Best Term Life Insurance Singapore: Top Picks

Welcome to your complete guide for securing your family’s future with smart financial planning. We understand how important it is to find the perfect protection that fits both your needs and budget.

This guide will walk you through various options available from top providers. You’ll discover plans that offer excellent value with surprisingly low monthly premiums.

We’ll show you how these temporary protection plans can provide essential security during critical life stages. They ensure your loved ones are protected when they depend on you most.

Our detailed comparison highlights how these plans remain incredibly affordable while offering substantial coverage. You’ll learn the key differences between temporary and permanent options to make the best choice for your situation.

Key Takeaways

- Temporary protection plans offer substantial coverage at affordable rates

- Monthly premiums can be surprisingly low for comprehensive protection

- These plans provide essential financial security for your family

- They’re particularly valuable during critical life stages and responsibilities

- Top Singapore providers offer competitive options with various features

- Understanding different plan types helps you make informed decisions

- Proper coverage aligns with your financial obligations and future goals

Understanding Term Life Insurance in Singapore

Temporary coverage arrangements provide a clear path to securing your loved ones’ future during crucial life stages. These fixed-period plans offer pure protection without investment components, making them both affordable and straightforward.

A typical temporary protection plan covers you for a specific duration, usually between 5 to 40 years. Many options extend coverage until ages 65, 75, or even 85. The core concept is simple: you pay regular premiums, and if covered events occur during the active period, your beneficiaries receive financial support.

These plans differ significantly from permanent options that include cash value accumulation. The focus remains exclusively on death benefit protection, which explains the substantially lower premium costs. You’re paying only for the protection component without any savings or investment features.

Basic coverage typically includes payout for death from most causes, with standard exceptions like suicide within the first year. Terminal illness diagnosis is also commonly covered, providing support when it’s needed most.

Most temporary protection plans in Singapore offer coverage until age 75. If you pass away or receive a terminal illness diagnosis before reaching this age, your designated beneficiaries receive the full sum assured. This financial safety net ensures your family’s needs are met during difficult times.

If you outlive your policy period, the coverage simply expires without any cash value or refund. This pure protection approach is why premiums remain affordable compared to permanent alternatives.

Singapore insurers provide various term structures to match different needs:

| Term Type | Duration | Premium Structure | Best For |

|---|---|---|---|

| Renewable Terms | 5-10 years | Premiums may increase at renewal | Short-term needs or budget flexibility |

| Level Terms | Fixed duration (10-30 years) | Fixed premiums throughout term | Long-term financial planning |

| Age-Specific Coverage | Until age 65, 75, or 85 | Fixed or increasing premiums | Life stage protection |

These temporary plans are particularly valuable during your highest earning years. They provide essential financial security when your family depends most on your income. The simplicity of these arrangements makes them easy to understand and manage.

You pay regular premiums, and if covered events occur during the active period, your family receives the promised financial support. This straightforward approach eliminates confusion about investment components or cash values.

Choosing the right temporary protection plan depends on your specific circumstances, financial obligations, and future goals. Understanding these basic principles helps you make informed decisions about your family’s financial safety.

Term vs. Whole Life Insurance: Key Differences

Financial security planning involves choosing between temporary protection that expires and permanent coverage that lasts a lifetime. This decision impacts both your budget and long-term financial strategy.

Understanding these two main categories helps you select the right approach for your situation. Each serves different purposes with distinct advantages.

What is Term Life Insurance?

Temporary protection arrangements focus exclusively on pure security without investment components. They provide coverage for a specific duration, typically ranging from 5 to 40 years.

These plans offer substantial death benefit protection at remarkably affordable rates. Premiums remain fixed throughout the entire policy period.

If the insured passes away during the active term, beneficiaries receive the full sum assured. This includes coverage for death, terminal illness, and often disability.

The main advantage is cost efficiency. You get maximum protection per premium dollar spent.

These arrangements work well during high-responsibility periods like mortgage years or child-rearing phases. They provide essential security when financial obligations are greatest.

What is Whole Life Insurance?

Permanent protection plans offer lifelong security, typically extending to age 99 or 100. They combine death benefit coverage with cash value accumulation.

The cash component grows over time through guaranteed and non-guaranteed returns. If you outlive the policy, you receive these accumulated values.

Premium costs are significantly higher due to the dual nature of protection and savings. However, they offer limited pay options where premium payment periods are shorter than the coverage duration.

These policies often include multipliers that boost coverage during critical years. They provide both lifelong security and a savings component.

The choice between temporary and permanent protection depends on your budget, coverage needs, and financial objectives. Many people start with affordable temporary plans during early career stages.

They later transition to other financial products as their wealth and needs evolve. Understanding these differences ensures you make informed decisions about your family’s financial safety.

Why Choose Term Life Insurance?

Many Singapore residents discover that fixed-period protection offers an ideal balance of comprehensive coverage and budget-friendly pricing. This approach provides essential financial security during your most critical years without the complexity of permanent alternatives.

Temporary protection arrangements deliver maximum value for your premium dollars. They focus exclusively on providing security when your family needs it most.

Affordability and Lower Premiums

Fixed-period protection stands out for its remarkable cost efficiency. Premiums typically range from S$15.40 to S$34.12 monthly for substantial S$500,000 coverage.

This represents significant savings compared to permanent options. You can secure essential protection without straining your monthly budget.

The fixed premium structure allows for predictable financial planning throughout your policy duration. You won’t face unexpected increases that can disrupt your budget.

Young professionals, new parents, and homeowners particularly benefit from these affordable rates. They can maintain comprehensive security while managing other financial responsibilities.

Substantial cost savings—often 10-12 times cheaper than whole life options—free up funds for other goals. You can invest, save, or address immediate financial needs while maintaining essential protection.

Simplicity and Flexibility

Temporary protection plans offer straightforward understanding without complex components. You pay premiums for pure security without cash value calculations or investment features.

Policy terms clearly define coverage for death, terminal illness, and optional riders like total permanent disability. This transparency eliminates confusion about what your plan covers.

You enjoy flexibility in choosing coverage periods that match specific financial obligations. Options include mortgage terms, children’s education years, or until retirement age.

Temporary coverage means you only pay for protection during years when you actually need it. This avoids unnecessary lifelong premium payments that characterize permanent alternatives.

Customization options let you tailor coverage amounts and terms to your evolving needs. As your financial responsibilities change, your protection can adapt accordingly.

This combination of simplicity and flexibility makes temporary protection an attractive choice for many Singapore families. It provides essential security without complexity or excessive cost.

Factors to Consider When Choosing a Term Plan

Selecting the right protection arrangement requires careful evaluation of several important elements. Your choices today will shape your family’s financial security tomorrow.

Smart decisions begin with understanding how different factors affect your coverage and costs. Let’s explore the key considerations that should guide your selection process.

Coverage Amount and Duration

Determining the right protection level starts with calculating your financial responsibilities. Add up your mortgage balance, outstanding loans, and family living expenses.

Children’s education costs and ongoing financial support for parents should also factor into your calculations. This comprehensive approach ensures your loved ones maintain their lifestyle.

Policy length should match your longest financial commitment. Most people choose coverage until their mortgage clears or children become independent.

Common terms extend to age 65, as many arrangements become expensive beyond this point. Aligning duration with obligations prevents overpaying for unnecessary years.

Your Financial Obligations

Homeowners should prioritize their mortgage when calculating protection needs. Consider both the remaining balance and payment timeline.

Other debts like renovation loans, car financing, and personal borrowings require inclusion too. Your total sum assured should cover all these obligations completely.

Future expenses like children’s university fees deserve careful consideration. Education costs typically increase over time, so build in some buffer.

Monthly support for aging parents represents another important factor. If you provide regular allowances, ensure this continues through your protection.

Health and Lifestyle Factors

Your physical condition significantly impacts premium rates and approval chances. Pre-existing medical conditions may require additional underwriting.

