Singapore stands as a leading hub for real estate investment trusts in Asia, with a thriving market valued at over US$100 billion. This sector makes up nearly 12% of the country’s total market capitalization, showcasing its significance in the financial landscape.

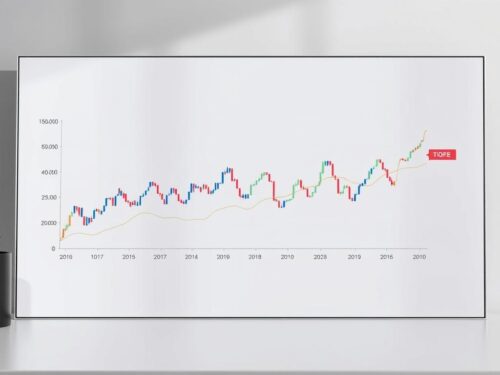

The iEdge S-REIT Index tracks 31 high-performing trusts, offering investors access to prime commercial, industrial, and healthcare properties. With strong fundamentals and stable regulations, these trusts provide a reliable way to diversify portfolios.

Current market conditions present unique opportunities. Despite global economic shifts, many trusts have maintained consistent dividend growth over the past decade. Investors can benefit from both steady income and potential capital appreciation.

Key Takeaways

- Singapore is a dominant force in Asia’s REIT market, valued at US$100 billion.

- The iEdge S-REIT Index includes 31 high-quality trusts.

- Investors gain exposure to commercial, industrial, and healthcare real estate.

- Current conditions offer attractive entry points for long-term growth.

- Many trusts have a proven track record of dividend growth.

Why Invest in Singapore REITs?

Investors seeking stable returns often turn to Singapore’s well-regulated investment trusts. The real estate sector here combines strong growth potential with institutional safeguards, making it a standout in Asia.

Singapore’s REIT Market Overview

The market features 31 listed trusts, spanning commercial, industrial, and healthcare properties. The iedge s-reit index tracks these assets, with the top 10 holdings representing 70% of its weight.

CapitaLand Integrated Commercial Trust (CICT) and CapitaLand Ascendas REIT (CLAR) lead with market caps of S$13.5B and S$11.9B, respectively. Mapletree’s trusts alone contribute over 25% to the index.

| REIT | Market Cap (S$B) | Sector |

|---|---|---|

| CICT | 13.5 | Commercial |

| CLAR | 11.9 | Industrial |

| Mapletree Pan Asia | 9.2 | Diversified |

Benefits of REIT Investments

Tax transparency and a robust regulatory framework attract global capital. Investors enjoy quarterly dividends without direct property management hassles.

Diversification is another perk. Trusts hold assets across geographies and sectors, reducing risk. For example, industrial properties might thrive even if retail lags.

Liquidity stands out too. Unlike physical real estate, SGX-listed trusts can be traded daily, offering flexibility missing in traditional estate investment.

How We Selected the Best REITs in Singapore

Choosing top-performing trusts requires a deep dive into financial metrics and market trends. We prioritized assets with a 10-year DPU growth history, stable dividend yields, and disciplined debt management. Here’s how the criteria stack up.

Key Metrics: DPU Growth, Yield, and Gearing Ratio

DPU growth signals consistent income potential. For example, MPACT delivered a 4% annualized growth over the past decade. Meanwhile, gearing ratios below 40% (like CICT’s 39.9%) indicate balanced leverage.

| Trust | DPU Growth (10-Yr) | Gearing Ratio | Dividend Yield |

|---|---|---|---|

| MPACT | 4.0% | 38.2% | 5.1% |

| CICT | 3.2% | 39.9% | 4.8% |

| PREIT | 2.8% | 36.5% | 5.3% |

The Role of Debt and Interest Rates

Fixed-rate loans shield trusts from volatility. PREIT’s 1.32% interest rate on Japanese loans exemplifies this strategy. Ideal trusts maintain >75% fixed-rate debt and refinance proactively.

“Low-interest, long-term debt is a cornerstone of resilient trusts.”

Compare MLT’s 2.5% borrowing cost to the sector average of 3.7%. This advantage supports higher dividend yields during rate hikes.

