Singapore’s financial market remains a stable choice for those seeking reliable payouts. With a 4.4% GDP growth in 2024 and supportive government policies, the outlook for 2025 is promising. A 20% corporate tax rebate for new listings and a S$5B investment program further enhance opportunities.

The city-state’s resilient economy offers a mix of steady income and potential growth. Experts highlight sectors like banking, real estate, and utilities as key performers. These industries are known for consistent yields and strong fundamentals.

For investors, balancing a portfolio with high-yield options can create lasting value. This guide explores top-performing assets and strategies to maximize returns. Let’s dive into the details.

Key Takeaways

- Singapore’s economy shows steady growth, supporting reliable payouts.

- Government incentives like tax rebates boost market appeal.

- Banking and real estate sectors lead in consistent performance.

- Diversification helps balance risk and reward.

- Expert insights highlight top opportunities for 2025.

Introduction to Dividend Stocks in Singapore

Investors seeking reliable payouts often turn to shares with regular profit distributions. These ownership stakes reward shareholders with a portion of company earnings, typically paid quarterly or annually.

In Singapore, blue-chip companies dominate this space. Their strong financials and market stability make them popular choices for those prioritizing steady income. Sectors like banking and telecom are particularly resilient during economic shifts.

“Singapore’s market structure favors long-term investors, with tax-free payouts from locally listed shares.”

The Singapore Exchange (SGX) plays a pivotal role in regional finance. It hosts many high-yield options while ensuring transparency and liquidity. For beginners, STI ETFs offer instant diversification across top performers.

| Sector | Key Feature | Example |

|---|---|---|

| Banking | High cash flow | DBS Group |

| Telecom | Defensive demand | Singtel |

| Utilities | Stable returns | Keppel Corp |

Local investors enjoy added perks, including no taxes on distributions from SGX-listed shares. This advantage strengthens the appeal of building a portfolio around these assets.

Why Invest in Dividend Stocks in Singapore?

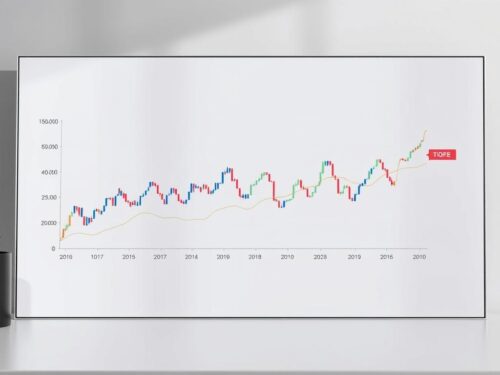

Stable returns and long-term growth make these assets attractive. They provide passive income even when markets fluctuate. Top banks in the region average a 5.24% yield, outpacing global benchmarks.

REITs and banks have historically delivered reliable payouts. For example, ST Engineering reported a 22% profit surge in 2024. Such performance highlights the resilience of key sectors.

“Reinvesting dividends turns small gains into significant wealth over time.”

Compounding works silently but powerfully. A $10,000 investment with 5% annual growth and reinvested payouts doubles in 14 years. This strategy builds wealth without extra effort.

Inflation protection is another perk. Companies like Keppel Corp have raised payouts for 10+ years. Rising distributions help maintain purchasing power.

| Sector | 2024 Yield | Growth Trend |

|---|---|---|

| Banking | 5.24% | +7% YoY |

| REITs | 5.8% | +4% YoY |

| Industrials | 4.1% | +22% YoY |

Diversification spreads risk across industries. A mix of utilities, telecoms, and finance balances a portfolio. This approach smooths out market swings.

For investors, the appeal lies in predictable cash flow. Regular payouts cover expenses or fund new opportunities. It’s a practical way to grow wealth steadily.

How to Pick the Best Dividend Stocks

Smart investors focus on key indicators to identify high-performing shares. A mix of quantitative metrics and sector trends helps build a resilient portfolio.

Understanding Key Metrics

Dividend yield measures annual payouts relative to share price. For example, OCBC’s 5.24% yield means $5.24 per $100 invested.

Payout ratio shows what portion of profits fund distributions. Banking leaders like DBS maintain ratios below 60%, ensuring sustainability.

- Debt-to-equity ratio: Property firms average 1.2x, while tech stays under 0.5x.

- Share price performance: Singtel gained 8% over 12 months, signaling stability.

Strategic Selection Tips

Stress-test against crises. During the pandemic, UOB’s S$3B capital return proved its resilience.

| Sector | Payout Ratio | Growth Driver |

|---|---|---|

| Banking | 55% | Digital adoption |

| Telecom | 70% | 5G expansion |

“Focus on companies with rising cash flows and manageable debt.”