Family health history also plays a role in risk assessment. Certain hereditary conditions might affect your options or costs.

Lifestyle choices like smoking dramatically increase premium expenses. Tobacco users often pay substantially more for identical coverage.

Income stability and future earning potential influence affordability throughout your policy term. Choose premium amounts that remain manageable during income fluctuations.

| Consideration | Impact on Choice | Practical Example |

|---|---|---|

| Mortgage Balance | Determines minimum coverage amount | S$500,000 mortgage = S$500,000 minimum sum assured |

| Children’s Ages | Influences policy duration | Young children = longer term needed |

| Smoking Status | Affects premium rates significantly | Smokers pay 50-100% higher premiums |

| Existing Coverage | Helps avoid overlapping protection | Review employer group plans first |

Additional riders like critical illness or total permanent disability coverage deserve evaluation. These enhancements provide extra security against specific health challenges.

Inflation and future cost increases should influence your sum assured decision. What seems adequate today might prove insufficient in 20 years.

Always review existing arrangements from employer group plans or other policies. This prevents duplicate coverage while identifying protection gaps.

“The right protection amount covers your debts and provides for your family’s future needs without creating financial strain today.”

For detailed comparisons of various options available in Singapore, visit our comprehensive comparison guide. This resource helps you evaluate different features and find the perfect match for your situation.

Remember that your needs will evolve over time. Regular reviews ensure your protection remains aligned with changing financial responsibilities.

Best Term Life Insurance Singapore: Top Provider Reviews

Singapore’s protection market offers diverse options from leading companies. Each brings unique features to meet different needs.

We’ve analyzed seven popular arrangements to help you compare strengths. These reviews highlight what makes each option stand out.

Singlife Elite Term: Flexible and Affordable

This flagship product delivers remarkable flexibility with various coverage periods. You can choose renewable options from five years up to age 99.

Perpetual discounts make it exceptionally cost-effective. Death and TPD coverage receives 30% off, while critical illness riders get 10% savings.

The basic arrangement includes protection for death and terminal conditions. Additional riders enhance security against various health challenges.

FWD Term Life Plus: Fuss-Free Online Experience

Digital convenience defines this completely online solution. Application and claims processing happen through user-friendly platforms.

Unique family support services add significant value. These include legal advice sessions worth $5,000 for policyholders.

The streamlined approach eliminates paperwork and speeds up approvals. It’s perfect for those preferring digital management.

Income Term Life Solitaire: Guaranteed Renewal

This option offers peace of mind through guaranteed policy renewal until age 100. You won’t face medical re-assessment at renewal dates.

Fixed terms range from 10 to 40 years. Alternatively, choose coverage until specific ages like 64, 74, 84, or 100.

The assurance of continuous protection makes it ideal for long-term planning. You maintain security without worrying about future health changes.

AIA Secure Flexi Term: Long-Term Coverage

Comprehensive protection extends up to 100 years with this arrangement. It includes terminal cancer benefit within base coverage.

Renewable periods come in 5, 10, 20, or 30 year increments. Alternatively, select coverage until ages 65 or 75.

The flexibility accommodates various life stages and financial responsibilities. It grows with your changing needs over time.

Tokio Marine Term Assure II: Smoker-Friendly Options

This provider offers attractive incentives for tobacco users. Smokers receive 40% premium discount for the first three years on level terms.

Coverage options include renewable terms or fixed protection until age 85. The arrangement encourages healthier lifestyles through financial benefits.

Those who quit smoking can eventually qualify for non-smoker rates. It’s a practical choice for tobacco users seeking affordable protection.

AXA Term Protector: Currency and Payment Flexibility

Unprecedented customization options distinguish this solution. Choose between SGD or USD currency for your policy.

Premium payment periods offer various durations to match your cash flow. Conversion options to whole life plans provide future flexibility.

The arrangement adapts to international needs and changing financial circumstances. It’s excellent for those with global considerations.

Manulife ManuProtect Term II: Quit Smoking Incentive

This innovative approach rewards healthier choices through its Quit Smoking Incentive. Smokers enjoy non-smoker rates for the first three years.

Continued discounts apply if they successfully quit tobacco use. Guaranteed renewal until age 85 occurs without further medical underwriting.

The combination of health encouragement and security makes it stand out. It supports both your physical and financial well-being.

“The right protection should match your lifestyle today while accommodating changes tomorrow.”

Each provider offers unique rider options including TPD, critical illness, and multipay CI coverage. Premium structures and discounts vary between companies.

Consider your specific needs when comparing these excellent options. The perfect match depends on your budget, health status, and long-term objectives.

Comparing Premiums: What You Can Expect to Pay

Understanding premium costs helps you budget effectively for your family’s security. Monthly payments vary based on several key factors that influence pricing.

Your age plays the most significant role in determining rates. Younger applicants enjoy substantially lower costs for the same protection amount.

For a 30-year-old male non-smoker seeking S$500,000 coverage, monthly costs range from S$15.40 to S$28.50. This represents excellent value for comprehensive financial protection.

Smoking status dramatically affects what you’ll pay. Tobacco users typically face 50-100% higher rates than non-smokers with identical profiles.

Coverage duration also impacts your premium amount. Longer protection periods naturally cost more but provide extended security.

| Provider | Plan Name | Monthly Premium (30M, Non-Smoker) | Coverage Amount |

|---|---|---|---|

| Singlife | Simple Term | S$15.40 | S$500,000 |

| FWD | Term Life Plus | S$16.84 | S$500,000 |

| Income | Term Life Solitaire | S$28.50 | S$500,000 |

| AIA | Secure Flexi Term | S$28.47 | S$500,000 |

| Tokio Marine | Term Assure II | S$26.75 | S$500,000 |

| AXA | Term Protector | S$28.00 | S$500,000 |

| Manulife | ManuProtect Term II | S$26.81 | S$500,000 |

Additional riders increase your overall cost but enhance protection. Critical illness coverage typically adds 20-50% to base premiums.

Your occupation type influences rates too. Manual or hazardous jobs face higher costs than administrative roles.

Women generally pay slightly less than men for identical coverage. This reflects statistical differences in life expectancy.

Direct purchase options often offer 10-20% savings. Eliminating agent commissions reduces overall expenses.

Remember that premiums remain fixed throughout your policy duration. This allows for predictable financial planning.

“Smart protection planning balances adequate coverage with affordable premiums that fit your budget.”

Always compare multiple options before making your final decision. Different insurers offer varying rates for similar coverage.

Consider both immediate costs and long-term value when selecting your plan. The right choice provides peace of mind without financial strain.

Understanding Coverage: Death, TPD, and Terminal Illness

Knowing exactly what your protection covers gives you confidence in your financial safety net. Different events trigger different benefits within your arrangement.

Most temporary protection includes three main coverage types. Understanding each helps you choose the right options for your situation.

Death Coverage Explained

The core purpose of temporary protection is providing financial security if you pass away. This benefit pays your chosen beneficiaries the full amount you selected.

Coverage typically includes death from any cause during the active period. There are very few exceptions to this comprehensive protection.

Standard exclusions include suicide within the first policy year. Dangerous activities or illegal acts may also not be covered.

Your family receives the complete sum as a single lump sum payment. This money helps maintain their lifestyle and meet financial obligations.

Total and Permanent Disability (TPD)

This optional rider provides crucial protection if you become completely disabled. It covers situations where you cannot perform any gainful employment.

Medical certification must confirm permanent disability with no recovery hope. The definition varies slightly between different providers.

When approved, this benefit pays the full sum assured amount. This financial support helps cover medical costs and living expenses.

Some arrangements include TPD in their base coverage. Others offer it as an additional rider for extra premium.

Terminal Illness and Critical Illness Riders

Terminal condition coverage provides early payout if diagnosed with a fatal illness. Doctors must confirm limited life expectancy, typically 12-24 months.