Why These Are the Best REITs in Singapore

Three trusts dominate discussions for their resilience and growth potential. Each combines strategic assets with disciplined financial management, offering unique advantages.

Mapletree Pan Asia Commercial Trust (N2IU)

The Mapletree Pan Asia trust leverages its post-merger strength, anchored by Vivocity and regional retail hubs. With 75.17% total returns over a decade, it balances 85% fixed-rate debt and a 2.8-year maturity profile.

Mapletree Industrial Trust (ME8U)

Focused on data centers (56% of assets), ME8U delivers 206% total returns. Its North American holdings and 79.5% fixed-rate debt cushion against market volatility.

CapitaLand Integrated Commercial Trust (C38U)

The CapitaLand Integrated Commercial Trust thrives with a 93.7% Singaporean retail-office portfolio. Its 70% returns and 3.9-year debt maturity highlight stability.

“Geographic diversification and sector focus are key to weathering economic shifts.”

| Trust | Total Returns | Fixed-Rate Debt | Debt Maturity |

|---|---|---|---|

| MPACT | 75.17% | 85% | 2.8 years |

| ME8U | 206% | 79.5% | 3.1 years |

| CICT | 70% | 78% | 3.9 years |

These trusts exemplify how strategic asset allocation and prudent debt management create investor value. Their distinct approaches—retail hubs, data centers, and mixed-use portfolios—cater to diverse risk appetites.

Top-Performing REITs with Strong Track Records

Investors looking for stable income and growth should consider these high-performing trusts. Each combines sector expertise with disciplined financial management, offering unique advantages.

Mapletree Logistics Trust (M44U)

The Mapletree Logistics Trust thrives on e-commerce demand, with 42% of assets in China. Its 145% total returns and 83% fixed-rate debt showcase resilience. A 3.7-year debt maturity profile adds stability.

ParkwayLife REIT (C2PU)

Focused on nursing homes and hospitals, ParkwayLife REIT delivers recession-resistant income. Its 127% returns and ultra-low 1.32% borrowing cost stand out. Long-term leases with healthcare providers ensure steady cash flow.

Frasers Centrepoint Trust (J69U)

Frasers Centrepoint Trust capitalizes on suburban malls like Causeway Point. With 115% returns, it balances higher borrowing costs (4.3%) with strong tenant demand. Residential-centric locations drive consistent foot traffic.

| Trust | Total Returns | Fixed-Rate Debt | Borrowing Cost |

|---|---|---|---|

| Mapletree Logistics | 145% | 83% | 3.7% |

| ParkwayLife | 127% | 76% | 1.32% |

| Frasers Centrepoint | 115% | 72% | 4.3% |

- E-commerce tailwinds boost Mapletree’s logistics portfolio.

- ParkwayLife’s nursing homes benefit from aging populations.

- Frasers’ malls serve residential hubs, ensuring steady demand.

“Sector-specific strategies—like healthcare or logistics—can mitigate market volatility.”

Comparing Dividend Yields and Total Returns

Understanding the balance between immediate income and long-term growth is crucial when evaluating investment trusts. Some assets offer higher dividend yields today, while others deliver superior total returns over time. This section breaks down how leading trusts perform across both metrics.

High-Yield Versus Growth-Oriented Portfolios

Mapletree Pan Asia Commercial Trust (MPACT) demonstrates how yield and growth can diverge. Its 6.3% dividend yield outpaces CapitaLand Ascendas REIT’s 5.7%, yet CLAR’s 120% decade-long returns exceed MPACT’s 75%.

Healthcare-focused ParkwayLife REIT (C2PU) shows another pattern. Its modest 4.1% yield comes with 127% total returns, proving that sector selection matters. Industrial-focused ME8U leads all peers with 206% growth despite a competitive 5.8% yield.

| Trust | Dividend Yield | 10-Year Returns | Primary Sector |

|---|---|---|---|

| MPACT | 6.3% | 75% | Retail/Commercial |

| CLAR | 5.7% | 120% | Industrial |

| ME8U | 5.8% | 206% | Data Centers |

Decade-Long Performance Trends

The past years reveal why industrial and healthcare trusts outperformed. CapitaLand Ascendas REIT benefited from e-commerce logistics demand, while ParkwayLife’s nursing homes proved recession-resistant.

