lender for a preliminary assessment. Most IPA letters are valid for 30 days, giving you ample time to explore property options.

Top providers of IPA in Singapore include:

- DBS: Known for quick processing and competitive offers.

- OCBC: Offers detailed assessments and personalized advice.

- HSBC: Provides flexible options for expats and locals alike.

Here are some tips to maximize your chances of approval:

- Apply for IPA before bidding for a property to strengthen your position.

- Ensure your credit score is in good standing to avoid delays.

- Use platforms like MoneySmart, which boast a 92% IPA success rate.

| Provider | Key Feature |

|---|---|

| DBS | Quick processing and competitive offers |

| OCBC | Detailed assessments and personalized advice |

| HSBC | Flexible options for expats and locals |

Securing an IPA not only streamlines your property purchase but also gives you confidence in your financial readiness. With the right preparation, you can navigate the loan approval process smoothly and efficiently.

HDB Loan Eligibility (HLE) Letter

When applying for public housing in Singapore, the HDB Loan Eligibility (HLE) letter is a must-have document. It serves as a preliminary approval for financing your HDB flat, ensuring you meet the necessary criteria. This eligibility letter is especially crucial for Build-To-Order (BTO) applications, as it confirms your ability to secure an hdb home loan.

What is the HLE Letter?

The HLE letter is issued by the Housing and Development Board (HDB) to assess your eligibility for a loan. It considers factors like your income, financial commitments, and property ownership status. This document is valid for six months, giving you ample time to complete your property purchase.

How to Apply for the HLE Letter