Critical illness riders cover specific serious health conditions. These include cancer, heart attack, stroke, and other major illnesses.

Early critical illness options cover less severe stages. They allow earlier claims and sometimes multiple claims for different conditions.

Multipay riders provide partial payments for different illness stages. This offers ongoing financial support during treatment and recovery.

| Coverage Type | Included in Base Plan | Typical Payout | Common Exclusions |

|---|---|---|---|

| Death Benefit | Yes | Full sum assured | Suicide (first year), dangerous activities |

| Terminal Illness | Usually included | Full sum assured | Pre-existing conditions not disclosed |

| Total Permanent Disability | Sometimes included | Full sum assured | Self-inflicted injuries, war-related |

| Critical Illness Rider | Optional add-on | Full or partial sum | Specific condition exclusions |

Always review specific definitions with your chosen provider. Coverage details can vary significantly between different companies.

Disclose all health information honestly during application. Non-disclosure might affect claim approvals later.

Consider your family’s specific needs when selecting riders. The right combination provides comprehensive protection without unnecessary cost.

“Understanding your coverage details ensures you get the protection you actually need when challenges arise.”

Regular policy reviews help keep your coverage aligned with changing needs. Life circumstances evolve, and your protection should too.

How to Apply for Term Life Insurance

Getting your protection in place is simpler than you might imagine. The application journey typically follows three straightforward phases that guide you from initial inquiry to active coverage.

Modern providers have streamlined their processes to make securing financial security convenient. You’ll find both digital and traditional options available to suit your preferences.

Step-by-Step Application Process

Begin by answering basic questions about your needs and situation. Our intelligent comparison system analyzes your responses to suggest suitable options.

This initial step eliminates the hassle of manually comparing numerous policy documents. You receive personalized recommendations based on your specific circumstances.

Next, our specialist team contacts you to discuss your options in detail. These conversations help clarify your protection needs and explain available features.

This personalized advice ensures you understand exactly what you’re purchasing. Our experts answer any questions about coverage details or premium structures.

Finally, complete your application through our secure online portal. The digital process makes submitting your information quick and convenient.

You’ll need to provide personal details including:

- Basic identification information

- Income and occupation details

- Health history and lifestyle habits

- Beneficiary designations

Medical examinations might be required for larger coverage amounts or certain health conditions. These assessments help determine appropriate premium rates.

The underwriting process evaluates your risk profile based on multiple factors. This includes health status, occupation type, and family medical history.

Approval times vary depending on your situation. Simple applications might receive instant approval, while more complex cases could take several weeks.

Once approved, you’ll receive detailed policy documents outlining all terms and conditions. Keep these materials safe for future reference.

Payment Methods: GIRO, Credit Card, and More

Premium payment options offer flexibility to match your financial preferences. Most providers offer multiple convenient methods for managing your payments.

Credit card arrangements provide simplicity through automatic deductions. Your agent typically sets up recurring payments when finalizing your contract.

This hands-off approach ensures you never miss a payment deadline. It’s perfect for those who prefer automated financial management.

GIRO payments directly transfer funds from your bank account. Contact your provider or agent to establish this recurring arrangement.

This method offers reliability without requiring ongoing attention. Payments process automatically on their scheduled dates.

AXS stations provide physical payment locations throughout Singapore. Alternatively, use their website or mobile app for digital convenience.

This option works well for those who prefer making individual payments rather than automatic arrangements.

Online banking transfers offer another straightforward payment method. Simply log into your bank’s platform to send payments directly.

Most insurers provide clear instructions for completing these transfers correctly.

Premium frequency options include:

- Monthly payments for budget-friendly spacing

- Quarterly installments for less frequent management

- Semi-annual options reducing payment frequency

- Annual payments often receiving discount incentives

“Choosing the right payment method ensures your protection remains active without financial stress.”

Remember that maintaining premium payments is essential for continuous coverage. Select the option that best fits your financial management style.

Regular reviews help ensure your protection remains aligned with evolving needs and circumstances.

Conclusion

Securing your family’s financial future requires thoughtful planning. Temporary protection offers excellent value during your peak earning years.

The variety of available arrangements ensures something for every budget. From basic death coverage to comprehensive protection with riders, choices abound.

Consider premium rates, features, and company strength when selecting. Regular reviews keep your protection aligned with changing circumstances.

Savings from affordable premiums can fund other wealth-building opportunities. Professional guidance helps navigate complex policy details.

Your needs evolve through different life stages. Adjust your coverage accordingly to maintain proper security.

Ultimately, peace of mind knowing your loved ones are protected is priceless. That security makes careful planning worthwhile.

FAQ

What is term life insurance?

It’s a type of protection that provides a payout if you pass away or are diagnosed with a terminal illness during the policy term. It offers pure protection without any cash value component, making it a straightforward and affordable option.

How does term coverage differ from whole life?

Term plans are designed for a specific period and focus solely on protection, while whole life policies combine coverage with a savings or investment element that builds cash value over time. Term tends to be much more budget-friendly for the same amount of coverage.

Why should I consider a term plan in Singapore?

These plans are ideal if you want significant financial security for your loved ones without a high cost. They’re simple, flexible, and allow you to match the policy length to your needs, like covering a mortgage or your children’s education years.

How much coverage do I actually need?

A good rule of thumb is to aim for a sum assured that is 10 times your annual income. You should also factor in debts, future expenses like college fees, and any existing policies to ensure your family is fully protected.

Are premiums for non-smokers lower?

Yes, absolutely. Insurers typically offer significantly lower rates for non-smokers because they represent a lower health risk. If you smoke, you’ll pay higher premiums, but some providers have specific plans or incentives for smokers looking to quit.

What does TPD stand for in a policy?

TPD stands for Total and Permanent Disability. It’s a benefit where the insurer pays the full sum assured if you become completely and permanently disabled and are unable to work, providing crucial financial support during a difficult time.

Can I add critical illness coverage to my plan?

Yes, most insurers offer it as an optional rider. This add-on provides a lump sum payment upon diagnosis of a covered critical illness, helping to manage medical bills and loss of income while you focus on recovery.

What’s the typical application process like?

It usually involves filling out a form with your personal and health details. Depending on the sum assured and your health, you might need a medical exam. Once approved, you can set up payments easily via GIRO, credit card, or other methods.

Best Log Cake Singapore: Top 10 Picks for You

Christmas in Singapore brings a unique tradition to our tropical shores – the festive yule log dessert. This rolled confection has become an essential part of holiday celebrations across the island.

Our guide helps you discover the perfect holiday treat for your festivities. We’ve carefully selected ten outstanding options based on flavor, quality, and value.

Many bakeries and hotels have already unveiled their 2024 holiday collections. From luxurious hotel creations to affordable bakery offerings, there’s something for every preference and budget.

We’ll also share ordering details, delivery options, and special promotions. For those feeling creative, we’ve included information about DIY workshops where you can make your own masterpiece.

Key Takeaways

- Log cakes have become a beloved Christmas tradition in Singapore

- This guide covers both luxury and affordable options

- Many establishments have released their 2024 holiday collections

- Ordering information and delivery options are included

- DIY workshop options are available for baking enthusiasts

- The selection is based on quality, taste, and value

- Perfect dessert options for Christmas celebrations

Introduction to Christmas Log Cakes in Singapore

While Singapore may not have winter snow, our Christmas tables feature a dessert with centuries of European heritage. This rolled confection has become an essential part of holiday celebrations across the island.

The Tradition of Yule Log Cakes

The story begins in Europe where families burned actual wooden logs during winter solstice celebrations. These Yule logs provided light, warmth, and symbolized good fortune for the coming year.

French pastry chefs transformed this tradition when homes began losing their fireplaces. They created the bûche de Noël, meaning “Christmas log,” as an edible version of the tradition. This sweet innovation quickly spread worldwide.