Track sector shifts. Digital banking and 5G rollout are reshaping opportunities for long-term gains.

Best Dividend Stocks in Singapore in 2025

Looking for steady income? These top performers stand out with strong fundamentals and consistent track records. We analyze key players across banking, telecom, and infrastructure sectors.

DBS Group Holdings Ltd.

Asia’s leading bank reported S$11.4B net profit with a 4.9% yield. Its digital banking services now cover 5.8M customers, driving growth.

United Overseas Bank Ltd.

UOB combines S$1.80/share distributions with a S$500M buyback program. Regional expansion boosts returns, especially in Vietnam and Thailand.

OCBC

With S$7.02B profits, OCBC leads in digital transformation. Its mobile app users grew 28% year-over-year.

![]()

Singapore Telecommunications Limited

Singtel offers 15¢ distributions alongside its Tuas data center project. The 5G rollout should boost profits by 12-15% through 2026.

Singapore Exchange Limited

SGX’s 34.5¢ payout comes with record derivatives volume. New cryptocurrency services may create additional revenue streams.

CapitaLand Investment Limited

The real estate giant posted S$781M profit in 2023. Its funds under management grew 22% across Asia-Pacific markets.

“REITs like CapitaLand benefit from Singapore’s stable property laws and tourism recovery.”

Keppel Corporation Limited

Keppel’s S$88B FUM marks 18% annual growth. Offshore wind projects should drive future distributions.

ST Engineering

S$4.3B in new contracts supports its payout reliability. Aerospace and urban solutions lead the growth.

Great Eastern

A 39% profit surge in 2023 strengthens this insurer’s position. Healthcare funds show particular promise.

Haw Par

The healthcare firm’s 46% FY23 profit jump comes from Tiger Balm sales. Its net cash position ensures sustainable payouts.

These companies represent diverse opportunities for building a resilient income portfolio. Each combines strong fundamentals with shareholder-friendly policies.

How to Invest in Dividend Stocks in Singapore

Getting started with income-generating investments requires the right approach. Begin by choosing between a CDP or custodian account. CDP accounts offer direct ownership of shares, while custodians provide convenience for international assets.

Compare local brokers like DBS Vickers and Syfe. Syfe charges just S$1.98 per trade, ideal for frequent trading. DBS Vickers suits those preferring integrated banking services.

Understand SGX order types to optimize price execution. Limit orders let you set a target price, while market orders fill instantly at current rates.

- Dollar-cost averaging: Invest fixed amounts monthly to smooth out market swings.

- STI index trends: Historically, Q4 offers stronger entry points for blue-chip shares.

- Dividend calendars: Track ex-dates to ensure eligibility for payouts.

“Odd-lot trading platforms like Syfe’s remove barriers for small investors.”

Syfe’s odd-lot feature allows buying partial shares, making high-price assets accessible. Pair this with reinvested payouts to compound gains over time.

| Strategy | Benefit | Example |

|---|---|---|

| CDP Account | Direct ownership | SGX-listed shares |

| Custodian Account | Global access | US REITs |

With these steps, building a diversified investment portfolio becomes straightforward. Focus on sustainable yields and long-term growth.

Low-Risk Alternative to Dividend Stocks: StashAway Simple™ Plus

For those seeking stable returns with lower volatility, bond funds offer an attractive alternative. StashAway Simple™ Plus combines LionGlobal and Nikko AM funds, targeting a 3.5% yield to maturity with minimal risk.

Unlike equities, bond funds show less price swings. Their duration risk is managed by holding short- to medium-term bonds. This ensures steady cash flow even during market dips.

After the 0.2% management fee, net returns remain competitive. Compare this to REITs, where payouts can vary with property markets. Bond funds provide predictability.

“Over 12 months, StashAway Simple™ Plus delivered 3.3% net returns with no capital loss.”

Liquidity is another perk. Investors can withdraw cash within days, unlike lock-in periods for some high-yield assets. This flexibility suits emergency income needs.

For investors, blending bond funds with traditional shares balances risk and reward. It’s a smart way to diversify while keeping returns consistent.

Conclusion

Building a resilient portfolio starts with understanding key financial metrics. The highlighted companies show strong balance sheets, with debt ratios below industry averages. This financial health supports consistent payouts even during economic shifts.

Focus on sustainable growth when selecting assets. Emerging sectors like renewable energy and healthcare offer fresh opportunities. These areas complement traditional income generators.

Diversification remains crucial. Mixing sectors and asset types balances risk while maintaining steady returns. For more insights, explore this detailed guide on building a robust investment strategy.

Regularly review your holdings to align with changing market conditions. This approach ensures long-term stability and compounding benefits. Start optimizing your selections today.