Commercial trusts like CICT show how capital value stagnation impacts results. Despite stable yields, its 70% returns trail sector leaders. Investors must decide between:

- High-current income (6%+ yields)

- Compound growth (150%+ returns)

- Balanced approaches (CLAR’s middle path)

“Total returns combine yield and appreciation—focusing solely on dividends misses half the picture.”

Data center and healthcare reits delivered the strongest performance over the past years. Their specialized assets commanded premium valuations while maintaining reliable payouts.

Navigating Market Risks and Interest Rate Impact

Market volatility and rising interest rates create challenges for trust investors. The iEdge S-REIT Index fell 12% last year, reflecting broader economic pressures. With 10-year bond yields at 3.091%, understanding these risks is key to protecting value.

How Rising Rates Affect Valuations

Higher borrowing costs squeeze profits, especially for trusts with floating-rate debt. Duration risk also matters—longer leases lose appeal when rates climb. For example, a 1% rate hike can cut asset value by 5–10%.

Refinancing risks loom large in 2025, when S$4.2B of debt matures. Trusts with low gearing ratios (under 40%) fare better. MPACT’s 85% fixed-rate loans shield it from volatility, unlike peers with 60% floating exposure.

Smart Strategies for Mitigating Risk

Fixed-rate debt hedges against hikes. Mapletree’s 2.8-year loan terms and 3.7% average cost beat the market. Investors should also track yield spreads—the 5.772% REIT threshold outperforms bonds when spreads widen.

“Locking in low-rate debt and diversifying maturities is the ultimate defense.”

| Trust | Fixed-Rate Debt | Gearing Ratio | 2025 Maturities |

|---|---|---|---|

| MPACT | 85% | 38.2% | S$320M |

| CLAR | 78% | 39.9% | S$1.1B |

| PREIT | 76% | 36.5% | S$290M |

Focus on trusts with strong balance sheets and yield cushions. The right mix of defensive assets and smart financing turns interest rates from a threat into an opportunity.

When to Buy: Timing Your REIT Investments

Yield spreads often signal optimal buying opportunities. When the gap between REIT yields and government bonds widens beyond historical averages, it typically indicates undervalued assets. Currently, the 5.772% threshold presents a compelling entry point.

Using the Bond-REIT Yield Spread

The historical 3.83% spread has expanded to 5.772%, suggesting strong value. Mapletree Pan Asia Commercial Trust (MPACT) exemplifies this with its 6.3% yield – well above the buy signal threshold. Three of our seven featured trusts currently meet this criterion.

Compare yields to 10-year averages for context. Keppel REIT’s current 5.1% yield sits 0.8% above its decade-long average, while CICT trades at a 15% discount to pre-rate hike valuations.

Identifying Undervalued Opportunities

Price-to-book (PB) ratios below 1.0 often indicate hidden value. Keppel REIT currently trades at 0.87x book, suggesting the market may be overlooking its prime office assets. Industrial trusts show similar opportunities with PB ratios averaging 0.92x.

Consider these timing strategies:

- Dollar-cost averaging during interest rate peaks smooths entry points

- Target trusts with >75% fixed-rate debt during tightening cycles

- Monitor quarterly reports for occupancy and lease renewal trends

“The sweet spot arrives when high yields coincide with stable fundamentals – that’s when patient investors reap rewards.”

Current conditions favor gradual accumulation. While no one times the market perfectly, these metrics help identify when quality assets become attractively priced as part of a balanced portfolio.

Conclusion

Building wealth through real estate doesn’t require direct property ownership. Trusts offer a streamlined path with diversified assets and steady income.

Focus on quality metrics like DPU growth and fixed-rate debt, not just high yields. A balanced portfolio might mix logistics, healthcare, and commercial trusts.

Current conditions create a rare buying window. With yield spreads at attractive levels, patient investors can lock in value before potential rate cuts.

Top performers like Mapletree and CapitaLand demonstrate how sector expertise and disciplined finance drive returns. Start small, prioritize resilience, and let compounding work.