Today’s versions maintain the wooden log appearance through creative decoration. Sponge cake gets rolled with creamy fillings and coated to resemble bark.

Common decorations include chocolate coating, buttercream frosting, and sugar “snow.” Many feature meringue mushrooms and holly leaves for that authentic forest look.

Why Log Cakes Are a Singapore Christmas Essential

Despite our tropical climate, this European tradition has found a special place in local celebrations. The dessert has become more than just food—it’s a centerpiece of holiday gatherings.

Singaporean bakeries and hotels have put their own spin on traditional recipes. You’ll find flavors incorporating local ingredients alongside classic chocolate varieties.

These creations appear at family dinners, workplace parties, and as popular festive gifts. The tradition has been embraced by establishments from luxury hotels to neighborhood cafés.

Key components typically include:

- Light sponge cake base

- Rich cream or buttercream filling

- Chocolate or decorative coating

- Seasonal decorations

Cultural significance in Singapore:

- Symbol of Christmas celebration

- Centerpiece for holiday gatherings

- Popular gift item during the season

- Represents blending of traditions

Each year brings new interpretations while maintaining the dessert’s cherished traditions. This sweet treat continues to evolve while keeping its festive spirit alive.

Our Top 10 Best Log Cakes in Singapore for Christmas 2024

Finding the perfect holiday centerpiece can transform your celebrations. We’ve curated an exceptional selection that showcases incredible variety and creativity.

From traditional favorites to innovative local twists, these offerings represent the finest holiday baking talent. Each creation brings something special to your festive table.

1. Baker’s Brew Blackforest Yule Log

This masterpiece combines tangy cherry jelly with smooth vanilla crémeux. The 54% dark chocolate ganache adds depth to every slice.

Festive packaging makes it ready for gifting. Prices range from S$50.80 to S$78.80.

2. Pinch Bakehouse Chocolate Creation

Their halal-certified offering features cream cheese chantilly frosting. Adorable meringue mushrooms decorate the 55% chocolate ganache.

Priced at S$59.90, it’s a charming addition to any gathering.

3. Singapore Marriott Tang Plaza Signature Chocolate Fudge

This bestselling item comes in two budget-friendly sizes. The rich chocolate flavor has made it a perennial favorite.

At S$55 for the smaller size, it offers excellent value.

4. Shangri-la Snow White Dessert

A refreshing alternative featuring yogurt and white chocolate ganache. Crunchy granola and berry cremeux create delightful texture contrasts.

Priced at S$88, it’s a sophisticated choice for holiday entertaining.

5. Crowne Plaza Changi Airport Pandan Gula Melaka

This local-inspired creation blends pandan sponge with coconut mousse. It beautifully represents Singapore’s culinary heritage.

The S$98 price reflects its premium ingredients and craftsmanship.

6. Four Seasons Durian Mao Shan Wang Specialty

Made with 100% pure durian puree for true enthusiasts. The intense flavor profile makes it unforgettable.

At S$68, it offers exceptional quality for durian lovers.

7. PARKROYAL COLLECTION Marina Bay Traditional Chocolate

Features luxurious chocolate mousse with crunchy pearls. The textural contrast elevates this classic dessert.

Priced at S$89, it’s a premium hotel offering worth considering.

8. Emicakes Affordable Selection

Starting from S$49.60, these options include D24 durian and Black Forest varieties. They prove holiday treats can be both delicious and budget-friendly.

9. Annabella Patisserie Disney Christmas Hazelnut

From S$49.80, this festive creation features Disney character macarons. The hazelnut flavor appeals to both children and adults.

10. Swensen’s Ice Cream Alternatives

Their frozen options include Merry Giftmas at S$66. These provide a cool tropical twist on traditional holiday desserts.

| Establishment | Specialty | Price Range | Key Feature |

|---|---|---|---|

| Baker’s Brew | Blackforest Yule | S$50.80-78.80 | Dark chocolate ganache |

| Pinch Bakehouse | Chocolate Creation | S$59.90 | Halal-certified |

| Singapore Marriott | Chocolate Fudge | S$55/80 | Two size options |

| Shangri-la | Snow White | S$88 | Yogurt and white chocolate |

| Crowne Plaza | Pandan Gula Melaka | S$98 | Local flavors |

| Four Seasons Durian | Mao Shan Wang | S$68 | 100% durian puree |

| PARKROYAL COLLECTION | Traditional Chocolate | S$89 | Crunchy pearls |

| Emicakes | Various flavors | From S$49.60 | Budget-friendly |

| Annabella Patisserie | Disney Hazelnut | From S$49.80 | Character macarons |

| Swensen’s | Ice cream varieties | S$66 | Frozen option |

More Excellent Log Cake Options to Consider

Beyond our top picks, Singapore offers many other wonderful holiday desserts. These additional selections provide even more variety for your festive celebrations.

You’ll find luxurious hotel creations and charming local bakery specialties. Each brings unique flavors and styles to your holiday table.

Hotel Offerings: St. Regis, Mandarin Oriental, and More

The St. Regis Singapore presents two elegant choices. Their signature chocolate creation features rich layers at S$79. A new nougat pistachio option offers delightful nutty flavors at the same price.

Mandarin Oriental Singapore crafts a sophisticated Chocolate Buche de Noel. Priced at S$98, it features chocolate génoise and premium 64% chocolate ganache. The presentation matches its luxurious taste.

Holiday Inn Singapore Atrium introduces creative flavor combinations. Their passion fruit cream cheese creation balances tart and creamy notes at S$108. A coconut yam version offers local inspiration at the same price.

Pan Pacific Singapore caters to serious chocolate enthusiasts. Their Guanaja Chocolat Noir selection delivers intense chocolate satisfaction for S$88.

Local Bakery Specialties

Awfully Chocolate remains a favorite for dark chocolate lovers. Their simple yet rich creations range from S$62 to S$88. The quality ingredients shine through in every slice.

Paris Baguette offers popular mini versions perfect for gifting. These smaller treats range from S$35 to S$75. They make wonderful presents for friends and colleagues.

Bengawan Solo evokes nostalgic memories for many locals. Their chocolate and black forest options bring back childhood Christmas feelings. Prices range from S$40 to S$70.

Cedele provides healthier bake options with festive twists. Choose between chocolate or pistachio flavors from S$60 to S$90. These appeal to health-conscious consumers.

Other local favorites include Châteraisé’s Japanese-style cream desserts. Various neighborhood bakeries also offer their own special versions.

How to Order Your Perfect Christmas Log Cake

Getting your holiday dessert ready requires some planning. This year brings many convenient options for securing your festive treat.

Most bakeries and hotels have streamlined their ordering processes. You can choose between delivery or pickup based on your preference.

Special promotions make this season particularly appealing for dessert lovers. Many establishments offer discounts that help you save on your holiday celebrations.

Ordering Deadlines and Delivery Options

Timing matters when ordering your holiday dessert. Most places accept requests until December 25, 2024.

Delivery fees vary between different providers. Here’s what you can expect from popular establishments:

| Establishment | Delivery Fee | Free Delivery Threshold |

|---|---|---|

| Baker’s Brew | From S$15 | Orders above S$120 |

| Pinch Bakehouse | From S$9.99 | Orders above S$150 |

| Shangri-la | Flat S$4.99 | Not available |

| Four Seasons | S$3.99 | Not available |

| Emicakes | Free | Orders above S$60 |

| Annabella Patisserie | Free | Orders above S$48 |

| Swensen’s | S$2.98 | Not available |

Self-collection remains a popular choice for many customers. Most bakeries and hotels offer pickup options at their locations.

Place your order through various channels for convenience. Online stores, telephone orders, and in-person requests are all available.

For optimal freshness, consider ordering closer to your celebration date. Proper storage ensures your dessert maintains its quality.

Special Promotions and Discounts Available

This season brings attractive savings on holiday treats. Many establishments offer discounts that make your purchase more affordable.

Singapore Marriott Tang Plaza provides 20% off with promo code BINO20. This applies to their popular chocolate fudge creation.

Shangri-la offers a 15% discount on their Snow White dessert. Four Seasons gives 20% off plus additional vouchers for future purchases.

PARKROYAL COLLECTION matches with 20% off and extra vouchers. These can be used for upcoming visits or future orders.

Emicakes provides 20% off their already budget-friendly options. Additional savings apply when spending S$45 or more.

Annabella Patisserie offers discount vouchers for their Disney-themed creation. Swensen’s has maintained their prices despite general inflation.

These promotions make holiday celebrations more accessible. Take advantage of these offers to enjoy quality desserts at better prices.

DIY Log Cake Workshops in Singapore

Create lasting holiday memories by crafting your own festive dessert. Hands-on workshops offer a wonderful alternative to simply purchasing ready-made treats.

These experiences bring friends and families together during the Christmas season. You’ll leave with both delicious creations and cherished memories.

Where to Find Christmas Baking Experiences

Many local bakeries host special holiday sessions throughout December. Traveloka’s experience page serves as an excellent booking platform for these activities.

Workshops provide all necessary materials for participants. You’ll receive pre-baked sponge bases, various fillings, and decorative elements.

Typical kits include:

- Light sponge cake ready for rolling

- Rich cream cheese filling options

- Chocolate ganache and buttercream frostings

- Festive toppings and decorative accessories

“The joy of creating something beautiful with loved ones makes these workshops special.”

Groups typically range from 10-15 participants per session. Most workshops last 2-3 hours, perfect for an afternoon holiday activity.

No previous baking experience is necessary. Instructors guide you through each step with patience and expertise.

Making Your Own Yule Log Creation

Participants can choose from various flavor profiles and designs. Options often include a classic traditional chocolate version or creative cream cheese variation.

Some workshops feature unique combinations like nougat pistachio creations. These special flavors add excitement to the baking experience.

The process typically follows these steps:

- Preparing the sponge cake base

- Spreading your chosen filling

- Carefully rolling the creation

- Decorating with festive elements

Couples enjoy these workshops as romantic holiday dates. Friends find them perfect for seasonal gatherings and celebrations.

Families with children particularly love the hands-on experience. Kids enjoy decorating their edible masterpieces.

| Workshop Type | Duration | Group Size | Special Features |

|---|---|---|---|

| Traditional Chocolate | 2 hours | 12 people | Classic decoration techniques |

| Cream Cheese Variation | 2.5 hours | 10 people | Tangy filling options |

| Nougat Pistachio | 3 hours | 8 people | Premium ingredient focus |

| Family Workshop | 2 hours | 15 people | Child-friendly instructions |

Popular workshops fill quickly during the holiday season. Early booking ensures you secure spots for your preferred dates.

These experiences create more than just desserts—they build holiday traditions. The satisfaction of serving something you made yourself adds special meaning to your celebrations.

Best Areas to Stay for a Singapore Christmas Experience

Choosing the right location transforms your holiday visit into something magical. Different neighborhoods offer unique festive atmospheres and experiences.

Each area brings its own special charm during the Christmas season. You’ll find various accommodation options to match your preferences and budget.

![]()

Orchard Road: The Heart of Christmas Celebrations

This famous shopping street becomes the epicenter of holiday magic every December. Spectacular light displays stretch along the entire boulevard.

Giant Christmas trees and festive decorations create a wonderland atmosphere. The entire area transforms into a destination that captures the holiday spirit.

Endless shopping opportunities await with special Christmas markets popping up. These seasonal markets offer unique gifts and local crafts.

Many hotels in this area provide excellent access to the festivities. Recommended options include Carlton Hotel Singapore and Conrad Singapore Orchard.

Marina Bay: Luxury Christmas Atmosphere

This area offers a glamorous holiday experience with breathtaking skyline views. The waterfront comes alive with premium events and potential fireworks displays.

Luxury accommodations provide the perfect base for enjoying upscale celebrations. The parkroyal collection marina area features sophisticated holiday ambiance.

JW Marriott Hotel Singapore South Beach sits in this premium location. Mandarin Oriental Singapore also offers luxurious stays with fantastic views.

Fairmont Singapore provides another excellent option in this prestigious area.

Other Notable Christmas Areas

Bras Basah/Bugis offers cultural and heritage experiences during the holidays. This area blends traditional celebrations with modern festivities.

Chinatown provides an authentic local experience with its own holiday charm. The contrast between cultural traditions creates a unique atmosphere.

Sentosa Island delivers a beach resort Christmas feel for those seeking relaxation. Tropical holiday celebrations take on a special character here.

| Area | Christmas Atmosphere | Recommended Hotels | Special Features |

|---|---|---|---|

| Orchard Road | Shopping and light displays | Carlton Hotel, Conrad Singapore Orchard | Giant Christmas trees, festive markets |

| Marina Bay | Luxury waterfront celebrations | JW Marriott, Mandarin Oriental, Fairmont | Skyline views, premium events |

| Bras Basah/Bugis | Cultural heritage experience | Various boutique options | Historical sites, local traditions |

| Chinatown | Authentic local atmosphere | Neighborhood hotels | Cultural contrast, traditional elements |

| Sentosa | Beach resort holiday feel | Resort accommodations | Tropical celebrations, relaxation |

December represents peak season for visitors, so book accommodations early. Planning ahead ensures you get your preferred location and rates.

Consider combining your area stay with holiday dessert experiences from nearby establishments. Many hotels and bakeries offer special Christmas treats you can enjoy during your visit.

Each neighborhood provides different advantages for holiday travelers. Choose based on whether you prefer shopping, luxury, culture, or relaxation.

Conclusion

Your holiday celebration deserves a memorable centerpiece. This guide showcases an incredible variety of festive desserts available for 2024.

From traditional chocolate to innovative local flavors, there’s something for every taste. Plan ahead to secure your preferred choice before ordering deadlines.

Consider DIY workshops for a fun, hands-on experience with loved ones. These creations have become essential to holiday gatherings across the island.

Don’t forget special promotions that offer great value. Share the festive spirit through these delightful treats with family and friends.

May your celebrations be filled with joy, sweetness, and wonderful memories. Enjoy every moment of this special season!

FAQ

What is a Yule log cake?

A Yule log cake is a traditional holiday dessert shaped like a log. It usually features a rolled sponge cake filled and covered with rich chocolate or flavored cream. This sweet treat has European roots and is now a beloved part of Christmas celebrations worldwide.

Where can I find unique flavors like durian or pandan in a log cake?

Several places offer creative local twists! Four Seasons Hotel has a Mao Shan Wang durian option, while Crowne Plaza Changi Airport serves a pandan gula melaka version. These blends give a delicious Singaporean touch to the classic dessert.

Are there any ice cream log cakes available?

A> Yes! Swensen’s offers festive ice cream log cakes. These are perfect for those who prefer a cool, creamy treat during the warm holiday season. They come in various flavors and are a fun alternative to the traditional sponge-based creation.

When should I place my order to ensure delivery before Christmas?

It’s best to order early! Many bakeries and hotels set deadlines 3–7 days in advance. Popular spots like St. Regis or PARKROYAL COLLECTION Marina Bay often have cut-off dates, so check their websites or call directly to secure your dessert on time.

Can I attend a workshop to learn how to make my own log cake?

Absolutely! Several baking studios and culinary schools in Singapore host seasonal workshops. These hands-on experiences guide you through making a Yule log from scratch—a great activity for families or friends during the festive period.

What if I’m looking for a more affordable option?

Emicakes offers a range of budget-friendly log cakes without compromising on taste. Local bakeries also often have wallet-friendly selections that still deliver on flavor and festive charm.

Best Term Insurance Singapore: Compare Top Plans

Life is full of surprises, and having a solid financial plan brings peace of mind. Many people in Singapore seek affordable ways to protect their loved ones.

A term life insurance plan offers coverage for a specific period. It provides a lump-sum payout if something happens during that time. This makes it a popular choice for those wanting straightforward protection.

Premiums are often fixed and budget-friendly. For example, a 30-year-old non-smoker might pay between S$18.67 and S$34.12 monthly for S$500,000 coverage over 20 years. That’s up to ten times cheaper than whole life options!

Whether you’re covering a mortgage or family expenses, picking the right policy matters. This guide will help you compare top offerings from providers like Singlife and FWD based on your budget and goals.

Let’s make this simple. You’ll find clear insights ahead to choose a plan that fits your life.

Key Takeaways

- Term life insurance provides coverage for a fixed period with a death benefit.

- Premiums are affordable, often costing less than whole life plans.

- Prices can be as low as S$18.67 per month for substantial coverage.

- Plans help with financial planning for mortgages or family needs.

- Comparing options from providers like Singlife and FWD is essential.

- Choosing the right policy depends on your budget and long-term goals.

Understanding Term Life Insurance in Singapore

In today’s world, having the right knowledge about financial safety nets makes all the difference. Many people wonder how to protect their loved ones without breaking the bank.

Let’s break down the basics so you can make an informed decision about your family’s protection.

What is Term Insurance?

A term life insurance policy provides protection for a specific timeframe. It offers a lump-sum payment if something happens during that period.

This type of plan covers death, terminal illness, or total permanent disability. If the term ends without any claims, the policy simply expires.

There’s no cash value or savings component involved. It’s pure protection designed for temporary needs.

How Term Insurance Differs from Whole Life

Whole life coverage lasts until age 99 or death. It includes a cash value component that grows over time.

However, this comes at a much higher cost. Premiums for whole life are typically 10-12 times more expensive than term options.

Term plans are simpler to understand with straightforward premiums. You pay for protection without complex investment features.

For example, a 30-year-old might pay around S$15-28 monthly for good coverage. That’s significantly more affordable than permanent options.

Why Singaporeans Choose Term Coverage

Many residents opt for term plans because they’re budget-friendly. Young adults and new parents find them particularly useful.

Homeowners often use them to cover mortgage payments. The affordable premiums make financial planning easier.

Employer group insurance often doesn’t provide enough protection. Personal term coverage fills these gaps beautifully.

It ensures your family has complete financial security. You can learn more about comparing options at MoneySmart’s term life guide.

Before choosing any plan, assess your specific situation. Consider your family’s needs and financial goals carefully.

Key Benefits of Term Insurance Plans

Getting the right protection doesn’t have to be complicated or expensive. Many smart financial decisions start with understanding what works best for your situation.

These policies offer straightforward advantages that make them popular choices. Let’s explore why they might be perfect for your needs.

Affordable Premiums for Maximum Coverage

One of the biggest advantages is the low cost. You get substantial protection without straining your budget.

For example, a 30-year-old non-smoker might pay between S$15.40 and S$34.12 monthly. This provides S$500,000 of coverage for 20 years.

That’s about one-tenth the price of permanent insurance plans. This affordability makes quality protection accessible to more people.

Fixed Premiums for Financial Planning

Your payments stay the same throughout the entire term. This predictability helps with long-term budgeting.

You won’t face unexpected increases that disrupt your finances. This stability is especially valuable during economic uncertainty.

Fixed premiums mean you can plan your expenses with confidence. It’s one less thing to worry about in your financial life.

Flexible Coverage Periods

These plans offer remarkable flexibility in duration. You can choose protection periods from 5 years up to age 99.

This lets you match your coverage to specific life events. Common choices include mortgage durations or children’s education years.

You might select a 25-year term to match your home loan. Or choose coverage until your youngest child finishes university.

The variety of options ensures you only pay for protection when you need it most.

| Coverage Period | Typical Use Case | Monthly Premium Example* |

|---|---|---|

| 10 years | Short-term debt coverage | S$12.50-S$28.00 |

| 20 years | Mortgage protection | S$15.40-S$34.12 |

| 30 years | Child education funding | S$18.75-S$42.30 |

| To age 65 | Retirement planning | S$22.10-S$48.90 |

*Based on S$500,000 coverage for 30-year-old non-smoker

This flexibility makes term insurance plans ideal for life changes. Becoming a parent or buying a home are perfect times to consider protection.

Understanding these benefits helps you choose the right policy. Next, we’ll examine what features to look for in quality coverage.

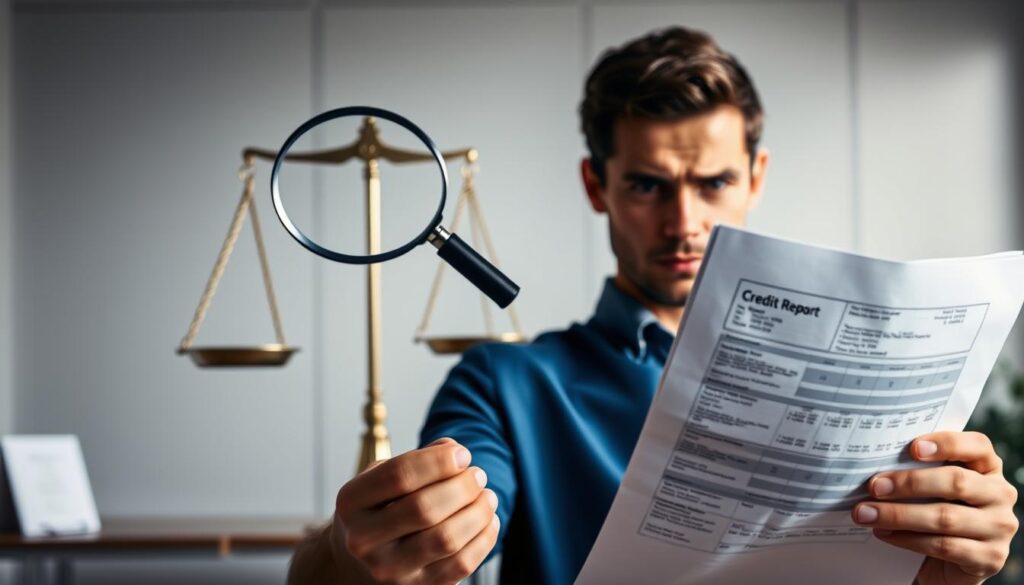

What to Look for in the Best Term Insurance Singapore

Choosing the right protection plan requires careful thought about several key factors. These elements help ensure your coverage truly matches your personal situation.

Let’s explore what makes a policy stand out and how to select one that offers real value.

Coverage Amount and Duration

Start by calculating how much protection you actually need. Add up your mortgage balance, any outstanding loans, and daily living costs.

Many experts suggest this simple formula:

Total debts + (Annual expenses × Years of support needed) = Ideal coverage amount

This approach helps determine your proper sum assured. It ensures your family maintains their lifestyle if something happens.

Next, consider how long you need protection. Match your policy’s length to major life events.

You might choose coverage until retirement age or until children finish their education. This alignment makes financial sense.

Additional Riders and Benefits

Basic plans cover death and disability. But you can enhance protection with optional add-ons called riders.

Critical illness coverage provides extra money if diagnosed with specific conditions. This helps cover medical costs and income loss.

Some providers offer advanced options like early CI or multipay benefits. These pay for less severe conditions or multiple claims.

Total permanent disability riders offer similar protection for disability cases. Remember that each rider increases your premium rates.

Consider which additions match your health concerns and budget. Not everyone needs every available option.

Insurer Financial Strength and Ratings

The company behind your policy matters as much as the features. You want an insurer that will be there when needed.

Independent agencies like Standard & Poor’s rate financial stability. These grades indicate claim-paying ability.

Look for insurers with strong ratings like AA- or higher. This means they have excellent financial health.

Income Insurance and AIA both hold AA- ratings from S&P. Such companies offer peace of mind through reliability.

Always verify these ratings before committing to any policy. It’s your assurance of long-term security.

| Selection Factor | What to Look For | Why It Matters |

|---|---|---|

| Coverage Amount | Enough to cover debts + 5-10 years of expenses | Ensures family’s financial stability |

| Policy Duration | Matches mortgage term or until kids are independent | Protection when you need it most |

| Additional Riders | Critical illness, TPD, or multipay options | Extra protection for specific situations |

| Insurer Rating | AA- or higher from agencies like S&P | Financial stability and claim reliability |

Comparing these elements across different insurance policies helps find your perfect match. Take your time to evaluate what truly meets your needs.

Your ideal protection balances adequate coverage with affordable costs. The right choice brings confidence and security.

Comparing Singapore’s Top Term Insurance Providers

Understanding price differences between providers can help you make a more informed decision. Looking at various companies shows how costs and features vary.

This comparison helps you see the full picture. You’ll notice that monthly payments differ significantly between companies.

Premium Comparison Table

Monthly costs change based on your age and the company you choose. Here’s how prices compare for different ages with S$500,000 protection.

| Provider | Age 30 | Age 35 | Age 40 | Age 45 |

|---|---|---|---|---|

| Singlife Simple Term | S$15.40 | S$18.20 | S$24.80 | S$35.60 |

| FWD Term Life Plus | S$16.84 | S$19.95 | S$27.40 | S$39.25 |

| Income Term Life Solitaire | S$28.50 | S$33.75 | S$45.90 | S$64.80 |

As you can see, prices increase as you get older. Starting earlier locks in lower premiums for your entire policy period.

The cheapest option isn’t always the best value. Some plans include extra features that justify higher costs.

Insurer Reputation and Service Quality

Company stability matters for long-term protection. You want an insurer that will be there when you need them.

Financial strength ratings indicate reliability. Singlife has an A- rating from Fitch, while AIA holds AA- from S&P.

Service quality includes application ease and claim handling. FWD offers completely online applications for convenience.

Singlife receives positive user reviews for customer support. Smooth claim processing is crucial when families need help.

Some companies offer perpetual discounts or cashback promotions. These can significantly reduce your overall costs over time.

Always consider both price and quality when comparing insurance plans. The right balance depends on your personal needs.

Next, we’ll look at specific providers in detail. This will help you understand each company’s unique offerings.

Singlife Term Insurance Plans Review

Digital-first insurers are changing how people access essential coverage. Singlife stands out with its innovative approach to protection.

They offer two distinct solutions for different needs. Both provide quality security with modern convenience.

Singlife Elite Term Features

The Elite Term II plan offers remarkable flexibility in coverage periods. You can choose renewable terms of 5 or 10 years.

Fixed terms are available up to age 85 or 99. This lets you match protection to your specific life situation.

A unique feature is the multipay critical illness rider. It provides comprehensive coverage for multiple claims.

Bundling riders can reduce overall premiums. Limited-pay options are available for term-to-age-99 policies.

You can pay over 5, 10 years, or until age 65 or 75. This flexibility helps with long-term financial planning.

Singlife Simple Term Advantages

The Simple Term policy emphasizes accessibility and convenience. Applications happen completely online without medical exams.

This makes getting coverage surprisingly straightforward. Approval often comes within days rather than weeks.

Basic protection starts at just S$15.40 monthly. That’s exceptional value for essential death and terminal illness coverage.

Riders enhance protection for TPD or critical conditions. The online process saves time while maintaining quality.

Current Promotions and Discounts

Singlife offers attractive perpetual discounts for qualified applicants. Policies with S$500,000 sum assured receive 30% off death/TPD coverage.

Critical illness and early CI riders get 10% discounts. These savings make comprehensive protection more affordable.

That’s like getting extra coverage without paying extra. The discounts apply for the entire policy duration.

These promotions make Singlife a strong competitor in the market. Their combination of digital access and competitive pricing stands out.

When comparing providers, consider both features and overall value. Singlife’s offerings deserve serious consideration for their flexibility.

Next, we’ll examine how HSBC Life’s term protection compares to these options.

HSBC Life Term Protector Analysis

Exploring different protection choices helps you find the perfect match for your situation. HSBC Life offers distinct features that set it apart from other providers.

Coverage Options and Flexibility

The Term Protector gives you many choices for protection length. You can pick fixed periods ending at ages 50, 55, 60, 65, 70, 75, 85, or 99.

Renewable options were available but are phasing out by November 2024. This means you should consider fixed terms for long-term security.

There are two main versions of this plan:

- Term Protector: Offers up to S$1,999,000 sum assured

- Term Protector Prime: Starts at S$2,000,000 coverage

This distinction helps people with different protection needs. Whether you need basic or extensive coverage, there’s an option for you.

Unique Survival Payout Feature

HSBC Life includes a special rider that many other companies don’t offer. If you reach age 99, they pay out your full sum assured.

This means your policy doesn’t just expire without value. Instead, it creates a guaranteed inheritance for your loved ones.

That’s like getting a bonus for living a long, healthy life. This feature makes the plan more than just basic protection.

It’s perfect for people who want to leave something behind regardless of what happens. This rider adds real value to your overall financial plan.

Premium Structure and Affordability

HSBC Life makes comprehensive protection surprisingly affordable. They currently offer up to 35% perpetual discount until June 30, 2025.

This discount applies to both main coverage and additional riders. That means long-term savings on your protection costs.

You can enhance your basic plan with useful add-ons:

- Total permanent disability coverage

- Critical illness protection

- Early critical illness benefits

As a former AXA company, HSBC Life maintains strong financial ratings. This gives you confidence in their stability and claim-paying ability.

When comparing different providers, consider both features and overall value. HSBC Life’s unique survival benefit makes it worth serious consideration.

Next, we’ll look at how Income Insurance’s offerings compare to these options.

Income Insurance TermLife Solitaire Overview

Finding the right protection involves exploring various offerings from trusted providers. Income Insurance brings a well-established option to the table with its TermLife Solitaire plan.

This policy stands out for its flexibility and strong financial backing. It offers multiple ways to customize your security based on personal circumstances.

Policy Term Options

TermLife Solitaire provides impressive flexibility in protection periods. You can select fixed durations ranging from 10 to 40 years.

Alternatively, choose coverage until specific ages: 64, 74, 84, or 100. This variety helps match your policy to major life milestones.

For example, you might pick 25 years to cover a mortgage. Or select age 100 for lifelong family protection.

The numerous choices ensure you only pay for coverage during crucial years. This approach makes financial planning more efficient.

Renewal Guarantees

A valuable feature is the guaranteed renewal option. This lets you extend coverage without additional medical checks.

Your health might change over time, making new applications difficult. This guarantee ensures continuous protection regardless.

It’s perfect for those wanting long-term security without reapplying. You maintain coverage even if health conditions develop.

This benefit provides peace of mind about future insurability. Your family’s protection remains intact through life changes.

Cashback Promotions

Income currently offers attractive cashback incentives until June 30, 2025. Policies with annual premiums of S$1,200 or more qualify.

The promotion provides:

- 15% cashback for payment terms under 45 years

- 30% cashback for 45 years or longer

This effectively reduces your first-year costs significantly. A 30-year-old non-smoker might pay around S$28.50 monthly for solid coverage.

Combined with the cashback, this represents excellent value. The savings make comprehensive protection more accessible.

Income Insurance holds an AA- rating from Standard & Poor’s. This indicates strong financial stability and claim-paying ability.

The base plan covers death and terminal illness situations. Optional riders enhance protection for:

- Total permanent disability

- Critical illness conditions

- Early critical illness diagnoses

These additions let you build coverage matching specific concerns. The variety of term options helps address different financial goals.

Whether covering loans or supporting dependents, this plan offers solid solutions. Comparing its features against other providers shows its unique advantages.

Next, we’ll examine Manulife’s offering and its distinctive quit smoking program.

Manulife ManuProtect Term II Examination

Different protection plans offer unique features that cater to specific situations. Manulife brings a thoughtful approach with its ManuProtect Term II.

This policy stands out for its health-focused incentives and flexible protection periods. It provides solid security while encouraging positive lifestyle changes.

Quit Smoking Incentive Program

The most distinctive feature is the smoking cessation program. Smokers can enjoy non-smoker premium rates for the first three years.

If they provide proof of quitting by the third anniversary, rates remain at non-smoker levels. This makes protection more affordable while promoting better health.

That’s like getting rewarded for making healthy choices. It addresses a common barrier to affordable coverage for many people.

Coverage Duration Choices

This plan offers remarkable flexibility in protection periods. You can choose renewable terms or level terms from 11 to 40 years.

Alternatively, select coverage until ages 65, 75, or 85. This variety helps match your policy to specific financial obligations.

The base protection covers death and terminal illness situations. A 30-year-old non-smoker might pay around S$26.81 monthly for good coverage.

Rider Availability

You can enhance basic protection with useful add-ons. Total permanent disability and critical illness riders are available.

However, early critical illness coverage is not offered. This might be a consideration for those wanting comprehensive health protection.

The combination of base coverage and available riders creates solid security. It addresses most common protection needs effectively.

Current Promotions and Value

Manulife offers an 8% perpetual discount until March 31, 2025. This makes an already affordable plan even more budget-friendly.

The discount applies to both main coverage and additional riders. Combined with the smoking incentive, it represents excellent value.

This approach makes quality protection accessible to more people. It’s particularly appealing for those committed to healthier lifestyles.

| Feature | Manulife ManuProtect Term II | Why It Matters |

|---|---|---|

| Smoking Incentive | 3 years non-smoker rates for smokers | Makes coverage affordable and promotes health |

| Term Options | 11-40 years or to age 65/75/85 | Flexible protection matching life stages |

| Available Riders | TPD and critical illness coverage | Enhanced protection for specific situations |

| Current Promotion | 8% perpetual discount until March 2025 | Additional savings on comprehensive coverage |

This plan works well for smokers wanting to reduce costs. It also suits anyone valuing health incentives in their protection.

While it offers strong features, other providers might better suit different needs. Next, we’ll examine FWD’s completely online application process.

FWD Term Life Plus Assessment

Modern protection solutions have evolved to meet today’s digital lifestyle needs. FWD brings a refreshing approach with their completely online application process.

This plan stands out for its combination of convenience and unique support features. Let’s explore what makes it a compelling choice for many people.

Online Application Process

FWD offers a completely digital experience from start to finish. You can apply without meeting any agents or filling out paper forms.

The online system guides you through each step clearly. Approval often comes within days rather than weeks.

This approach saves time and makes getting coverage surprisingly simple. It’s perfect for busy individuals who prefer handling things online.

Everything happens through their secure website or mobile app. You get quality protection without traditional paperwork hassles.

Exclusive Recovery Programme

FWD includes a special feature that goes beyond financial support. Their Exclusive Recovery Programme provides practical help during difficult times.

If something happens, your family receives up to S$5,000 in support services. This covers legal advice sessions and administrative assistance.

That’s like having a helping hand when your family needs it most. It addresses both emotional and logistical challenges.

This unique benefit shows FWD’s understanding of real family needs. The support makes a difficult situation more manageable.

Premium Competitiveness

FWD offers remarkably affordable rates for quality protection. A 28-year-old non-smoker might pay just S$16.84 monthly.

This provides S$500,000 of coverage through their Term Life Plus plan. Such pricing makes comprehensive protection accessible to more budgets.

You can choose renewable terms of 10 years or fixed periods. Options range from 5 years up to age 100 coverage.

Additional riders enhance protection for specific situations:

- Total permanent disability coverage

- Critical illness protection

- Early critical illness benefits

These additions let you customize security based on personal concerns. The combination creates solid family protection.

| Feature | FWD Term Life Plus | Benefit |

|---|---|---|

| Application Process | Completely online | Quick approval without agent meetings |

| Recovery Programme | Up to S$5,000 support services | Practical help beyond financial payout |

| Premium Example | S$16.84/month for S$500,000 | Affordable protection for young adults |

| Coverage Options | 5 years to age 100 | Flexibility matching life stages |

This plan works well for tech-savvy users who value convenience. The digital approach and unique support features set it apart.

While FWD focuses on online accessibility, other providers offer different strengths. Next, we’ll examine AIA’s traditional approach with its terminal cancer benefit.

AIA Secure Flexi Term Evaluation

When exploring protection choices, established providers often bring valuable features worth considering. AIA’s Secure Flexi Term offers solid security with some thoughtful benefits.

This plan provides straightforward coverage for death and terminal illness. It stands out with its flexible approach to protection periods.

Terminal Cancer Benefit

A unique feature is the automatic terminal cancer payout. This applies even if you haven’t added any extra riders to your policy.

Specific conditions must be met for this benefit to activate. It provides an extra layer of security for cancer concerns.

That’s like having built-in protection for a specific health worry. This feature adds real value without increasing your premiums.

Renewable Term Options

You get remarkable flexibility in how long your protection lasts. Choose renewable periods of 5, 10, 20, or 30 years.

Fixed terms are available until ages 65 or 75. This variety helps match your coverage to different life stages.

The renewable option ensures you can maintain protection easily. You won’t need new medical exams when extending your term.

Coverage Age Limits

Basic fixed options cover you until age 75. However, guaranteed renewal lets you extend protection up to age 100.

This ensures long-term security if your needs change. You maintain coverage even as you get older.

Additional riders enhance your basic protection:

- Total permanent disability coverage

- Critical illness protection

Early critical illness riders aren’t available for age-based policies. This might affect those wanting comprehensive health protection.

Current Promotions and Value

AIA offers a 10% discount on first-year premiums until July 31, 2025. This reduces initial costs for new policies.

A 30-year-old non-smoker might pay around S$28.47 monthly. This provides solid death and terminal illness coverage.

The company holds an AA- rating from Standard & Poor’s. This indicates strong financial stability and reliability.

| Feature | AIA Secure Flexi Term | Benefit |

|---|---|---|

| Term Options | 5-30 years renewable or to age 65/75 | Flexible protection matching needs |

| Special Benefit | Automatic terminal cancer payout | Extra security without added cost |

| Age Limit | Up to age 100 with renewal | Long-term protection availability |

| Current Promotion | 10% first-year discount until July 2025 | Reduced initial costs |

This plan works well for those valuing renewable options and company stability. The terminal cancer benefit addresses specific health concerns effectively.

While AIA offers traditional strength, other providers have different promotional structures. Next, we’ll examine Tokio Marine’s discount approach.

Tokio Marine Term Assure II Review

Finding affordable protection that fits your budget is a key part of smart financial planning. Tokio Marine offers a compelling choice with its Term Assure II plan.

This policy provides solid security with some attractive initial savings. Let’s explore what makes it stand out in the market.

Impressive Premium Discount Structure

Tokio Marine currently runs a special promotion until June 30, 2025. For level terms, you get a 40% discount on your premiums for the first three years.

That’s like getting almost half off your initial payments! This makes comprehensive protection much more affordable when starting your policy.

Without this discount, a 30-year-old non-smoker might pay around S$26.75 monthly. The promotion significantly reduces those initial costs.

Remember to calculate long-term expenses beyond the discount period. This ensures the plan remains affordable throughout your chosen term.

Flexible Coverage Options

Term Assure II offers remarkable flexibility in protection periods. You can choose renewable terms of 5 or 10 years.

Fixed terms range from 11 years up to age 85. This variety helps match your coverage to specific financial obligations.

Whether covering a mortgage or ensuring family security, there’s an option for your situation. The renewable feature guarantees continued protection without new medical exams.